Manisha Natarajan

In several industry gatherings I’ve heard industry body representatives and promoters of real estate companies warn me that after RERA comes into force, apartment prices will start climbing. And the arguments they cite go something like these:

Argument # 1

So far in India, the capital of building a project has been funded by the buyer, who would merrily come in at the pre-launch phase and be asked to pay up almost 90 percent of the cost of his or her apartment with just the structure of the building ready.

After May 1, pre-launches simply can't happen. Builders have to pick up the cost of land, all approvals, and keep 70 percent of the amount raised from the buyers in a different account. This means a larger chunk of capital for projects will now have to be raised by the industry from institutions like banks, PE funds and NBFCs. And guess what, someone has to pay for it, and the industry will have to pass this on to the buyer.

Argument #2

There's a cost to making the real estate business RERA-compliant. A new knowledgeable team will have to be hired, there will be increased legal consultancy costs, more paperwork and compliance related costs, where the builder is forced to comply with stringent RERA norms. And someone’s got to pay for that as well. Right?

Argument # 3

New project launches have come down substantially. They have dropped to 33,000 new units in 2016, compared to the peak launch of 87,500 units in 2012. Post RERA, these launches will come down even more, as small- and mid-size players struggle to comply with RERA rules. So if supply shrinks, prices are bound to start rising sooner than later.

I doubt that.

Sure, new launches have shrunk by 62 percent from the euphoric rush of 2012. But they have for a reason and even before RERA Act has come into force.

Because there simply isn’t enough buyer demand to absorb the current inventory of already-launched apartments, floors and villas says, Samir Jasuja, Founder of Propequity. ”There is plenty of under-construction and ready supply in the pipeline. So even if costs to the developers of new projects go up post RERA, builders will have to absorb those. There is no room to pass them on to the buyer,” he adds.

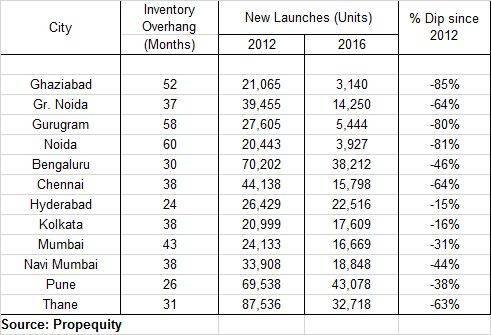

Take a look at the below table, which outlines the unsold inventory level across 12 key markets vis-a-vis new launches and the pattern is clear – the more the unsold inventory, the bigger the fall in new launches.

Anuj Puri, Chairman of JLL R, who recently bought out JLL India’s residential broking business says, “There’s going to be massive consolidation in the industry, but it isn’t as if construction activity will cease or stop post RERA. Ongoing construction activity is pegged at INR 174,000 crore, which will get delivered over the next 5 years. Of this 87 percent is residential.”

Watch: How RERA is going to change your homebuying experience

It’s likely that for the first three months after RERA coming into force, new project launches could slow down as developers grapple with the complexities of each state RERA rules. That won't last for long. Just as the effect of demonetisation did not. A recent CBRE residential report outlook for 2017 shows that supply jumped 70 percent in January-March 2017 compared to October–December 2016. It adds that 2017 alone will see USD 7 billion investments in India’s real estate.

And the number doesn’t seem stretched at all, if you see the spate of joint development announcements in the past one year, where individual land owners with ambitions of becoming builders have smelled the coffee. They have finally stopped waiting for land prices to go up and are bringing in large developers like Tata, Godrej and Sobha to get on with the job. Further shakeout is imminent and good for everyone’s sanity. Real estate must and should consolidate only to allow developers with a solid track record to exist. That I see as the best outcome of RERA.

Even today, India’s real estate market is differentiated on pricing. Trusted brands like K Raheja, ATS, Central Park, Brigade, Prestige, Ambuja Neotia, all charge a premium in their respective markets. And home buyers willingly pay, as they do for big corporate brands like a Tata or a Mahindra.

But to say, or even hint, that prices of new units will start climbing after the new law comes into force is a stretch.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.