Hassane Kamara is a high-octane defender at Watford FC in England. He was the club’s player of the year last season despite only joining in January 2022. He’s also emblematic of the financial engineering available to football clubs through the increasingly popular multi-club ownership model.

Watford was relegated from the Premier League last summer and Kamara was sold to Udinese of Italy for a profit of about £12 million ($14.4 million). That looked like a great trade — but even better was that Udinese, which is owned by the same Italian family that owns Watford, immediately loaned the player back.

No rules were broken and Watford Chairman Scott Duxbury was upfront about the motives, telling the club’s website that the deal aimed to balance “financial wellbeing and retaining a squad to compete.” It helped Watford cope with the revenue lost from dropping down a division.

This week, Manchester City, a member of a much bigger and more powerful multi-club group, was accused of more than 100 financial rule breaches by the Premier League. The club, part of Abu Dhabi-owned City Football Group, denies any wrongdoing. The breaches appear to be similar to claims already rejected or time-barred by the Court of Arbitration for Sport in 2020.

Watford’s in-house player trade is small beer in comparison, but for clubs that operate independently and for their fans, any financial benefit for teams in common ownership looks like it gives an unfair advantage. Such sale-and-loan-back transfers are just one example of how multi-club ownership can boost or smooth the finances of football teams in a group. The model is becoming increasingly popular with owners, although less so with fans who are wedded to the identity, history and local nature of their club.

