The market reversed some of the gains of the past week, which saw benchmarks hit new highs, to end lower on July 7, weighed down by FMCG, banking & financial services, technology and metal stocks. The broader markets also felt the selling pressure, with Nifty midcap 100 and smallcap 100 indices declining 0.8 percent and 0.4 percent.

The Sensex dropped 505 points to 65,280, while the Nifty fell 166 points to 19,332 and formed a bearish candlestick with a long upper shadow on the daily charts.

"Technically this pattern indicates rejection of bulls at the new highs. This could also be considered as a short-term top reversal pattern," Nagaraj Shetti, Technical Research Analyst, HDFC Securities, said.

The present weakness could be considered as a higher top reversal of the pattern. "Immediate supports like ascending resistance line as per change in polarity and daily 10 period EMA (exponential moving average) are placed around 19,200 levels, which could be an immediate cluster support for the market on further weakness," he said. Any upside bounce can encounter a strong hurdle at 19,425.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

The pivot point calculator suggests that the Nifty may get support at 19,302 followed by 19,250 and 19,166, whereas in the case of an upside, 19,470 can be a key resistance area followed by 19,522 and 19,606.

On July 7, Bank Nifty also traded lower and broke below 45,000 after five straight sessions to end at 44,925, down 415 points. The index formed a bearish candlestick pattern on the daily charts, making lower highs and lower lows.

"The index broke below the support level of 45,000, indicating a shift in the trend. However, a follow-up action is required to confirm and sustain the downward momentum," Kunal Shah, senior technical & derivative analyst, LKP Securities, said.

If the index stays below 45,000 on a closing basis, it would slip to 44,500 and 44,200.

The pivot point calculator indicates that Bank Nifty is likely to take support at 44,853 followed by 44,763 and 44,617, whereas 45,145 can be the initial resistance zone for the index followed by 45,235 and 45,381.

The maximum weekly call open interest (OI) remained at 19,400 strike, with 1.17 crore contracts, which can act as a resistance for the Nifty in the coming sessions.

This is followed by 1.14 crore contracts at 20,000 strike, while 19,900 strike has 1.10 crore contracts.

Meaningful call writing was seen at 19,400 strike, which added 93.3 lakh contracts, followed by 19,900 strike and 20,000 strike, which added 81.5 lakh and 73.32 lakh contracts.

Maximum call unwinding was at 19,000 strike, which shed 87,400 contracts, followed by 18,900 and 18,700 strikes, which shed 21,800 and 8,550 contracts.

On the put side, the maximum open interest was at 19,400 strike, with 68.18 lakh contracts, which could be an important level for the Nifty.

This was followed by the 19,300 strike, comprising 58.86 lakh contracts, and the 19,000 strike, which had 54.7 lakh contracts.

Put writing was seen at 18,800 strike, which added 22.73 lakh contracts, followed by 19,000 and 19,300 strikes, which added 21.13 lakh and 21.11 lakh contracts.

Put unwinding was at 19,500 strike, which shed 17.07 lakh contracts, followed by 18,100 and 18,700 strikes, which shed 8.7 lakh and 6.8 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Bharti Airtel, UltraTech Cement, HDFC, ACC and Larsen & Toubro among others.

Twenty-six stocks, including Indiabulls Housing Finance, Granules India, Cholamandalam Investment and Finance, Bosch, and Tata Motors, saw a long build-up based on the open interest (OI) percentage. An increase in open interest and price indicates a build-up of long positions.

