Have you ever needed a jumpstart or been stranded with an empty fuel tank? When you are stuck, it’s easy to get anxious and let slip the options you have at hand, especially when you need them the most.

And when it comes to credit cards, most people think of the convenience of cashless payments and rewards. However, one often-overlooked benefit that some credit cards offer is complimentary roadside assistance. This valuable feature can save you time, money and stress when you find yourself in an unexpected roadside emergency.

What benefits do these cards offer?

Roadside assistance is typically your best friend when you are stuck on the road. It includes services such as towing, battery jumpstarts, tyre changes, fuel delivery, lockout assistance and even providing a backup vehicle to transport you to the nearest city with a hotel stay in case your car becomes immobile. These services are designed to provide immediate help when you encounter problems with your vehicle while on the road.

One of the primary advantages of using the roadside assistance benefit from a credit card is cost savings. Instead of paying out of pocket for towing services or other emergency roadside services, you can rely on your credit card's complimentary assistance. This can be especially beneficial if you don't have a separate roadside assistance membership or if your existing membership has expired.

Also read: How to avoid troubles in motor insurance claims settlement

A paid yearly subscription usually costs around Rs 2,000 or can be bought bundled with vehicle insurance, which is significantly cheaper. Even though the subscription is not too costly, we tend to ignore it until we realise its importance once we are stuck and asked for hefty towing charges from a remote location.

When using roadside assistance, it's crucial to understand that this service is not meant to replace comprehensive auto insurance coverage. Roadside assistance typically covers immediate breakdowns and emergencies, but it does not provide coverage for accidents, repairs or general maintenance.

Roadside assistance includes services such as towing, battery jumpstarts, tyre changes, fuel delivery, lockout assistance and even providing a backup vehicle to transport you to the nearest city with a hotel stay in case your car becomes immobile

Roadside assistance includes services such as towing, battery jumpstarts, tyre changes, fuel delivery, lockout assistance and even providing a backup vehicle to transport you to the nearest city with a hotel stay in case your car becomes immobile

How to call your card company?

To make use of the complimentary roadside assistance benefit, you typically need to contact the credit card issuer's dedicated helpline. At the other end, there is a human working in a breakdown assistance provider company with whom your bank has tied up. You need to keep your credit card details handy and be prepared to provide information about your location, the nature of the problem and any other relevant details requested. The assistance provider will guide you through the process and arrange for the appropriate help.

Also read: Safety concerns could push up premiums for electric vehicles

Earlier, I had a paid plan that I had used once due to a wiring issue in my car and had to get it towed. Within 45 minutes, the crane reached my location, which was in a metro city. Recently, I also used the service that comes complimentary with one of the cards that I use, due to a battery drain-out issue. A person on a two-wheeler reached my location within 20 minutes with a charged battery and gave my car the much-needed jumpstart. The service was seamless and I didn’t have to pay anything for it.

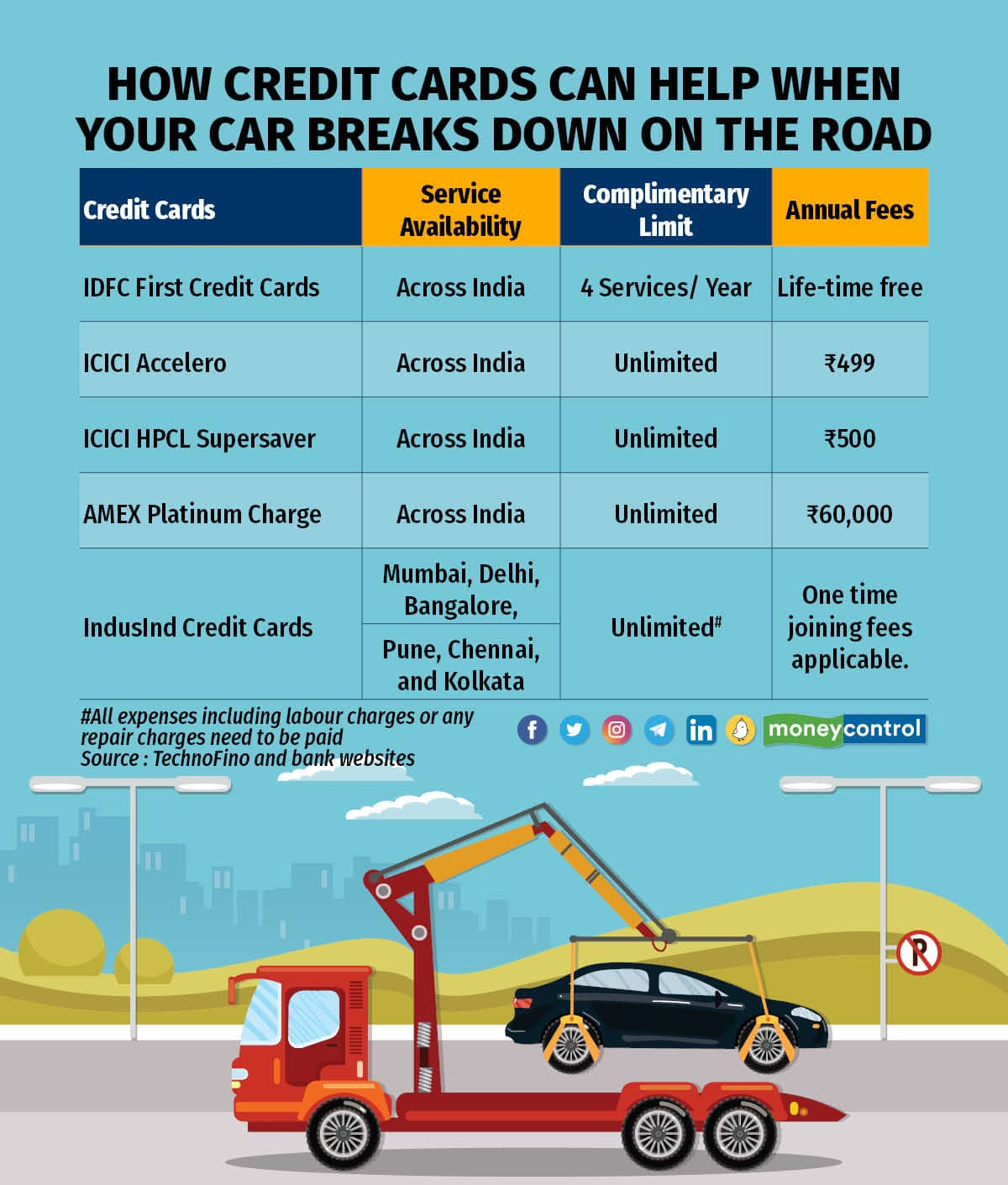

Apart from this, it's important to note that the coverage and limitations of complimentary roadside assistance can vary depending on the credit card issuer. Some cards may have restrictions on the number of service calls allowed per year or per incident. Additionally, coverage may be limited to specific geographical areas or certain types of vehicles. Therefore, it's essential to review the terms and conditions of your credit card's roadside assistance benefit to understand the extent of coverage and any limitations.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.