National award-winning director Hansal Mehta’s filmography reflects his propensity to push the envelope—Aligarh, Shahid and Omerta are a few glittering examples. That is some journey for a man who started his career with the iconic TV food show Khana Khazana.

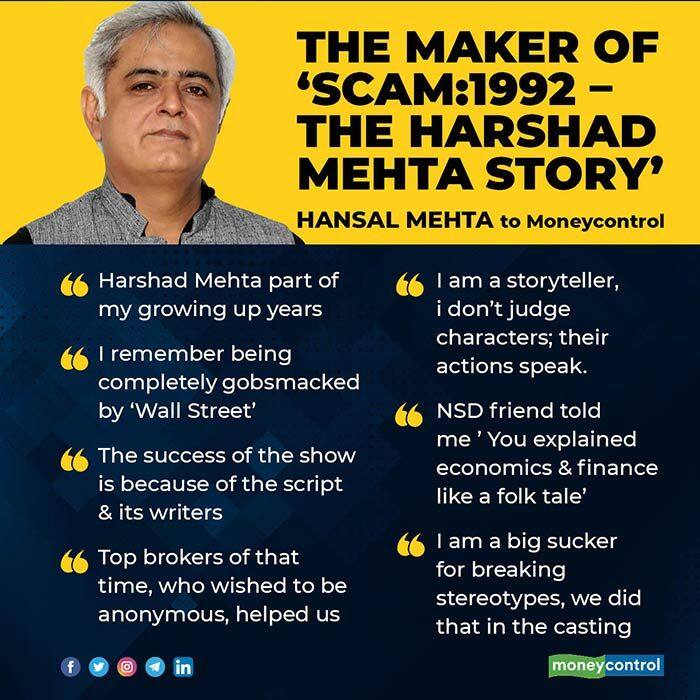

A big fan of 1987 Hollywood hit Wall Street, Mehta also enjoyed Margin Call and The Big Short that laid bare the financial system and the stock market. Mehta was waiting to bring to life the goings-on in the Indian stock market. A November 2017 meeting with Sameer Nair, CEO, Applause Entertainment, offered him that chance and ‘Scam 1992: The Harshad Mehta Story’ was born. Since its market debut, the show has been hitting the upper circuit every day, creating a buzz in the bustling OTT space.

The web series is an adaptation of journalist Sucheta Dalal and Debashish Basu’s book The Scam: Who Won, who Lost, who Got Away and traces the meteoric rise and dramatic fall of stockbroker Harshad Mehta who defrauded domestic banks and jolted the Indian stock market in the early 90s.

Moneycontrols’s Ashwin Mohan caught up with director Hansal Mehta to understand what went behind the popular show, the anonymous old-timers who helped him and his team, the casting strategy and if a series on Ketan Parekh was next. Edited excerpts:

Q: You started your career in 1993 by directing the smash-hit TV cookery show Khana Khazana. You bagged a national award for Shahid. Your film Aligarh focused on the life of a gay Marathi professor. You have dabbled with themes as diverse as food, human rights and sexual identity. What drove you to the world of Harshad Mehta and the stock market?Harshad Mehta is a part of my growing up years. I grew up with a lot of friends whose business was investing in shares and who were in finance. And I remember there was euphoria over this–the entry of the big bull and how people follow him in herds. And then the news came out, there was a bad crash and a few years later he was forgotten and then we were told that he died. And he died a very, very ordinary death. He was totally alone.

So I read about it, I had heard about it and while I was not completely fascinated, I read this book by Sucheta and Debashis. This was way back in 2005-2006 and the book really excited me. I felt that the book was very informative and had a lot of in-depth analysis of what really went down. It put things in perspective for me—all of us grew up thinking it was a stock market scam, not realising that it was more of a securities and banking scam. So, this is something I learned from the book and I tried to pitch the idea to people but it did not happen at that time. Nobody was really interested.

And I've always been a fan of these kinds of things. I remember being completely gobsmacked by Wall Street when it came out. I saw it a number of times. I found it fascinating—making a thriller out of goings-on in boardrooms and on the lives of people who make insane amounts of money.

So I wanted to explore that in an Indian film..., then later a film Margin Call, which was based on the Lehman Brothers crash, came. Then I saw Big Short. And it kept recurring to me why don't we ever make something like this. Until 2017, (when) somewhere in November, Sameer Nair called me to his office and he gave me the book and said, 'I've got the rights to this book' and asked me if I would be interested in making this into a series. I jumped. It was an opportunity I was really looking for. And the main thing is my proclivity for telling business stories and white-collar crimes—drama involving people who are not necessarily gangsters, even cops. There is a world outside cops and gangsters and this (world) is also very, very interesting and fascinating.

Q: Adapting a book into a movie or web series is always a daunting task. You can’t please everyone. Tell us about some of the challenges you faced as a director and why did you go with 10 taut episodes of an hour each instead of opting for several episodes spread over a few seasons?We were all very clear, Sameer and his creative team, my writers and me that we have to finish the story in one season, as there is enough material only for one season, and make it tight and interesting. The biggest challenge was that this is a work of non-fiction. The book was an investigative piece of journalistic writing. So, we had to create drama out of it, we had to create a dramatic story, create interesting characters.