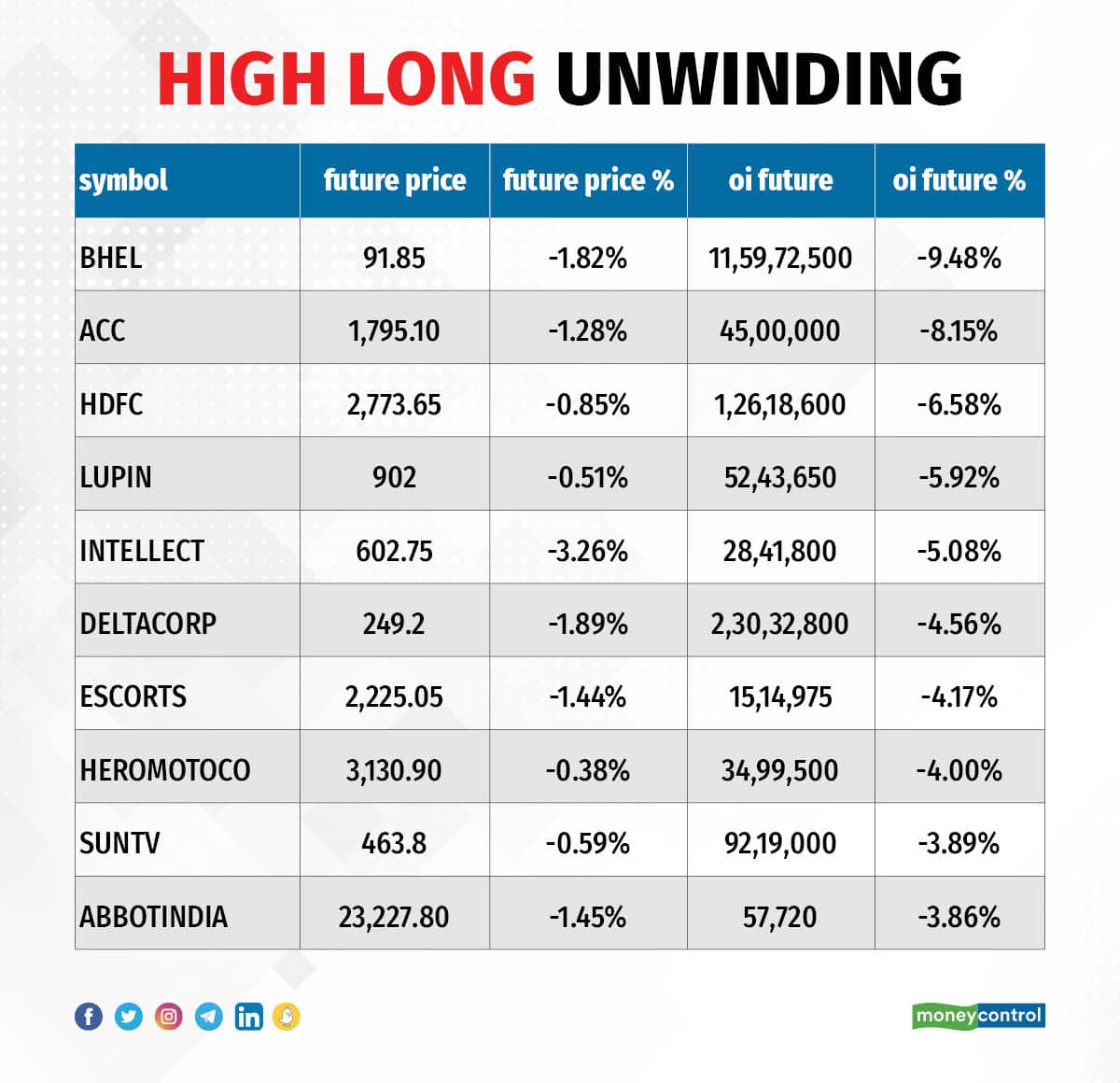

Based on the OI percentage, 77 stocks, including BHEL, ACC, HDFC, Lupin, and Intellect Design Arena, saw a long unwinding. A decline in OI and price generally indicates a long unwinding.

