In India, 6 percent of the population files income tax returns, and less than 3 percent pays income tax. Among those who do, the salaried class disproportionately shoulders the tax burden. Our estimates suggest that salaried employees contribute approximately 50 percent of total personal income tax collections. This imbalance highlights the pressing need for reforms to create a fairer system for the salaried class while fostering economic growth.

Reducing the tax burden on salaried employees would increase their disposable income, leading to higher consumption and investment. This, in turn, would inject liquidity into the economy and generate healthy demand, providing much-needed support to a slowing economy. However, to ensure fiscal stability, these measures must be accompanied by stricter enforcement of tax compliance for those currently outside the tax net.

India's income tax regime is characterized by multiple slabs and options, designed to offer flexibility but often adding unnecessary complexity for taxpayers and the Income Tax Department. For salaried individuals, navigating these intricacies can be burdensome.

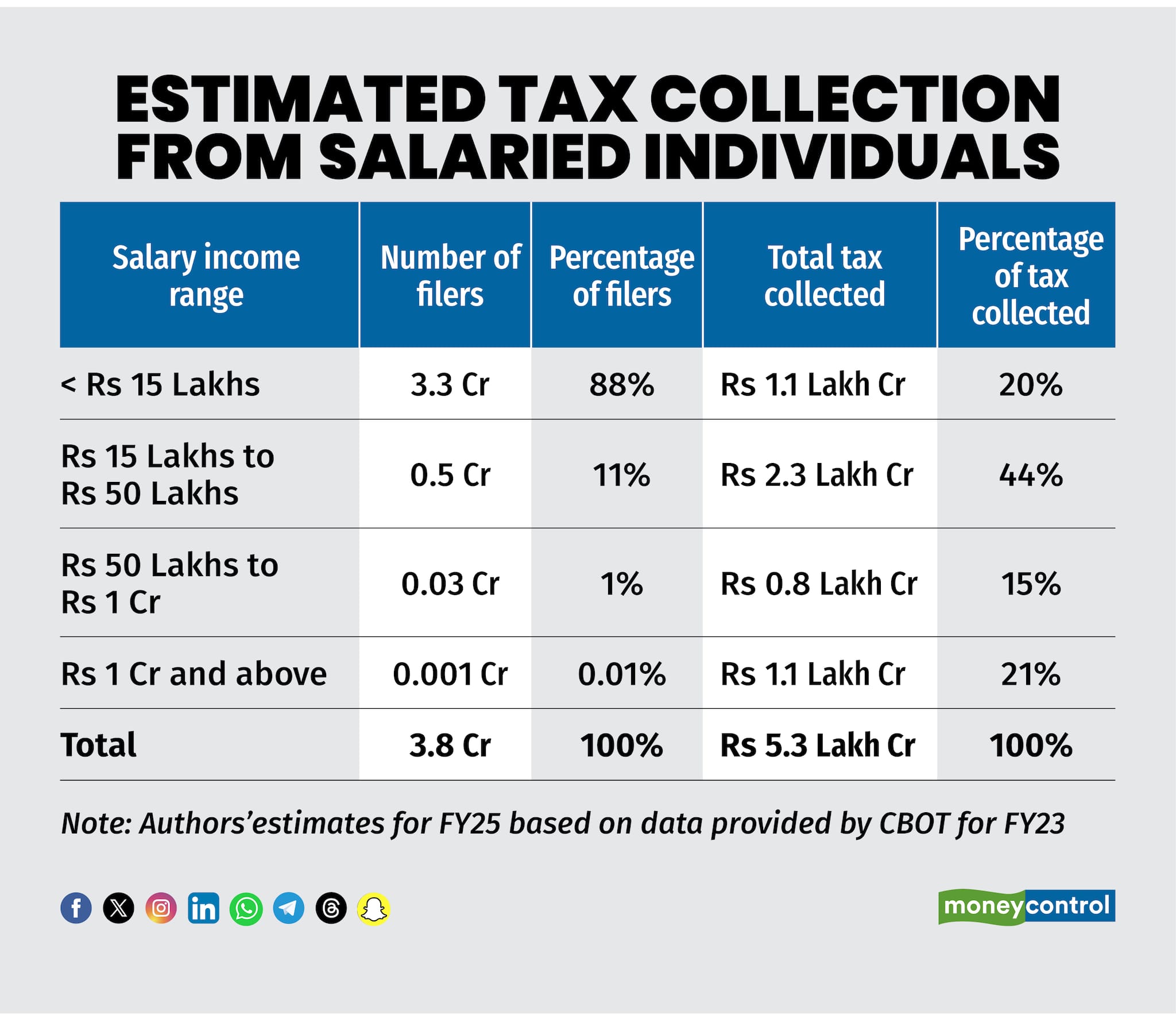

The 88:20 ratioThe table below illustrates tax collections across different salary income brackets.

The data shows that individuals earning salary income of less than Rs 15 lakh annually account for 88 percent of salaried tax filers but contribute only 20 percent of tax collections. Providing relief to this segment would benefit the largest number of taxpayers while having a minimal impact on overall tax collections.

Additionally, the Rs 15 lakh to Rs 50 lakh bracket contributes the highest share of tax collections (44 percent). Offering relief to this group would result in a substantial increase in disposable income, further boosting demand and savings.

A case for tax cut for salaried employeesIn light of the above, we propose a simplified tax structure specifically for salaried individuals as follows:

# No income tax for salaried individuals earning up to Rs 15 lakh per annum

# A flat 25 percent tax for those earning salary between Rs15 lakh and Rs 50 lakh per annum

# A flat 30 percent tax for those earning salary above Rs 50 lakh per annum

# Elimination of all deductions, surcharges and cess

# No change to capital gains tax, dividend tax and business income tax rates.

Fiscal Implications of the proposed tax cutsWe estimate that the above measures would release Rs 2.4 lakh crore (6 percent of gross direct and indirect taxes collected by the central government) into the hands of salaried taxpayers which works out to an average of Rs 1,00,000 tax savings per tax paying salaried individual. While this represents 0.75 percent of GDP, the potential economic benefits far outweigh the immediate fiscal impact:

