India released its first quarter (Q1) of FY24 GDP data on August 31. Real GDP growth came in at 7.8 percent y-o-y, broadly in line with consensus, though a tad lower than RBI’s expectation of 8.0 percent. A 7+ percent print should appear as a stellar growth number. Amongst the key global economies, the next best growth can be seen in Indonesia, at ~5 percent. China is at 4.5 percent.

Yet, this data does not reflect the true underlying momentum. For example, if one looks at the demand side break-up of Q1 GDP growth, barring government revenue spending, everything looks exciting. Household consumption spending (PFCE) is growing at 6 percent, gross fixed capital formation at 8 percent and exports (in real terms) at 12 percent. The trends gauged from earnings outcome or other high frequency do not portend any similar strength. India’s merchandise exports volume is declining compared to a year ago. Receipts from services exports are on a moderation path. Volume growth for consumption-oriented companies is much weaker than trends typically seen with a 6 percent PFCE growth.

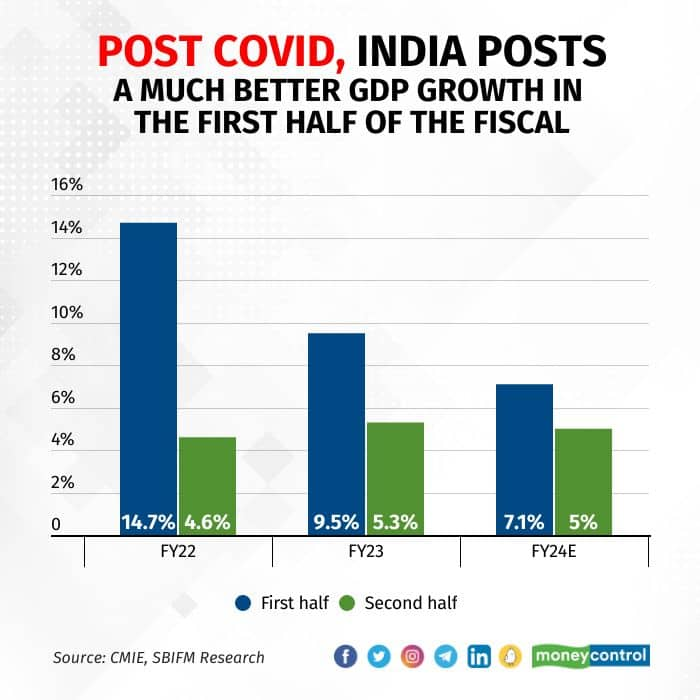

There have been some nuances to the GDP data post the Covid19 pandemic. The GDP growth during April-September (1H of fiscal year) is much better than October-March (2H of fiscal year). This anomaly hasn’t corrected itself even three years past the pandemic. Owing to this anomaly, Q2 GDP growth would still be a respectable 6-6.5 percent, but growth is likely to moderate to ~5 percent in 2H FY24, resulting in a full-year growth of ~6 percent in FY24.

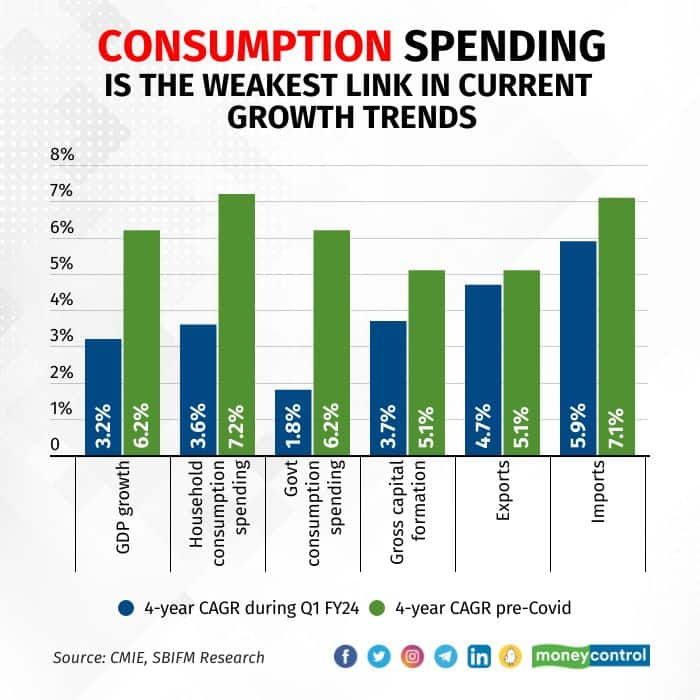

Given such statistical nuances to post-COVID GDP data, we find it better to compare GDP in any quarter to the respective quarter in FY20 and understand the true underlying strength of the economy. Doing so, we find that, India’s GDP is growing at a 4-year CAGR of 3-3.5 percent which is likely to further improve to 4-4.5 percent by the end FY24. Growth is on a gradual recovery.

Consumption demand is the weakest. Real household spending has grown at just 3.6 percent CAGR, significantly below the 7 percent trend in 4 years pre-COVID. Higher inflation has dented the true purchasing power of Indian households. Government revenue spending is understandably low, given that there is an increased focus on infrastructure creation. Investment spending is catching up. Exports saw significant growth in FY22 (2-year CAGR of 8.4 percent) and FY23 (3-year CAGR of 10 percent). Hence, despite its recent moderation, exports growth is better than the pre-COVID trend.

High-frequency activity indicators

Another way to gauge the economic momentum is by looking at various high-frequency activity indicators. These indicators underscore the following aspects of Indian growth today. Exports have weakened since the start of 2023, and the outlook is cautious. Demand from Europe is weaker than the US, and Chinese exports are once again up in competition. Government capex has jumped significantly as the central government frontloads capex ahead of the election alongside a higher budgetary allocation and state capex revives three years of post-COVID weakness.

This has led to a robust order inflow for construction companies. Real estate launches are rising as current real estate inventory is low, demand pipelines seem to be healthy, and the industry has seen a considerable consolidation over the last decade. Consequently, cement and various other building material companies witness a positive demand trend. Consumption demand — both on the rural and urban side — is not truly exciting, barring a few sectors such as air travel, leisure, luxury goods, and jewellery. Ideally with construction and capex picking up in India, its second-order effects should also lead to job creation and consumption demand to improve in years to come. Overall, the domestic side of demand can still be summed up as healthy. The global outlook is fragile though and makes one cautious about the near-term growth outlook.

Another important aspect which probably did not receive its due attention is the ongoing moderation in nominal GDP growth. The Q1 FY24 nominal GDP grew by a mere 8 percent and is likely to stay in single digits for the remaining quarters of FY24. This is not good news for near-term corporate revenue and profit outlook, tax collection, bank credit and other indicators linked to nominal output in the economy.

To sum up, India cannot be decoupled from the global growth trajectory. Prospects of a slowdown in global growth and tighter financial conditions will weigh on the country’s growth dynamics, contributing to weaker exports and likely delays in investment activity. Nevertheless, once the global headwinds fade, India can post a strong rebound: its macro fundamentals are well positioned for a multi-year improvement in economic output and earnings. Overall, the economic growth rate probably remains below potential.

Namrata Mittal is Chief Economist, SBI Mutual Fund. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.