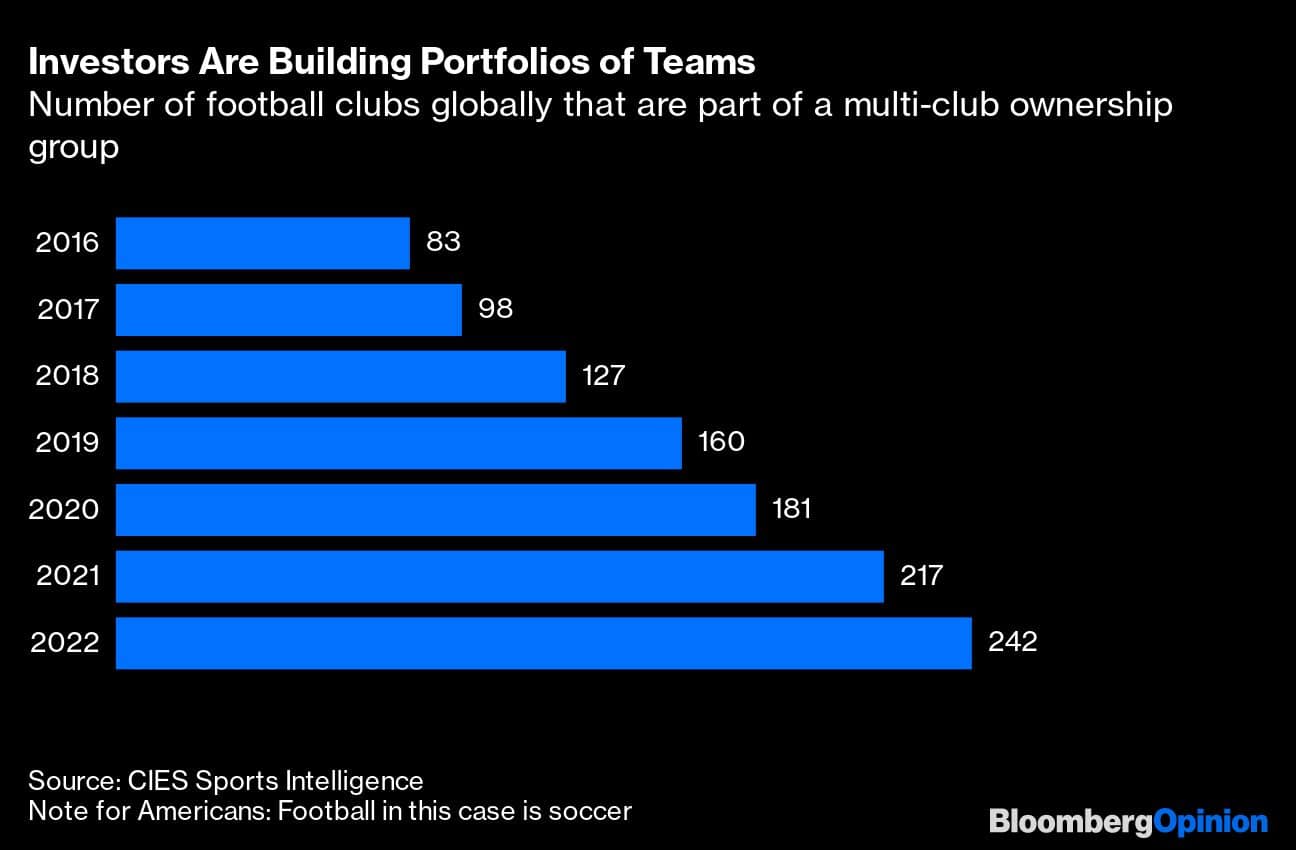

Advocates of multi-club ownership say it can help protect clubs financially. The phenomenon is certainly spreading: Nearly 250 football clubs globally were part of a multi-club group in 2022, up from fewer than 100 five years before, according to the Sports Intelligence division at the International Centre for Sports Studies (CIES) in Switzerland. According to UEFA, European football’s governing body, nearly one-in-10 top-division clubs in Europe have ownership links with one or more others.

The financial pressures of elite football are huge. The annual jeopardy of missing out on lucrative competitions can cost clubs tens of millions in lost TV revenue. At the same time, teams have to meet UEFA rules on financial sustainability designed to stop them spending beyond their means and going bust, or benefiting too greatly from super-rich owners.

Clubs are constantly hunting for ways to boost income to cover the spiraling prices of players and their wages. English clubs have just spent the most on new players in January ever, at £815 million. Clubs have locked expensive players into longer contracts so they can amortize the cost over more years, as Chelsea did with an eight-year contract for the £90 million midfielder Mykhailo Mudryk this year. UEFA has already signaled a rule change is planned to stop this.

Fernando Roitman, head of sports intelligence at CIES, says that player transfers, cross-club sponsorship agreements and player scouting costs could be used to help the finances of a specific team. Most multi-club groups have a clear vertical hierarchy with a flagship club ahead of lesser clubs in the pecking order, he says. This is a big reason fans don’t like it: They want their team to fight honestly for trophies, not be an incubator or feeder club for a single elite team.

However, Roitman adds that the main rationale for a multi-club strategy is to optimize player recruitment and development, especially with younger prospects – and ultimately to maximise the profits when a player is sold outside of the group.

In Europe, clubs owned or controlled by the same investors aren’t allowed to face each other in cup or league competitions. If a lesser club in a group got into an intra-European competition, the investor might have to sell out — although on-field success would also likely mean selling for a profit. In 2017, RB Leipzig of Germany and Red Bull Salzburg of Austria both qualified for the Champions League. Despite their link through investments from the Red Bull drinks group, they were each allowed to compete after changes in governance, financing and personnel. UEFA decided no single person or entity controlled both clubs.

Problems like these have been rare so far. Despite the recent rapid growth and interest from investors, the multi-club model is still in its infancy, says Theo Ajadi, a manager in the sports business group at audit and consulting firm Deloitte. The idea has been around for a long time, but not many investors have tried to exploit it yet.

Owners have a lot of freedom around how and where to recognize revenue from things such as multi-club sponsorship deals. There is nothing to stop a group skewing most of the income to the top club with the higher player costs, although national leagues or regulators can make judgments about the fairness and propriety of how the money is allocated, Ajadi adds. Many of Manchester City’s alleged rule breaches are concerned with revenue, sponsorship, related parties and operating costs.

Niall Couper, chief executive officer of Fair Game, a UK research and pressure group, says the model opens up new questions around transparency and financial fairness. “It needs to be thoroughly unpicked and held up to robust scrutiny,” he says.

Complaints about the commercialisation of football ring hollow to me – that ship sailed decades ago. But it seems important not to let sporting and commercial dominance become unassailable. The more this multi-team model grows, the more we need to keep track of how it is used and assess whether it does create an unfair advantage.

Paul J. Davies is a Bloomberg Opinion columnist covering banking and finance. Views are personal and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.