Domestic equities consolidated on November 16 resulting in moderate gains for the benchmark indices. The BSE Sensex registered a fresh record close while the Nifty50 held the 18,400 mark as global markets turned cautious amid geopolitical tensions.

The BSE Sensex rose 108 points to 61,981, while the Nifty50 gained 6 points to 18,410 and formed a Doji kind of pattern on the daily charts, indicating indecisiveness among bulls and bears about the future market trends.

However, the index maintained higher top formation for the fourth consecutive session, indicating a positive undertone of the market.

"The momentum indicator RSI (relative strength index) is sustaining above 65 mark and moving higher which hints at the strong positive momentum for the short to medium term," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

As per the overall price structure and evidence supported by indicators, the market feels that Nifty will remain in a positive trend and move towards the level of 18,500 followed by the 18,650 mark. However, the "bullish view will be negated if it breaches below the 18,282 level," Sawant said.

The broader markets were under pressure with the Nifty Midcap 100 and Smallcap 100 indices falling 0.65 percent and 0.83 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 18,361, followed by 18,338 & 18,301. If the index moves up, the key resistance levels to watch out for are 18,436 followed by 18,459 and 18,497.

The Nifty Bank extended its uptrend for yet another session, rising 163 points to end at a fresh record closing high of 42,535, and formed a bullish candle on the daily charts on November 16. The important pivot level, which will act as crucial support for the index, is placed at 42,361, followed by 42,286 and 42,166 levels. On the upside, key resistance levels are placed at 42,602 followed by 42,676 & 42,797 levels.

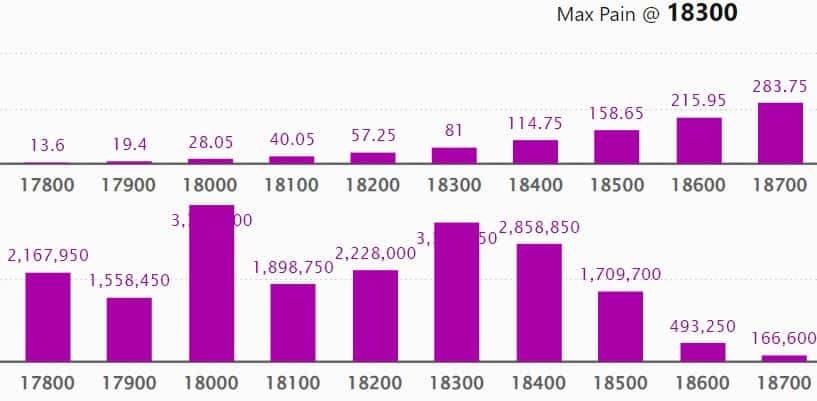

The maximum Call open interest of 38.37 lakh contracts was seen at 19,000 strike, which can act as a crucial resistance level in the November series.

This is followed by 18,400 strike, which holds 28.35 lakh contracts, and 18,500 strike, which have more than 27.87 lakh contracts.

Call writing was seen at 18,900 strike, which added 6.64 lakh contracts, followed by 18,400 strike which added 6.47 lakh contracts, and 18,500 strike which added 5.97 lakh contracts.

Call unwinding was seen at 18,200 strike, which shed 2.31 lakh contracts, followed by 18,100 strike which shed 2.2 lakh contracts and 18,000 strike which shed 1.67 lakh contracts.

Maximum Put open interest of 37.75 lakh contracts was seen at 18,000 strike, which can act as a crucial support level in the November series.

This is followed by 18,300 strike, which holds 33.57 lakh contracts, and 18,400 strike, which has accumulated 28.58 lakh contracts.

Put writing was seen at 18,400 strike, which added 9.64 lakh contracts, followed by 18,500 strike, which added 4.13 lakh contracts, and 17,800 strike which added 3.81 lakh contracts.

Put unwinding was seen at 17,500 strike, which shed 1.26 lakh contracts, followed by 17,400 strike which shed 78,600 contracts and 19,000 strike which shed 71,600 contracts.

