Fond hopes of bond market development arise every time issuances go up. But step out of easing and negative real interest rate cycles and look at the trend. This time may be no different.

Corporate bond issues as a proportion of national income have ranged 3-3.5 percent of the GDP from the time since policy attention focused on developing this market to replace the closure of development finance institutions. Corporates shift from banks to bond financing whenever interest rates are ultra-low or negative as now. A rational response but never lasting enough to become a trend.

Classic features of underdevelopment persist — 99 percent of bond issues are privately placed, the private, non-financial firms are a few and top-rated (almost half of outstanding amounts are AAA-rated), public sector presence dominates while the finance and infrastructure companies have almost two-third share.

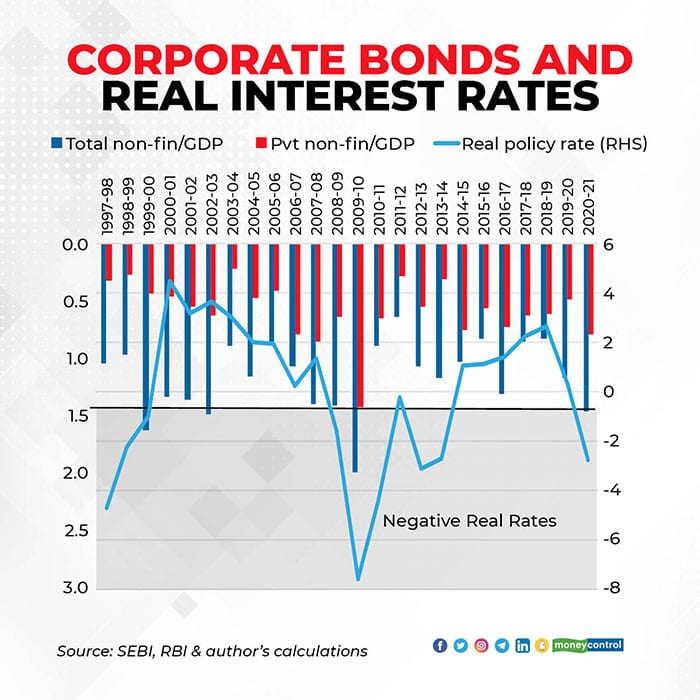

With such elements intact for over two decades, it won’t be any surprise if this time turns out no different from past episodes of negative real rates. As the chart below shows, corporates get interested in bonds during such periods, but retreat when the cycle turns. This was the case with non-financial bond issues, and its more insightful, private sector subset, in the noughties.

Perhaps rapid growth then provided extra fuel, and helped by the infrastructure investment push to replace demand loss after the 2008 crisis, total non-financial bond volumes touched 2 percent of the GDP in 2009-10. These were quick to scale back as monetary policy tightened thereafter.

A similar cycle is playing out now, creating illusions of bond market progress. In the pandemic year 2020-21, these touched 1.5 percent of the GDP from 0.9 percent in 2017-18 as real rates became negative in the pandemic monetary easing. Before that, the private, non-financial segment was in retreat although the total, which includes the public sector, reached 1.3 percent of the GDP in 2016-17, and remained comparably strong to 2018-19. The latter deviation is explained by finance and infrastructure companies that raised 90-92 percent of the funds, no doubt to strengthen balance sheets, and finance public investments as was the case in the late nineties and early 2000s; these entities enjoy implicit sovereign guarantee and best pricing as a result of which market-sourced debt is better.

Private firms find overseas debt comparably cheaper unless of course, domestic interest rates are so low so as to eliminate the cost gap. Coupled with the fact that almost half of the privately placed bonds are secured, it is no surprise they turn here sparely, never enduringly, the long intervals in bond issues depriving the market of depth and liquidity, or in other words, development!

There’s mutual reinforcement from banks too, the more so when they are risk-averse as in the last few years — loans are preferable to bonds that have to be marked to market, and, therefore, vulnerable to changes in interest rates.

Both past trends and persistence of backward features indicate the current cycle is no different. Instead of misplaced beliefs, it would be more useful to focus on why the bond market refuses to breakout despite numerous efforts and initiatives of two decades.

Why are the gaps in spreads of top-rated companies and moderate- to low-rated ones so wide? Does private placement encourage transparency and trust in retail investors whose presence is minimal? If information dissemination by credit rating agencies (CRAs) hasn’t helped, will the Insolvency and Bankruptcy Code (IBC), 2016, help?

Wishing bond market development on spurious signs will not deliver one, but improving corporate governance to inspire the trust essential for financial contracts may do so. Until then, it would be wiser to look at trends than cycles.

Renu Kohli is a New Delhi-based macroeconomist.

Views are personal and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.