# Stimulating consumption: Rs 1.1 lakh crores (45 percent of tax cut) would be released into the hands of individuals with salary income <Rs 15 Lakhs per annum. The marginal propensity to consume in this population is extremely high. Increased disposable income would drive consumption, particularly in critical sectors like retail, real estate, and automobiles, boosting GDP growth and creating employment opportunities.

# Indirect tax recovery: Greater consumption would result in higher collections from Goods and Services Tax (GST) and other indirect taxes. We estimate that around Rs 30,000 Crore in indirect taxes could be recovered, reducing the fiscal impact to 0.65 percent of GDP.

# Multiplier effect: Higher consumption would stimulate demand, encouraging businesses to expand and create jobs, further boosting the economy.

# Addressing the flight of capital: India has seen a growing trend of professionals emigrating, with high tax rates often cited as a significant reason. Simplifying the tax structure and reducing the burden on salaried individuals could incentivize many to remain in the country, strengthening India’s talent pool and contributing to its economic growth.

ConclusionA simplified tax regime tailored to the salaried class—exempting incomes up to Rs 15 lakh, imposing a flat 25 percent tax on incomes between Rs 15 lakh and Rs 50 lakh, and a flat 30 percent tax on incomes above Rs 50 lakh—is not just a fiscal adjustment; it is a strategic investment in India’s economic future. While the initial revenue loss is estimated at 6 percent of total gross tax collection by central government, the long-term benefits from increased consumption, higher indirect tax revenues, and talent retention far outweigh the short-term costs.

As India strives to become the third largest economy globally, bold taxation reforms could serve as the catalyst to unlock the full potential of its workforce and drive sustainable economic growth.

(MD Ranganath is Chairman of Catamaran Ventures, and Chirag Jain, Senior Associate, Catamaran Ventures.)Views are personal and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.