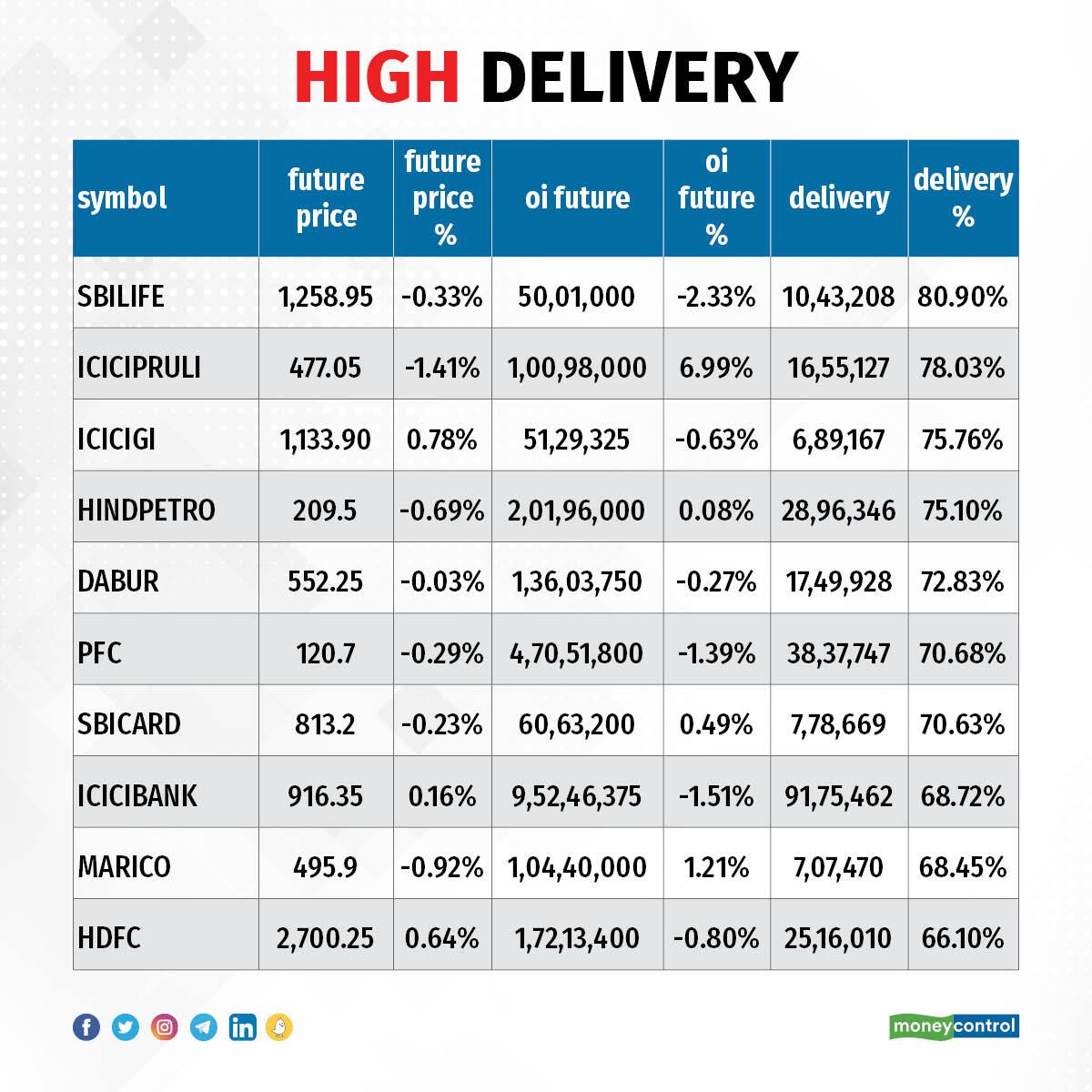

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. Highest delivery was witnessed in SBI Life Insurance Company, ICICI Prudential Life Insurance, ICICI Lombard General Insurance, Hindustan Petroleum Corporation, and Dabur India, among others.

