Anubhav Sahu Moneycontrol Research

Elantas Beck India Limited (EBIL) is the largest manufacturer of the specialty chemicals used in the electrical insulation space in India. Riding on technology from parent company Altana (a global specialty chemical leader), a dominant presence in the Indian market and power sector reforms, this company is worth a look. Interestingly, the company is 75 percent owned by parent Altana and none of the other subsidiaries or parent companies are listed anywhere in the world. Though there is nothing to suggest that a delisting is planned in India, a certain premium linked to speculation around this event is bound to be in the stock.

Company’s Background

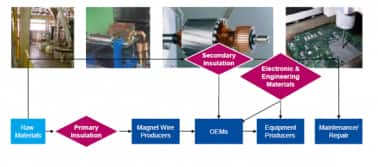

Incorporated as Dr Beck & Company, the company has been present in India since 1956. In 2003, it was acquired by leading electrical insulation company Elantas Gmbh (part of specialty chemicals leader Altana Group). The company is engaged in the sale of electrical insulation systems (82 percent of FY16 revenue) and electronic & engineering materials (18 percent) with its key end market being the electrical machinery industry.

It manufactures and sells wire enamels and insulation products (varnishes etc) for magnet wire manufacturers, motor and transformer industry and refurbishment industry. Applications are found in electric motors, household appliances, cars, generators, transformers, capacitors, TV sets, wind mills, computers, lamps, circuit boards, and sensors, etc.

Its manufacturing plants are located at Pimpri and Ankleshwar with capacities of 7,400 and 16,820 MT. The company’s key clients are major players in the electrical machinery industry like Bosch, ABB, Siemens, and BHEL etc.

Value chain for Elantas

Dominant player in the electrical insulation market:

Elantas is a market leader in all the segments of electrical insulation in India and holds a significant market share (about 40 percent each) in primary insulation segment (wire enamels) and secondary insulation segment (insulation of winding wire already mounted on a device). In the domestic market there are very few large players, with some competition in north India from a local supplier Harman Bawa. Internationally as well, there are very few companies that can match the company’s expertise – Axalta Coatings is one of them.

Power Sector Reforms are Key Long-term Growth Drivers

The government’s policy focus on the power sector and the anticipated increase in generation capacity to 400 GW by 2022 is one of the key drivers. Demand for generation and T&D (transmission and distribution) equipment are expected to grow by 25 percent CAGR till FY22. Industry body IEEMA (Indian Electrical and Electronics Manufacturers’ Association) forecasts the business for sub-stations, transmission lines, conductors, insulators and transformers etc. to grow in medium term on account of such a policy push.

In the last few years, Elantas has faced an indirect threat from the import of low-cost electrical machinery from China (16 percent of total demand in India) which leads to lower requirements for electrical insulation by the domestic equipment manufacturers. However, possible policy support from the government ranging from import curtailment to purchase of local products would be supportive for the company’s prospects. IEEMA has already highlighted a demand revival with 5.5 percent industry growth in Q4 FY17 (vs -1.4 percent in Q3 and 1.6 percent in Q2 2017). In our conversation with the company’s management, it was highlighted that company is operating at ~70 percent capacity utilization and expects it to gradually improve from hereon. Further it doesn’t see any incremental negative impact from Chinese imports.

Significant barriers to entry

Electrical insulation industry is a hi-tech niche segment which requires considerable investment in terms of technology, R&D for new applications and a matching skilled manpower. Elantas Beck benefits from the in-house R&D capabilities as well proven technology expertise from the parent company Altana. Additionally, it is the only company in India in this sector having presence in all the product segments. Further, a well-entrenched distribution network helps in maintaining customer relationship, critical in B2B industrial segment.

Raw Material Cost – a Crude Oil Derivative

Key raw materials are polymer intermediates (MDA, TMA, MDI) and solvents (cresol, phenol) which, in turn, are derivatives of crude oil. A sharp increase in crude oil prices and its derivatives can have an adverse impact on company’s margins. It is noticeable that the company has been a net beneficiary of low oil price regime as the raw material cost as a proportion of sales has reduced from 71.2 percent (in FY13) to 55.7 percent (Q1 2017). Given the oil production cut discipline in OPEC and improving shale oil production in US, oil prices are expected to remain contained in the medium-term. Further, the company is increasingly sourcing raw materials from the domestic firms (64 percent in FY16 vs 57 percent in FY13), which reduces its exposure to forex fluctuations.

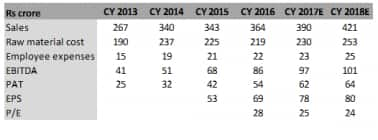

Financial Projections

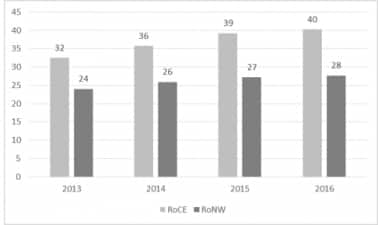

High and Improving Return Ratios (%) for Elantas

Valuation and Recommendation

We expect the company’s revenue to grow at 7 percent CAGR (FY15-18E) ahead of industry growth rate. Company’s EBITDA margins are expected to remain in range of 24-25 percent partially benefitting from the cost efficiency programmes. Elantas is currently trading at PE multiple of 25x 2017E EPS, which is at premium to median valuation prevailing in the Indian chemical sector universe (20x). However, we think this premium is warranted given the company’s dominant position and high barriers to entry in this segment. Further, compared to its global peers like Axalta coatings and Dupont, it is trading in discount.

Elantas is a steady performer where earnings volatility hasn’t been significant. Given that the parent holds 75 percent in the Indian listed subsidiary and is not listed and doesn’t have any other listed company globally, de-listing is an event that may not be ruled out.

In the last one year stock has given decent return of 27 percent (vs 32 percent for BSE small cap). In the current year, the stock has underperformed (4.5 percent vs. 29 percent for the BSE small caps) but given improving industry dynamics, company’s segment dominance and the probable option of delisting, this stock may be the right candidate for any risk-averse investor.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.