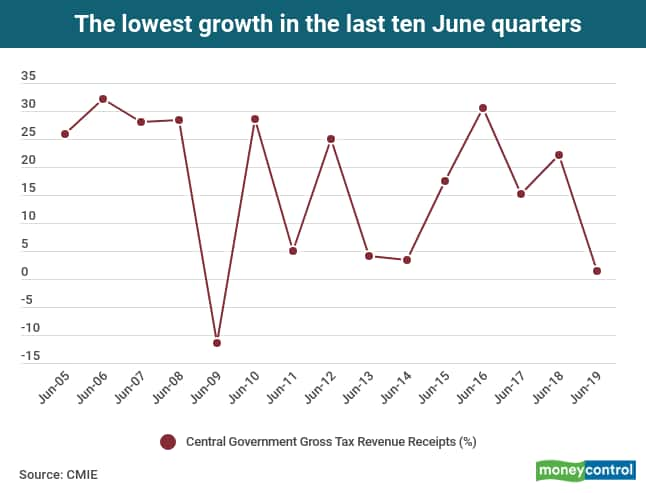

The weakness in the economy is evident from the fact that gross tax revenues of the central government were a mere 1.36 percent higher in the June 2019 quarter compared to the year ago quarter. In the Union Budget for 2019-20, the government had projected an increase of 18.3 percent in gross tax revenues for the full year, compared to the provisional estimates for 2018-19 published by the Comptroller General of Accounts. As the accompanying chart shows, the growth in gross taxes in the June 2019 quarter is the lowest since 2009, when the aftermath of the Lehman collapse shook the global economy.

The central government’s expenditure in the June 2019 quarter was affected by the elections. Capital expenditure was the worst affected, and capex during the June quarter was lower by 27.6 percent compared to the June 2018 quarter. That kept the fiscal deficit in check and it was higher than in the year- ago quarter by a mere 0.7 percent. The low deficit indicates that the government’s stimulus to the economy was minimal in the June 2019 quarter, which would impact GDP growth for the quarter.

Half the subsidies budgeted for the entire year have been paid out in the first quarter. Emkay Global economist Kruti Shah says ‘additional spending of the government is likely to be funded through the National Social Security Fund (FY19: ~1.4% of GDP), extra budgetary resources, and additional revenue mobilizations from RBI's reserves and foreign bond issue. This might continue to keep the G-sec yields artificially suppressed.’ The Emkay Global research note adds, ‘State spending growth in Q1FY20 has also been benign at 1.2 percent yoy, which together with lower central government spending might have triggered a severe slowdown in the economy.’

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.