With GST rollout scheduled to commence on July 1, India's textile sector is racing against time to align itself with the new indirect tax regime. While the near-term disruptions could take a potential toll on the financial performance of most players, the textile industry as a whole is poised to grow as organised units gain market share back from their unorganised counterparts, that currently constitute nearly 60-70 percent of the industry size.

We analyzed the probable impact of the new tax laws and the rates announced at different levels of the value chain to understand how things may pan out for the labour-intensive sector.

GST will essentially affect companies that cater mainly to the Indian markets. The export-oriented entities would not face headwinds since the input taxes paid by them on the exported output would be refundable in entirety. Comprehensive documentation and streamlining of input claims will only make things considerably easier than before.

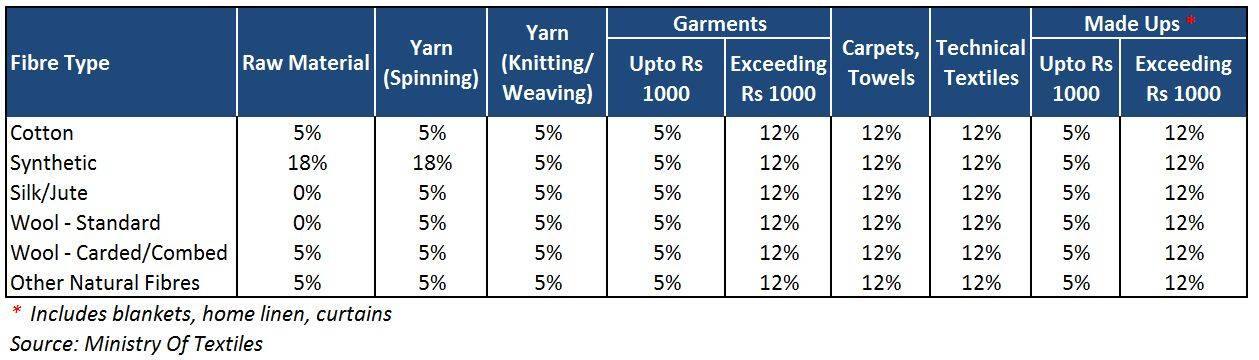

GST Rates Across Categories

From the rates perspective, barring man-made fibres, the new legislation appears to be in-line with the present tax scenario. This, coupled with easier and faster inter-state movement of goods (buoyed by simplified regulations), is likely to be beneficial for India’s regionally-diverse textile industry as a whole in the long run.

The positive impact of GST will be largely felt by companies engaged in manufacturing and/or dealing with fibre and yarn components, since the presence of unorganised units is relatively large compared to the fabric and garment units (where competition is comparatively less and barriers to entry are high due to greater requirement of funds as well as technical know-how).

In the short-run, however, inventory clearance and an impact on margins is a common theme that runs through the value chain.

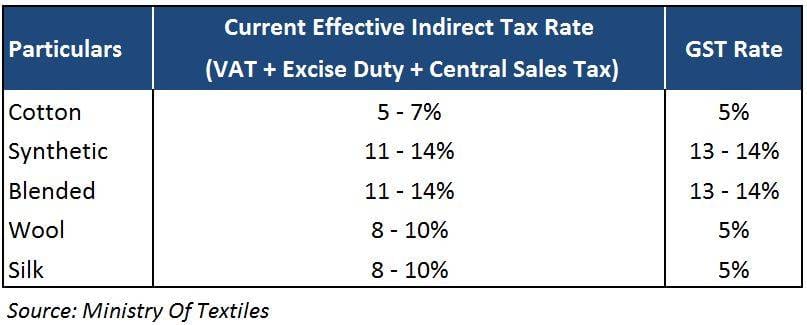

Tax Rate Comparison For Fabrics (Includes Cumulative Taxes From Fibre Procurement To Fabric Manufacturing)

As seen in the table above, on aggregation of all taxes involved till the fabric manufacturing stage (including the partial input credit set-offs, wherever applicable), GST rates seem more or less in line with the existing indirect tax structure in case of cotton and synthetic fabrics, implying that the new law is unlikely to have any material consequence on these fronts. For businesses involved in manufacturing woollen and silk fabrics, the announced rates come across as a positive sign.

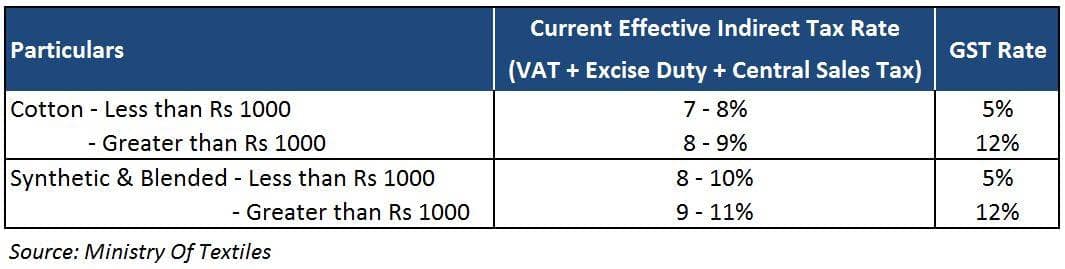

Tax Rate Comparison For Garments

Prima facie, though the GST rates on garments costing more than Rs 1,000 may result in a price rise and seem marginally negative for the garment manufacturers, tailwinds in the consumer dicretionary spending pan-India will make it easier for these players to pass on the tax increase to the final buyers.

The shift from unorganised to organised is the biggest long-term benefit from GST, notwithstanding the short-term inventory adjustment pangs. The only sub-segment that, prima facie, seems to be adversely impacted is the man-made textiles space, where tax rates have been hiked on man-made fibre and yarn under GST. Increasing use and popularity of synthetic textiles domestically and globally, backed by recent progression and growing competitiveness of India’s organised units in comparison to the Chinese players in international markets, is one of the key reasons that warrant some attention towards getting this issue addressed.

(With inputs from ICRA)

Follow @krishnakarwa152Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.