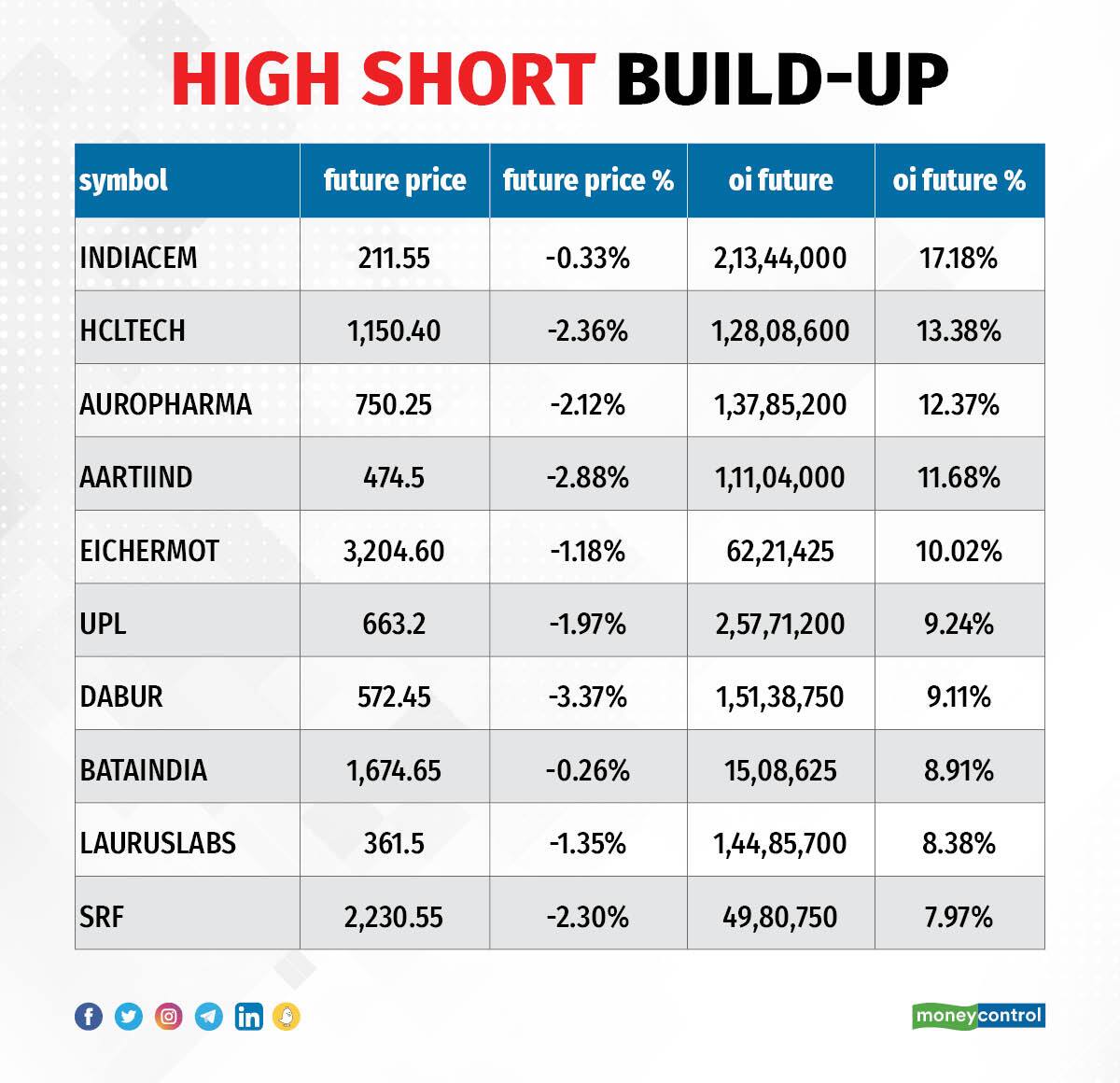

75 stocks see a short build-up

A short build-up was seen in 75 stocks, including India Cements, HCL Technologies, Aurobindo Pharma, Aarti Industries, and Eicher Motors. An increase in OI along with a price fall indicates a build-up of short positions.

