Index funds are said to be diversified. However, when a few stocks or sectors clearly outperform the others, does the diversification still remain intact? Let us go back to the basics to understand what exactly an Index is and what it represents.

A stock market Index of a country represents the economic health and the investor sentiment of that country. The Index constituents can be calculated through various methodologies however, generally, bigger the company size, higher is its weightage in the Index.

This ensures that top companies and sectors that dominate in a country are represented in its Index.

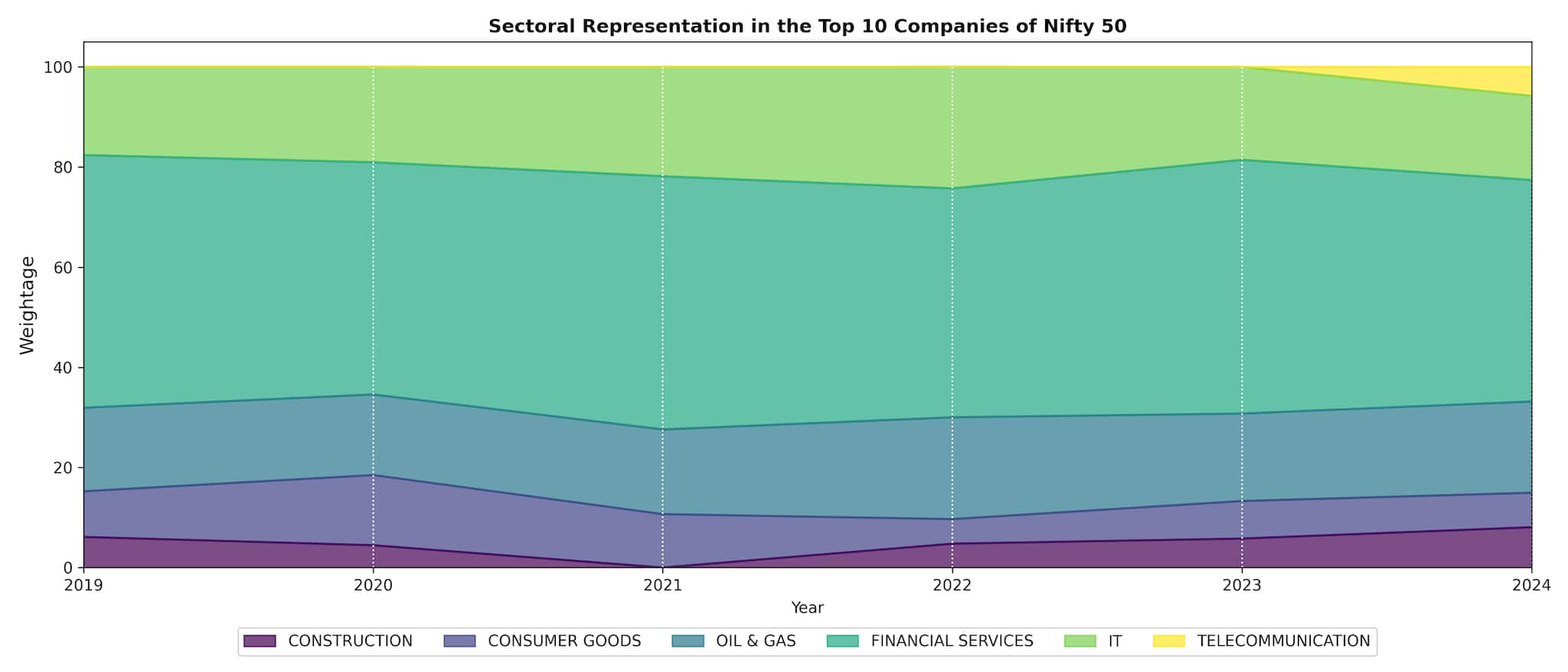

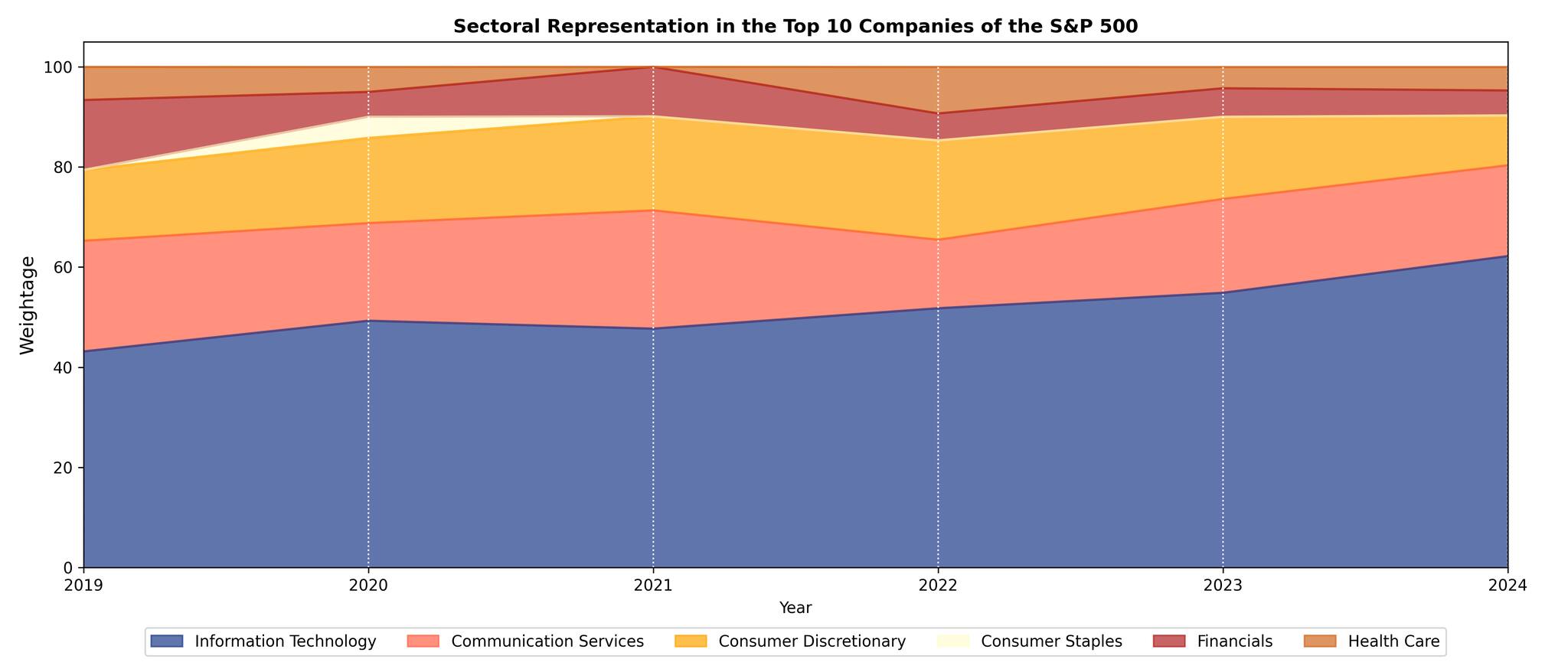

Example: In India the banking and financial services companies constitute to 34% of the Nifty 50 Index. In US the IT sector has 35% weightage in S&P 500.

Now if a passive investor wants to invest in a country, the most direct option is to invest in its Index fund. Index funds are considered diversified as it invests in several underlying stocks from different sectors.

We looked at the index constituents of India and US. It was observed that the top 20% of the companies in India’s Nifty 50 Index contribute to 56% weightage in the Index while in the US S&P 500 the top 20% of the companies contribute to 72% weightage in the Index.

This is a classic Pareto principle in play. The Pareto principle was developed by Italian economist Vilfredo Pareto in 1896. Pareto observed that 80% of the land in Italy was owned by only 20% of the population.

This also applies to different sectors in the same country. Financial Services & IT dominate the Indian Index. IT and Communication services dominate the US Index.

So that brings us back to the main question — Is the index really diversified? Yes, overall it is diversified however when a particular sector or stock dominates the index its weightage significantly increases in the Index as it can be seen with IT sector in the US.

If the objective is to seek pure diversification, perhaps an Equal Weighted Index or an Equal Risk Index could be a better option.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.