Anubhav Sahu Moneycontrol Research

Bhansali Engineering Polymers (BEPL), one of the two main manufacturers of ABS (acrylonitrile butadiene styrene) in India, reported another stellar quarterly results after it gained from elevated capacity utilization, improved product pricing and better operating performance.

Near-term earnings guided by pricing and higher capacity utilisation

In the second quarter of FY18, the company posted net sales of Rs 248 crore, adjusted for both GST recoveries and excise duty, up 11 percent QoQ and 52 percent YoY. Improved turnover reflected higher pricing trend for ABS and the elevated capacity utilization witnessed recently.

EBITDA margins improved sequentially by 207 bps (+563 bps YoY) on account of lower raw material costs (57 percent of net sales vs 68 percent of sales in Q1 FY18) offsetting higher purchase of stocks. In addition, other income helped net profit rise by 49 percent QoQ and 186 percent YoY.

Post GST, COMPS not exactly comparable

Post GST, excise duty and GST paid is clubbed under a single line item in financial statement. This helps to calculate net sales figure but this is not comparable to net sales data earlier which was only adjusted for excise duty. For last quarter as well as last year net sales reported data were not adjusted for other indirect tax data. It means % gain reported on net sales is perhaps understated and YoY change could be higher at about 60 percent.

Styrene/ABS pricing trend

ABS (Acrylonitrile butadiene styrene) prices appreciated last quarter on account of higher oil prices, elevated prices for acrylonitrile and higher end market demand. On year-to-date terms, Asian ABS prices have risen about 40 percent. One of the key factors driving this trend has been the higher Chinese demand for ABS required for automobile interiors.

Further, raw materials – particularly acrylonitrile – needed for the production of ABS have also risen which, in turn, has led ABS resin producers to hike the prices. Higher acrylonitrile prices have been guided by plant shutdowns in China along with Hurricane Harvey disruption in the United States.

Having said going forward, acrylonitrile prices are expected to ease as the two major facilities in Texas, Ascend Performance Materials and Ineos Nitriles, start supplying the acrylonitrile to the market.

Prices for Styrene, another raw material for ABS, have already dropped recently to the levels seen in mid-July. This eventually would help ABS resin manufacturers to improve margins further in near term.

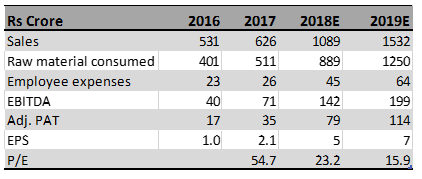

Financial projections & valuations

It is noteworthy that the company is building a fourfold increase in manufacturing capacity (by FY22) in two stages, which should help in capturing the import-dependent domestic market (industry domestic capacity 60 percent of demand).

In the near-term, the company aims to increase capacity to 137,000 MT (from 80, 000 MT) funded through internal accruals. Further, the company is also underway with a mega plan for 2 lakh TPA capacity which is likely to be commissioned by FY22.

As far as quarterly results are concerned, we are encouraged by the performance, as the earnings growth traction is close to our estimates. And, therefore, we continue to expect Bhansali to post earnings growth at a CAGR of 81 percent (FY17-19E) in the same period.

The stock has recently surged on the back of better operating performance. However, given better earnings visibility, we find valuations reasonable at PE multiple of 15.9x (FY19E earnings).

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.