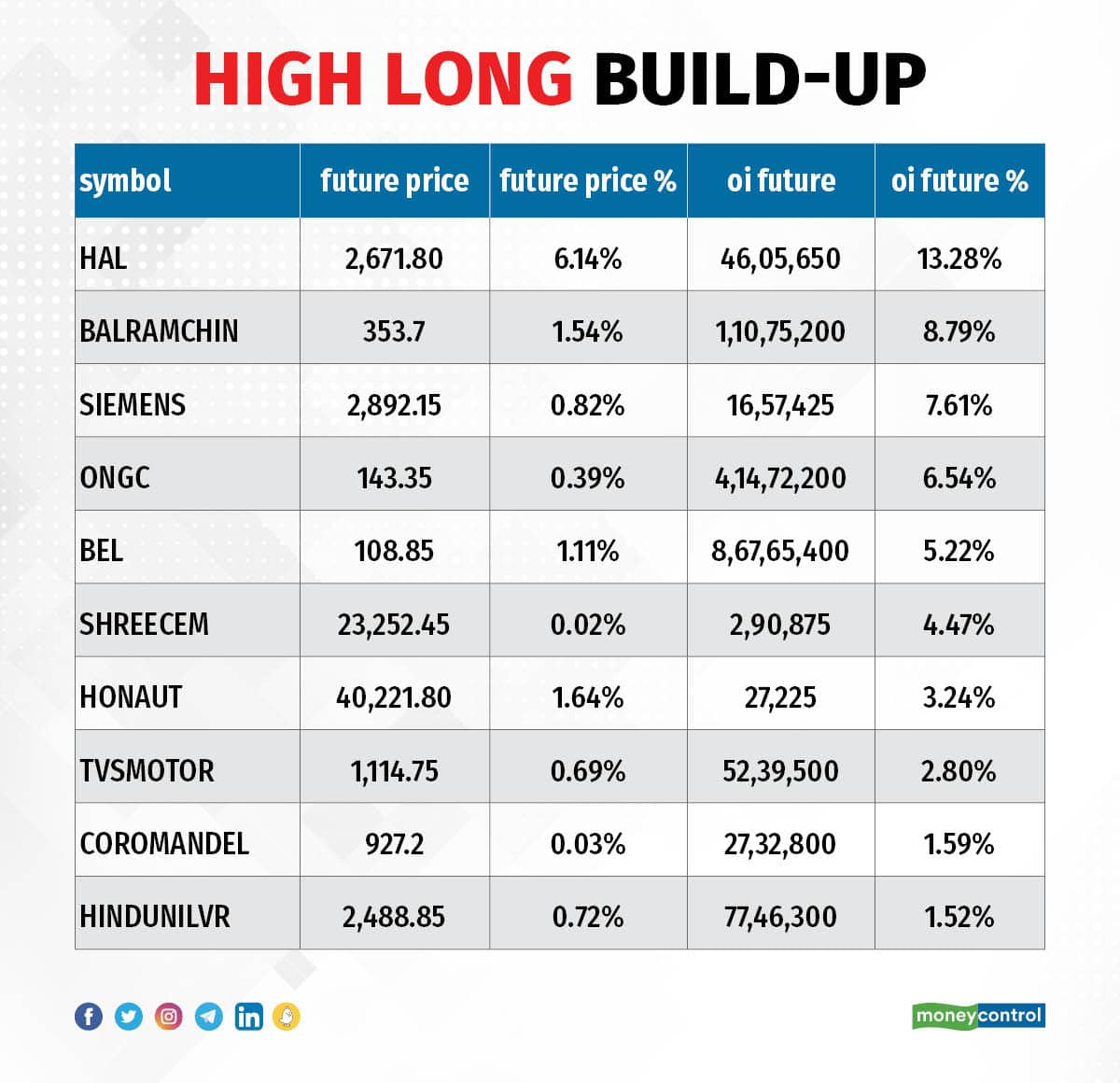

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Hindustan Aeronautics, Balrampur Chini Mills, Siemens, ONGC, and Bharat Electronics, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Delta Corp, Syngene International, Cummins India, Hindalco Industries, and Eicher Motors, in which long unwinding was seen.