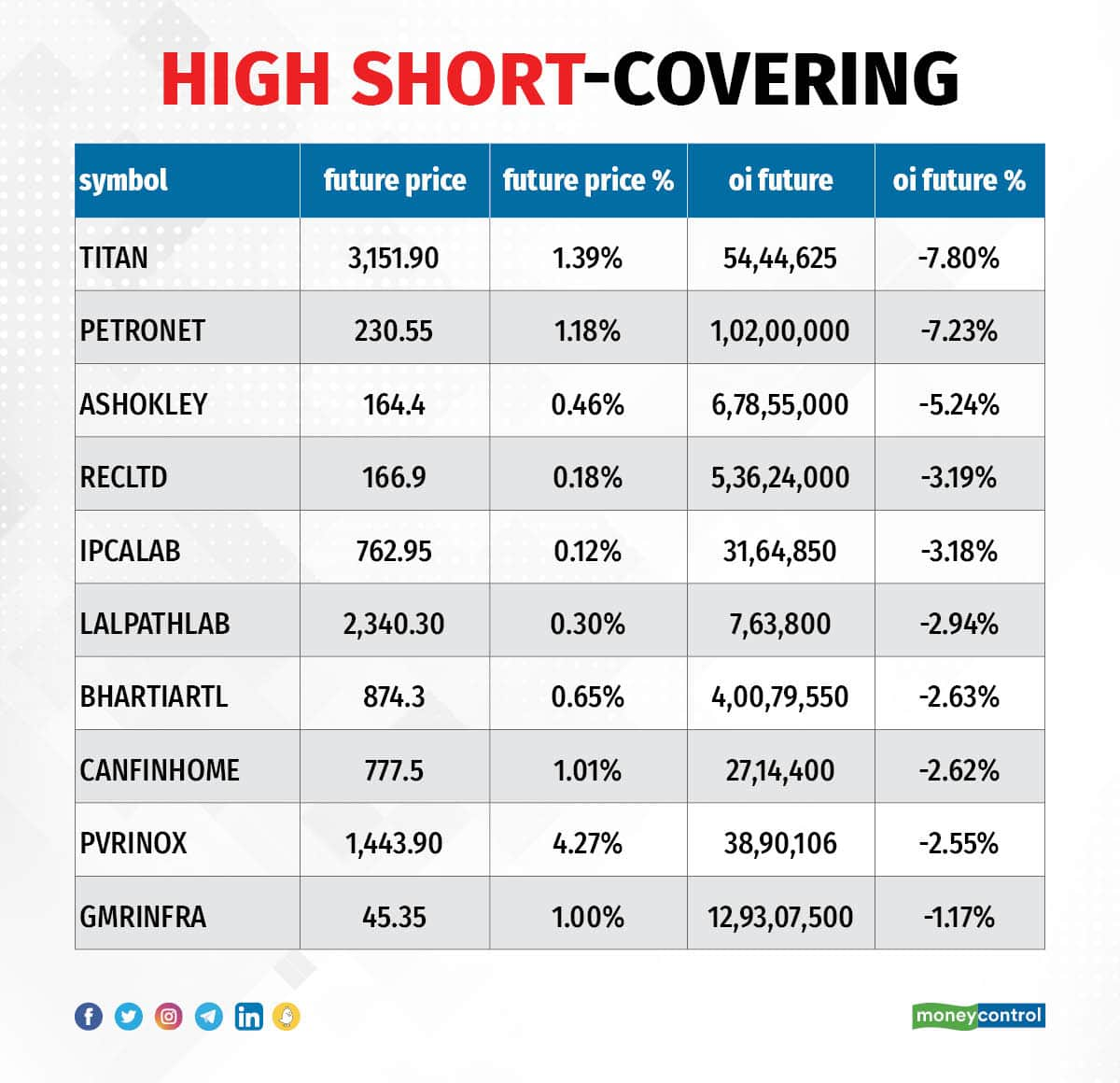

Based on the OI percentage, 12 stocks were on the short-covering list. These included Titan Company, Petronet LNG, Ashok Leyland, REC and Ipca Laboratories. A decrease in OI along with a price increase is an indication of short-covering.

