Aditya Agarwala

The Nifty-50 index Futures continues to oscillate back and forth in a narrow range indicating consolidation going on currently. The upper end of the range is placed at 10,850 and the lower end of the range is placed at 10,700.

The next trending move will be seen on a breakout from this range. A trade above 10,850 can resume the uptrend taking it to levels around 10,950-11,090.

However, a trade below 10,700 can trigger a correction to levels around 10,530-10,400. The RSI is also oscillating between the range of 40 and 60 affirming sideways consolidation.

The volatility index is trading at the lower end of the range indicating indecisiveness among the bulls and the bears. However, owing to the mean reversion nature of VIX, a rise in volatility is possible in the coming trading sessions which could lead to choppy trading sessions going ahead.

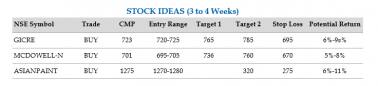

Here is a list of top three stocks which could give 8-11 percent return in next 3-4 weeks:

General Insurance Corporation of India: Buy| CMP: Rs 723| Target: Rs 785| Stop Loss: Rs 695| Return 9%

On the daily chart, General Insurance Corporation of India has broken out from a falling wedge pattern indicating bullishness building up in the stock.

A sustained trade above Rs 726 with healthy volumes can resume the uptrend taking it to levels of Rs 765-785. Further, it has taken support at the 78.6 percent Fibonacci retracement level and turned upwards affirming bullishness.

Moreover, RSI has witnessed a range shift entering in the bull zone after forming a double bottom at the 46-level affirming strength. The stock may be bought in the range of Rs 720-725 for targets of Rs 785, and keep a stop loss below Rs 695.

United Spirits: Buy| CMP: Rs 701| Target: Rs 760| Stop Loss: Rs 670| Return 8%

On the daily chart, United Spirits has broken out of a trendline resistance resuming the uptrend. Further, volume picked up in the breakout affirming the strength.

Further, on the weekly chart, it has turned upwards after taking support at the 61.8% indicating higher levels in the coming trading sessions.

The RSI has turned upwards breaking out of the upper Bollinger Bands suggesting extended bullishness in the coming trading sessions. The stock may be bought in the range of Rs 695-705 for targets of Rs 2,675-2,910, and keep a stop loss below Rs 2,440.

Asian Paints: Buy| CMP: Rs 1275| Target: Rs 1380| Stop loss: Rs 1240

On the daily chart, Asian Paints is on the verge of a breakout from a channel pattern suggesting bullishness building up in the stock.

Further, the stock has turned upwards after forming a double bottom and taken support at the 50-DMA affirming bullishness dominant. The RSI is in the bull zone suggesting higher levels in the coming trading sessions.

The stock may be bought in the range of Rs 1,270-1,280 for targets of Rs 1,335-1,380, and keep a stop loss below Rs 1,240.

Disclaimer: The author Technical Analyst at YES Securities (I) Ltd. The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.