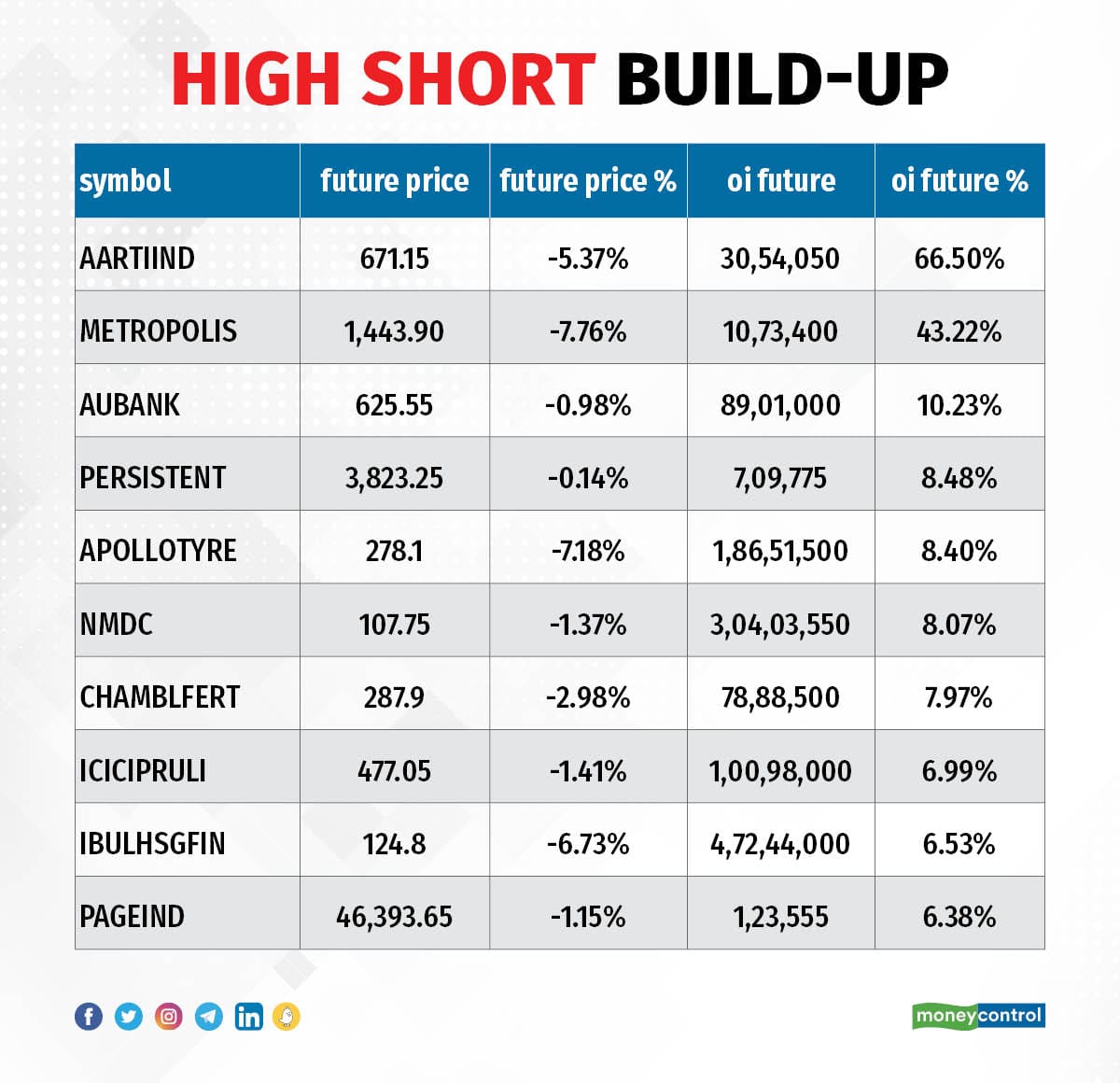

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including Aarti Industries, Metropolis Healthcare, AU Small Finance Bank, Persistent Systems, and Apollo Tyres.