So the adaptation was definitely the biggest challenge. And I was blessed. I had some really, really phenomenal writers. The success of the show is because of the script and its writers.

Q) Scam 1992 portrays the world of stock markets in the pre-computer era when trade was carried out differently, traders were a different lot and market regulations were weak. Today markets are sophisticated, everything happens at a snap of the fingers and we have a vigilant regulator in Sebi. The web series is obviously based on the book but what additional research did you do to accurately portray a bygone era?There was a lot of research that my team and my writers carried out. See Debashis and Sucheta helped us a lot in that. We met people who were members of the stock exchange at that time and share brokers who were in the thick of things who really, really helped us and they wanted to be anonymous. Some were top brokers of that time and people who were in the market at that time really, really helped us with the show.

There were a lot of old-timers. They gave a lot of inputs, many of them are still active. I used to visit them at Dalal Street. They took me to the ring. Also, BSE was a walk-in. There weren't multiple layers of security that we see today. Till the bomb blast happened, it was very, very easy. So I had fair knowledge, a fair idea of the geography. My director of photography was not even born at that time. My son was one-year-old and he is a co-director of this (show). So, none of them have really seen that time.

Q) When you create content on a controversial figure, it can get tricky. You not only have to avoid going overboard but should also not appear overtly sympathetic to the character. Harshad Mehta is no more but he is a polarising figure, with his share of fans and critics. How important was it for you to show his crooked ways but also highlight the rot in the financial system?It's not difficult, if you see my filmography, you see my work, what we are trying to do is to humanise—to make it a human story, whether it is human failings or human triumphs. My idea is to observe the story and to also take my audience on an observational journey. I am a storyteller. I'm not judging the character, their actions speak for themselves. So, the writing also reflects that. There is a graph up to which you are rooting for him and as you see him getting trapped, you see his downfall. So we had mixed feelings about Harshad.

But I wanted them (audience) to be aware that Harshad, yes, Harshad was somebody who did something wrong but along with him there was an entire system that was incomplete, total rot. I mean there were no checks and balances, no proper means of controlling malpractices and wrong trade practices. And that system also has to be shown, otherwise, it would be very one-sided. This long-form storytelling, where you have 10 episodes, gives you that liberty to explore the entire issue in a more holistic manner. I must give credit to Sucheta and Debashis’ book also. It has shown the system in a more holistic manner. They have not made Harshad Mehta the single villain of the piece. The system had foreign banks that actually pioneered these practices.

Q: 1992 Scam breaks down technical concepts and terms related to trading, stock markets and banking for the lay audience. Do you think that is also a factor that has contributed to its success by ensuring it reaches far beyond a niche audience?Definitely. See there’s a very old friend of mine, he is a senior actor from the National School of Drama. He sends me a beautiful message, 'Economics ko bhi aapne lok katha ki tarah samjha diya'. He basically said 'you explained economics and finance like a folk tale'. He said, 'ke maja aagaya'. All of us spent time trying to understand the concepts and Dharmesh ( Mehta)was a huge help. He explained it to us in very simple terms. What the money market meant, he explained to us in five minutes.

And his explanation gave us a clue because he broke it down but we used that to simplify it for the audience without overdoing it. If you see Big Short, how many of us in the Indian audience or even the American audience really understand derivatives? So it’s a complicated financial instrument but we are completely taken in by the characters in the drama and we know that something is going wrong. And by the end of it, we figure out what derivatives mean, we even start finding out more.

It was not that conscious a decision but yes, we were trying to find people who belonged to that time. I'm a big sucker for breaking stereotypes. So the way you see Satish Kaushik here, you have not seen him before. The way you have seen Rajat Kapoor, you normally see him as a very gentle character. So you have sort of broken that stereotype. As filmmakers, we often cast people in stereotypical characters, we broke that.

Q: Hollywood has dished out movies like Wall Street, The Wolf of Wall Street, The Big Short, Inside Job and Margin Call. In India, we have seen Bazaar, Gafla and now Scam 1992. Do you think the world of the stock market and finance is an underpenetrated subject in India and has the potential to throw up many more fascinating stories?I think white-collar crimes have been dominating headlines since the Harshad Mehta case. If there is one scam, it is soon replaced by another. I mean there are a lot of white-collar crimes with fascinating characters. If it should be done, I think it should be done the right way, if it is well researched, not boring, authentic and at the same time entertaining. And that is one of the big achievements of Scam 1992, that we have managed to tell an entertaining story about what is normally perceived as a dry subject. For instance, in the show Billions, there is a world of hedge funds and they have really glamourised it but it's also very well researched. I've always tried in my work to go away from the template, to create a new kind of template and to push the boundaries in the way stories are told.

Q: Another real-life character who ruled the stock market and later got embroiled in a securities manipulation scam is Ketan Parekh who, incidentally, worked in Harshad Mehta’s firm. Now that you have made a web show on his mentor, would you be open to a series on the rise and fall of the low-profile Parekh?It all depends there has to be enough inherent drama in the story. We haven't really looked at that yet. I cannot really comment on that. This is one story that we can explore but right now, no, we have not explored it at all. Perhaps it was much bigger in magnitude compared to the Harshad scam. It also meant destruction of many ordinary lives and it really opened a chapter in how far somebody can go in scamming the system. Beyond what is in the public domain, very little is known.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.