Ruchi Agrawal Moneycontrol Research

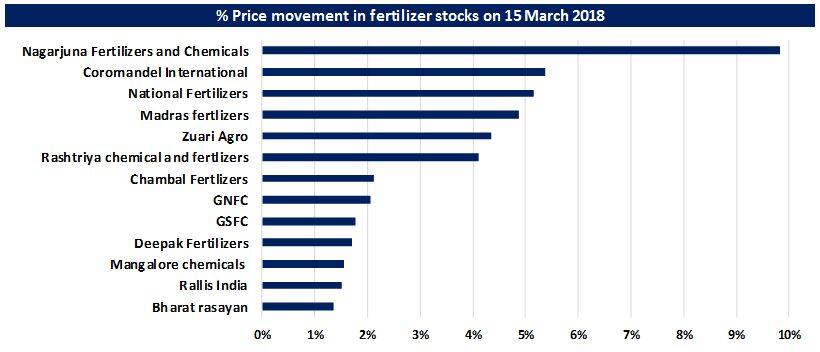

The Cabinet approval of the proposal from Department of Fertilizers to continue urea subsidy scheme from 2017 up to 2020 at a total estimated cost of Rs 1,64,935 crore along with the nationwide rollout of the DBT scheme (direct benefit transfer), created some momentum in the fertilizer stocks which rallied almost 10 percent. The announcements come in line with the government’s increased focus on stimulating the agri sector.

While the annual approval of the Urea subsidy by the Cabinet is an usual process, the current announcement for a preclearance for the upcoming three years wasn’t anticipated and hence received a positive response.

The background

The selling price of urea to farmers is controlled directly by the government. In order to compensate the companies for the loss, the difference between the cost of urea and the MRP (maximum retail price) is reimbursed through the urea subsidy scheme. This amounts to a significant burden on the exchequer, approximately Rs 42,748 crore in the current year. The urea subsidy amount for the coming year has been budgeted at Rs 45000 Crore (total fertilizer subsidy 2018-19: around Rs 70000 crore)

Recent steps by the government

In a bid to discourage farmers from overusing urea in their fields, government had also announced the cutting down of the urea bag size from the earlier 50 kg bag to a 45 kg bag. The argument stands that the farmers are very rigid on using a certain number of bags per hectare of land and do not generally reduce the urea usage despite other methods used by the government. This move could lead to a significant change in the consumption pattern and a possible decline in costly urea imports, along with some relief to the enormous subsidy burden on the exchequer.

In order to stall the industrial misuse of the subsidized urea, the government had also made the neem coating on urea mandatory. This move should help in discouraging the industrial diversion.

Along with these, the government has also started work on reviving closed urea manufacturing plants to ramp up production by 2022, in order to reduce imports of fertilizer, or rather to create a surplus which could find way to exports to neighboring countries such as Nepal, Bangladesh and Sri Lanka.

Rollout of DBT

Along with the pre-clearance for urea subsidy, the government has also announced the nationwide rollout of the DBT (direct benefit transfer) scheme, which is expected to smoothen out the subsidy woes of the fertilizer companies in times to come.

Given the huge farmer base, the usual mishandling of benefit transfers and the constraint of banking facility to each farmer, the DBT scheme being implemented in India is a modified version, where the transfer will still be made to the companies instead of directly to farmers.

This shifts the cycle of subsidy accruement from the point of factory gate to point of actual sale to the farmers, making the subsidy process dependent on accurate recording of the sales, which saw some glitches in the early phases of DBT implementation. However, with the proper implementation of systems at retails stores front, the transfer of subsidy at point of sale is expected to be immediate.

In addition, the government’s promise to clear all outstanding subsidy along with the implementation of the DBT scheme stand to benefit the fertilizer companies who could expect some relief in their working capital.

Apart from the proper recording of sales at the retail front, the shift of the subsidy accruement to point of sales makes forecasting of product demand an absolute necessary and critical step for the fertilizer companies. Any piling up of channel inventories would lead to expanding the subsidy reimbursement cycle and increase working capital requirements and thereby costs for the companies.

Overall, pre-clearances of longer term subsidy along with a more managed DBT scheme, smoother flow of subsidies is definitely expected to smoothen the subsidy clearance timeline for the companies, which had been a major pain point for fertilizer companies in the past. But some portion of the overall expected benefit would still be eaten away by the time taken for the fertilizer products to move from the factory to actual sales realizations.

The successive steps taken by the government ultimately aims at reducing the overall usage of urea in Indian farms (as Indian agriculture has always had lopsided usage of urea). While this could impact long-term volume outlook for urea manufacturers, the relief on the working capital front is a partial sweetener.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.