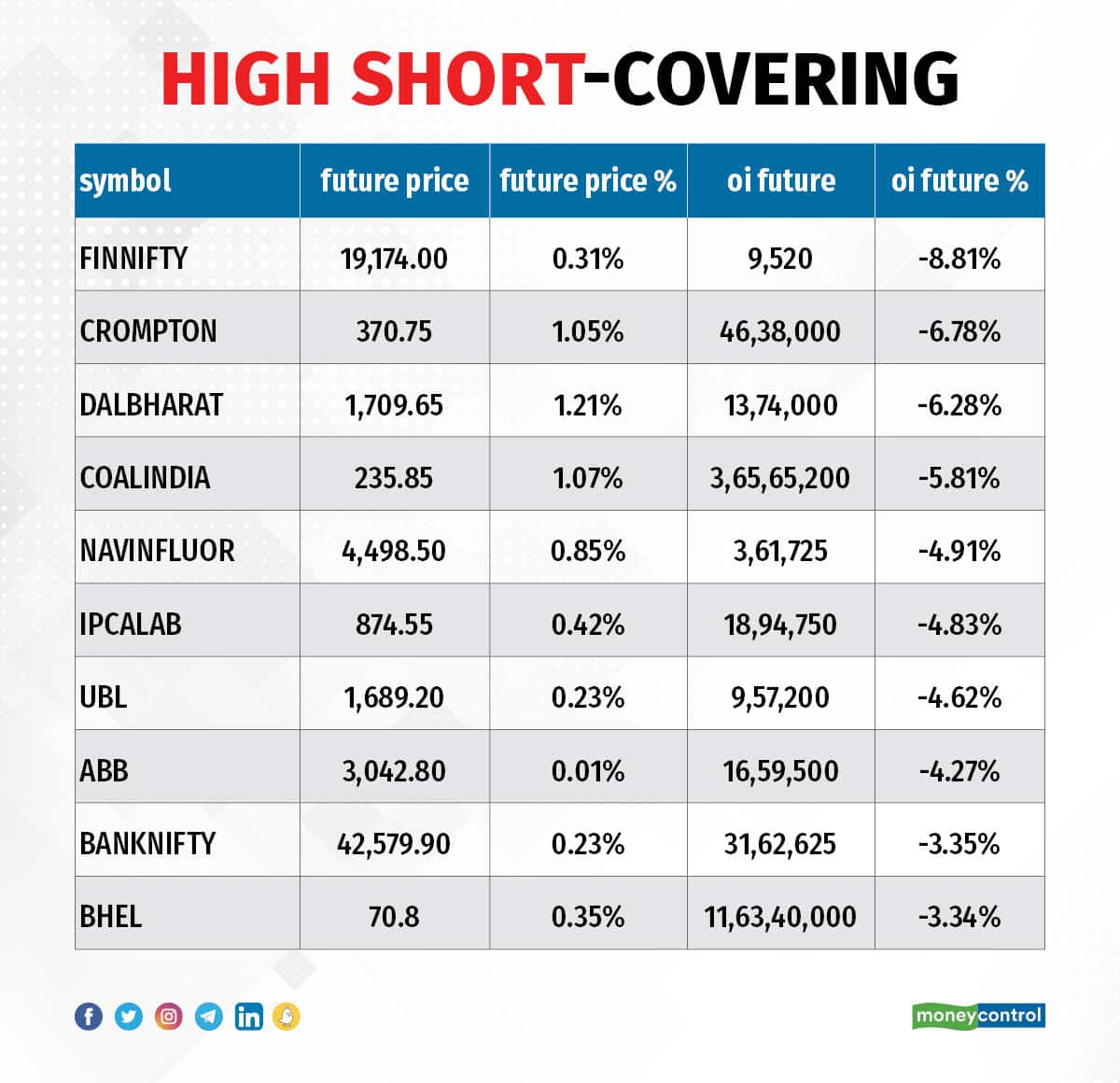

31 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which short-covering was seen include Nifty Financial, Crompton Greaves Consumer Electrical, Dalmia Bharat, Coal India, and Navin Fluorine International.