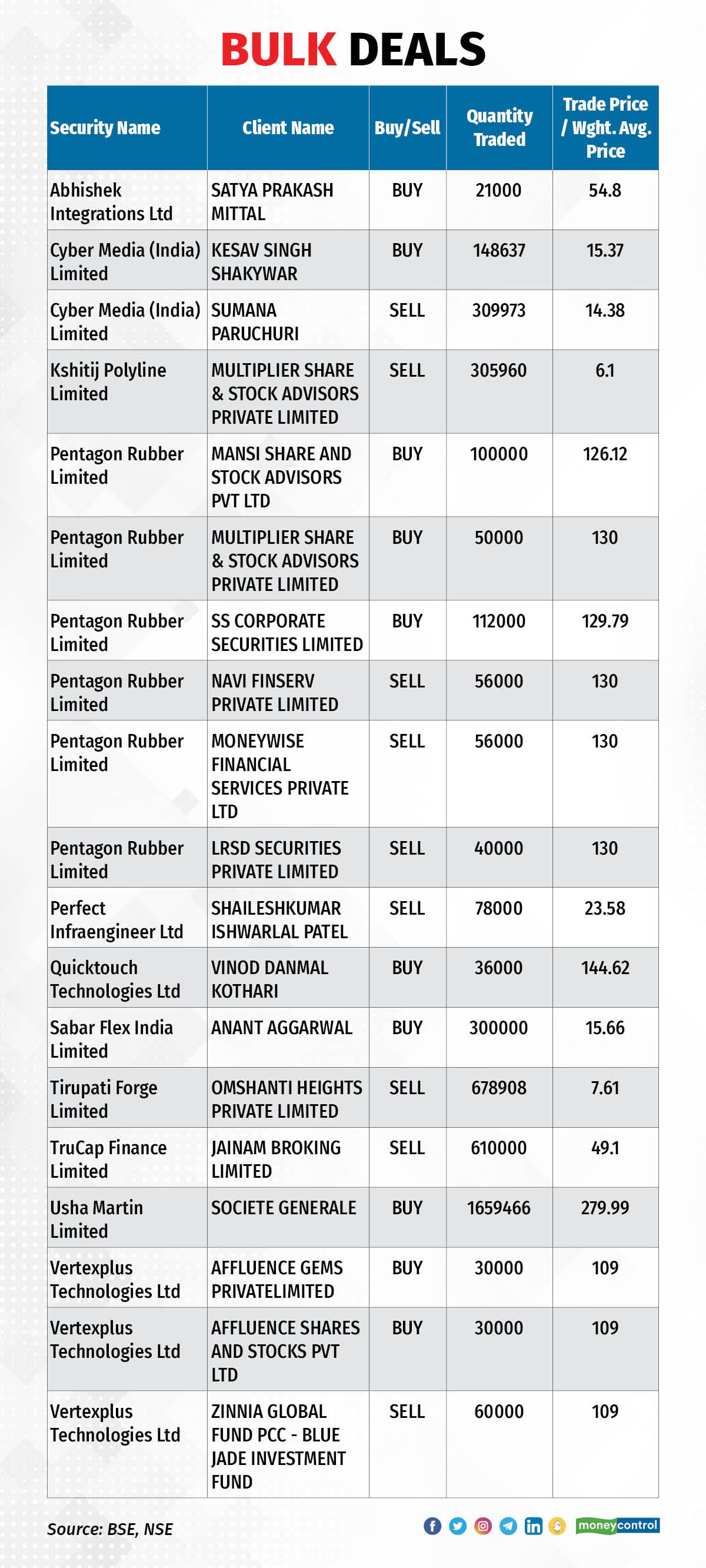

(For more bulk deals, click here)

Investors Meetings on July 10

Stocks in the news

Reliance Industries: Reliance Industries has said the board of directors of Reliance Retail approved a reduction of the equity share capital to the extent held by shareholders other than its promoter and the holding company Reliance Retail Ventures. Upon reduction, the shares held by such shareholders will stand cancelled. A consideration of Rs 1,362 a share, determined on the basis of valuation obtained from two reputed independent registered valuers, will be paid towards the capital reduction, it said.

Cyient DLM: The electronics manufacturing services and solutions company will list on the bourses on July 10. The final issue price has been fixed at Rs 265 a share.

HDFC Bank: MSCI has added HDFC Bank to its global standard indexes after the merger of Housing Development Finance Corporation (HDFC). Accordingly, HDFC has been deleted from the said indexes. The will be effective July 13.

Zydus Life Sciences: The United States Food and Drug Administration (USFDA) has closed the pre-approval inspection (PAI) with nil observations for Zydus group’s manufacturing facility in Ahmedabad. The FDA inspected the facility from July 2-7.

Indian Oil Corporation: The state-owned oil marketing company has received the board's approval for raising up to Rs 22,000 crore via a rights issue. The board also approved a joint venture company for battery swapping business in India as a private limited company. IOC will form a 50:50 collaboration with Sun Mobility Pte Ltd Singapore (SMS) and its equity investment for the battery swapping business will be Rs 1,800 crore till FY27.

Vedanta: The natural resources and technology conglomerate has added semiconductors and display glass manufacturing ventures to its diversified portfolio. It has got the board's nod for acquiring 100 percent in Vedanta Foxconn Semiconductors (VFSPL) and Vedanta Displays (VDL) via share transfer at face value. VFSPL and VDL are wholly owned subsidiaries of Twin Star Technologies (TSTL), which is a wholly owned subsidiary of Volcan Investments, the holding company of Vedanta.

Aurobindo Pharma: Subsidiary CuraTeQ Biologics has entered into an exclusive licence agreement with BioFactura Inc, USA, to commercialise BFI-751, a proposed biosimilar to Stelara (Ustekinumab). Ustekinumab is a recombinant monoclonal antibody used for treating Crohn's disease, ulcerative colitis, plaque psoriasis and psoriatic arthritis.

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 790.40 crore, whereas domestic institutional investors (DII) sold shares worth Rs 2,964.23 crore on July 7, provisional data from the National Stock Exchange (NSE) shows.

Stock under F&O ban on NSE

The NSE has added Granules India, and India Cements to its F&O ban list for July 10, while retaining BHEL and Delta Corp. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.