Krishna Karwa Moneycontrol Research

India’s automobile manufacturers have been a resilient lot in the aftermath of demonetisation and Supreme Court’s ruling in relation to restrictions on sale/registration of BS III vehicles. While some companies announced a good set of numbers amidst all the headwinds, most bore the brunt considerably.

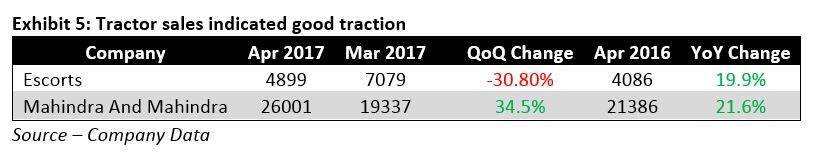

A preliminary look at the number of units sold by leading industry players across various categories reveals that passenger vehicle sales continued to maintain a reasonable uptrend overall (barring a few), all medium and heavy commercial vehicle manufacturers witnessed a significant decline in their sale volumes on a sequential and year on year basis, two-wheeler and light commercial vehicle sales were impacted in some cases, and tractors reported decent growth.

What can one expect from the Q4FY17 results?

Medium and heavy commercial vehicle companies would be staring at a difficult earnings season and the impact can linger on for a couple of more months. Unsold BS III inventory and retro-fitting costs (roughly to the extent of Rs 30,000-40,000 per truck) to ensure compliance with BS IV norms are likely to be a major drag on their financials.

High discounts offered by some two-wheeler companies at the end of March to get rid of their BS III stocks may result in a dent in their margins in the recently concluded quarter, but a recovery in sales in subsequent quarters, buoyed by a robust demand, is likely to help them get back on track.

The meteorological department’s forecast of a good monsoon should support tractor manufacturers, who stand to benefit on the back of a probable increase in orders, as the agrarian community readies itself for the pre-monsoon activities in Q1FY18.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.