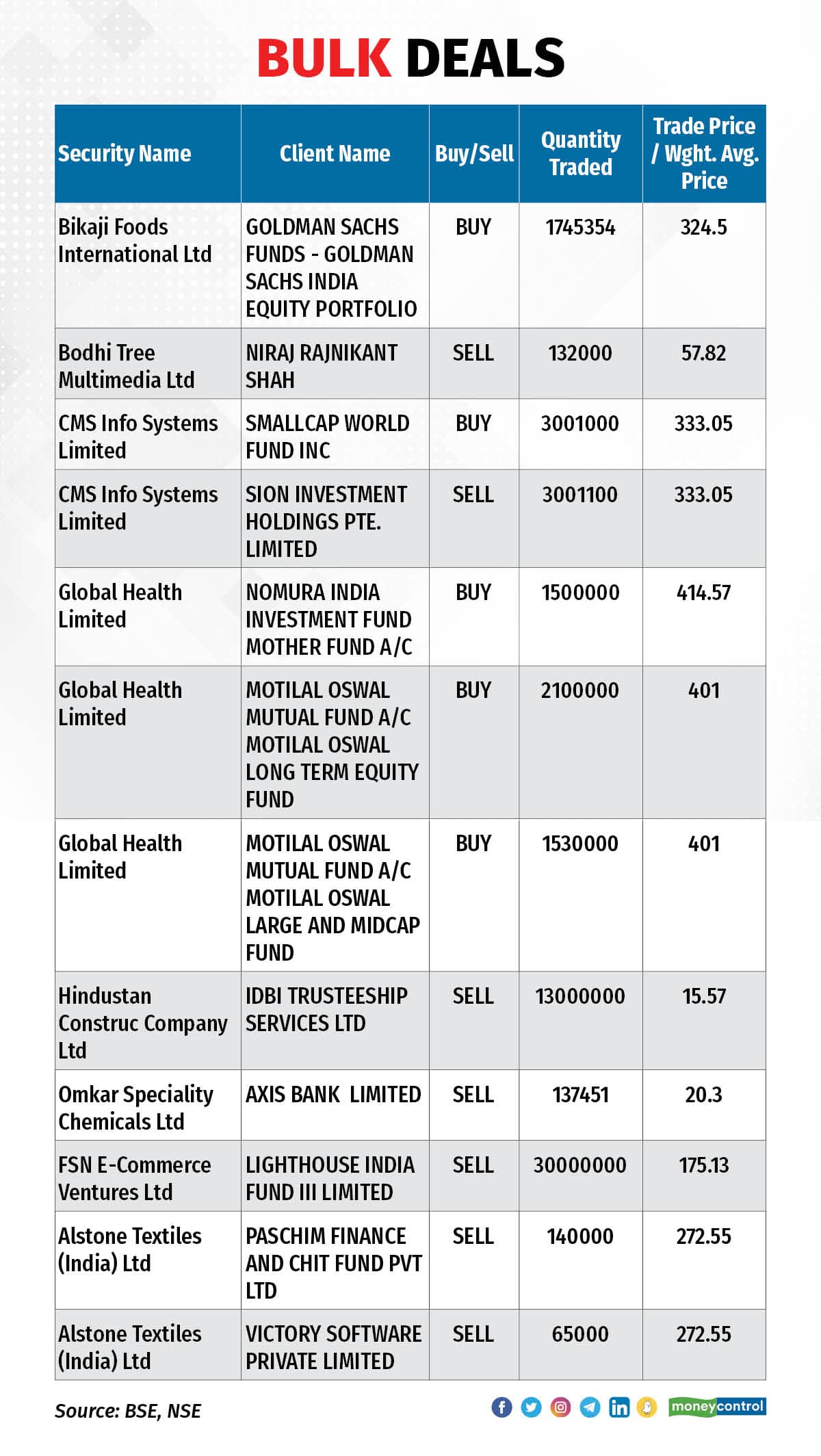

Bikaji Foods International: Goldman Sachs Funds - Goldman Sachs India Equity Portfolio acquired 17.45 lakh shares in the ethnic snacks company at an average price of Rs 324.5 per share.

