The aviation sector is approaching rough weather as the spread of novel coronavirus (COVID-19) has triggered travel restrictions and lockdown which will hit the airline players' revenue and margin significantly.

Brokerages are of the view that the industry will take longer than expected to recover fully from the disruption caused by COVID-19.

"Even as the macros of the Indian aviation industry may be in favour of propelling its growth, the industry may not fully recover any time soon post the effects of the pandemic which has affected business operations, travel and tourism and economies world over," said CARE Ratings in a note on March 30.

Domestic air traffic growth has been muted at 3.6 percent year-on-year (YoY) to 13.39 crore pax over April 2019-February 2020 due to weak demand. For March 2020, this should further weaken due to travel advisories and then a complete suspension of flights.

The industry, which had already been struggling with the lack of travel demand, is likely to find it difficult to cope with the acute fall in revenue and may be forced to go for measures such as trimming of employee salaries which have already started, brokerages said.

As per brokerage firm Centrum Broking, airlines are taking steps to cut down on costs, for example, IndiGo announced salary cuts ranging from 5-20 percent and Go Air has implemented rotational leaves to employees without pay and. Air India has cancelled and reduced certain allowances it pays to its executive pilots, cabin crew and officers.

Also, as per Centrum, airlines are in talks with the lessors to explore any deferment on lease payments which will support their near term liquidity requirement.

However, going for the airline players is expected to get tougher.

CARE Ratings said that there seems to be turbulence and stormy clouds for the Indian aviation industry as airlines will be operating on sub-par capacity which will result in low ticket booking, fall in revenues and low passenger load factor (PLF).

"Passenger growth of airlines is to fall sharply and register a negative 20-25 percent growth for FY21. Passenger growth has been 13.7 percent during FY19 and 3.7 percent during FY20 (April-February)," CARE said.

Freight operations may add support to overall traffic movement, CARE believes, but that is also likely to be subdued given the fall slowdown and shutdown of manufacturing units in most parts of the world and in the domestic economy due to the COVID-19 pandemic.

"In terms of capital expenditure airlines will be deferring or scaling back on CAPEX given the expected fall in the top line and bottom line of carries which means the purchase of airplanes or adding to the fleet sizes will not take place at least till 9-months-FY21," CARE said.

The fall in crude oil prices may also not help much as its benefit would be realised only once operations resume.

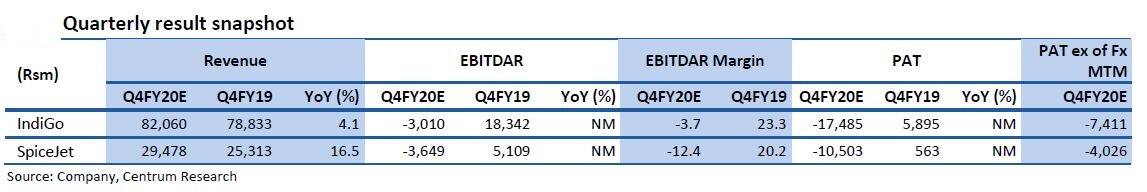

Centrum Broking said the interim cut of 11-12 percent in aviation turbine fuel (ATF) prices with effect from March 23 has a little impact with all operations suspended from March 25. Also, the rupee has depreciated by 5.8 percent in Q4FY20E which will increase outgo for dollar-based costs and also result in steep foreign exchange mark-to-market (fx MTM) losses on operating lease liabilities.

Centrum expects IndiGo’s RASK (revenue per available seat kilometre) yields to decline 2.5 percent YoY to Rs 3.5 and expect PAT loss of Rs 1,750 crore, primarily due to fx MTM loss of Rs 1,010 crore. It expects SpiceJet’s RASK yields to decline 3.6 percent YoY to Rs 3.9 and expect PAT loss of Rs 1,050 crore, primarily due to fx MTM loss of Rs 650 crore.

Centrum has a 'buy' recommendation on IndiGo, with a target price of Rs 1,340, and a 'reduce' rating on SpiceJet, with a target price of Rs 33.

There is a possibility of the lockdown being extended beyond April, which will lead to further earnings cuts. In this event, a relief package from the government (interest-free loans, lower taxes, etc) will be critical for the survival of airlines. Aircraft deliveries can also come under pressure as Boeing and Airbus have taken shut-downs, say experts and brokerages.

Brokerage firm Edelweiss Securities expects a weaker yield and passenger load factor (PLF) environment in the first half of FY21 as demand pain will linger.

"Factoring this, we cut FY21/22E EBITDAR 34 percent/18 percent for Indigo and 33 percent/6 percent for SpiceJet. With valuations turning reasonable at 8 times FY22E EV/EBITDAR post 40 percent correction since our downgrade and factoring near-term slowdown, we upgrade Indigo to ‘hold’ from ‘reduce’ with a revised target price of Rs 961 from Rs 1,297 earlier and maintain ‘buy’ on SpiceJet with a revised target price of Rs 79 from Rs 120 earlier," Edelweiss said.

Edelweiss added that even though valuations are lower after the recent correction, there is little room for upside at Indigo and advised that investors should avoid the sector at present.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.