CMS Info Systems: Smallcap World Fund Inc bought 30.01 lakh shares in the company at an average price of Rs 333.05 per share, however, promoter Sion Investment Holdings Pte Limited was the seller in this deal offloading almost same number of shares at same price. Sion has 63.01% shareholding in the company as of September 2022.

Global Health: Nomura India Investment Fund via Mother Fund account bought 15 lakh shares in the hospitals chain operator at an average price of Rs 414.57 per share. Motilal Oswal Mutual Fund via Motilal Oswal Long Term Equity Fund and Motilal Oswal Large and Midcap Fund acquired 36.3 lakh shares in the company at an average price of Rs 401 per share.

FSN E-Commerce Ventures: Lighthouse India Fund III Limited offloaded 3 crore shares in Nykaa Fashion operator at an average price of Rs 175.13 per share.

(For more bulk deals, click here)

Investors Meetings on November 17

MAS Financial Services: Officials of company will meet Sundaram Mutual Fund.

Polycab India, Jubilant Ingrevia, Hindalco Industries, Dodla Dairy, Anupam Rasayan India, Heritage Foods, Bajaj Consumer Care: Officials of companies will attend ‘Orion 2022 – Centrum Virtual Conference’.

Supreme Petrochem: Officials of the company will interact with Motilal Oswal AMC.

Advanced Enzyme Technologies: Officials of the company will interact with Mawer Investment Management, Singapore.

Radico Khaitan: Officials of the company will interact with Seven Canyon Advisors.

Tata Consumer Products: Officials of the company will interact with JPMorgan Asset Management (UK), and Point 72.

Indian Energy Exchange: Officials of the company will interact with Ethos Management, and Allard Partners.

Stocks in News

Timken India: The company will be setting up new manufacturing facility at Bharuch, Gujarat to manufacture spherical roller bearings and cylindrical roller bearings and components thereof. It already has manufacturing plant at Bharuch, wherein primarily tapered roller bearings and its components are manufactured.

Waaree Technologies: Promoter Waaree ESS bought 4.64 percent stake in the company via open market transactions on November 15. With this, it increased stake in the company to 60.42 percent, from 55.78 percent earlier.

One 97 Communications: SoftBank is looking to offload $215 mn worth stake in Paytm as lock-in for pre-IPO investors ends later this week, according to Bloomberg. The Japanese investor is offering to sell 29 million shares in the company at Rs 555 to Rs 601.45 apiece, at a discount of up to 7.72 percent to the current market price.

Tera Software: The company has received work orders worth Rs 46.7 crore from Bharat Electronics, for scanning & digitizations - E Mahabhoomi Polygons in 14 districts of Maharashtra. The period for completion of work will be 19 months.

Cholamandalam Financial Holdings: ICICI Prudential Mutual Fund under its various schemes bought 3.04 lakh shares in the company via open market transactions on November 14. As a result, the shareholding of the fund increased by 2.04 percent to 7.11 percent, from 5.07 percent earlier.

Aurobindo Pharma: The company has received Establishment Inspection Report from USFDA for unit XI, an API non-antibiotic manufacturing facility at Pydibhimavaram, Andhra Pradesh. The unit was inspected by the USFDA in February 2019 and issued a warning letter in June 2019. The said unit was further inspected by USFDA during July 25 - August 2 and issued a Form 483 with 3 observations.

Ircon International: The company has emerged as the lowest bidder (L1) for construction of balance work of Bahuti canal project on turnkey basis including completion of earth work of main canal system from RD 18 to 74 km & other ancillary activities. The project was floated by Madhya Pradesh government and value of project is Rs 392.52 crore.

Hindustan Zinc: The company said the Board of Directors approved second interim dividend of Rs 15.50 per share i.e. 775 percent on face value of Rs 2/- per share for FY23 amounting to Rs 6,549.24 crore.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 386.06 crore, while domestic institutional investors (DIIs) bought shares worth Rs 1,437.40 crore on November 16, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added Balrampur Chini Mills and Indiabulls Housing Finance, and retained BHEL, Delta Corp, Sun TV Network, and Gujarat Narmada Valley Fertilizers and Chemicals under its F&O ban list for November 17. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!