After a catastrophic 2020 and a near disastrous 2021, the year 2022 gave a glimpse of hope to all sectors in general and aviation in particular. For once, the traffic patterns were back to pre-Covid seasonality and not linked to Covid waves, giving a semblance of normalcy for airlines to better plan operations and focus on demand and supply.

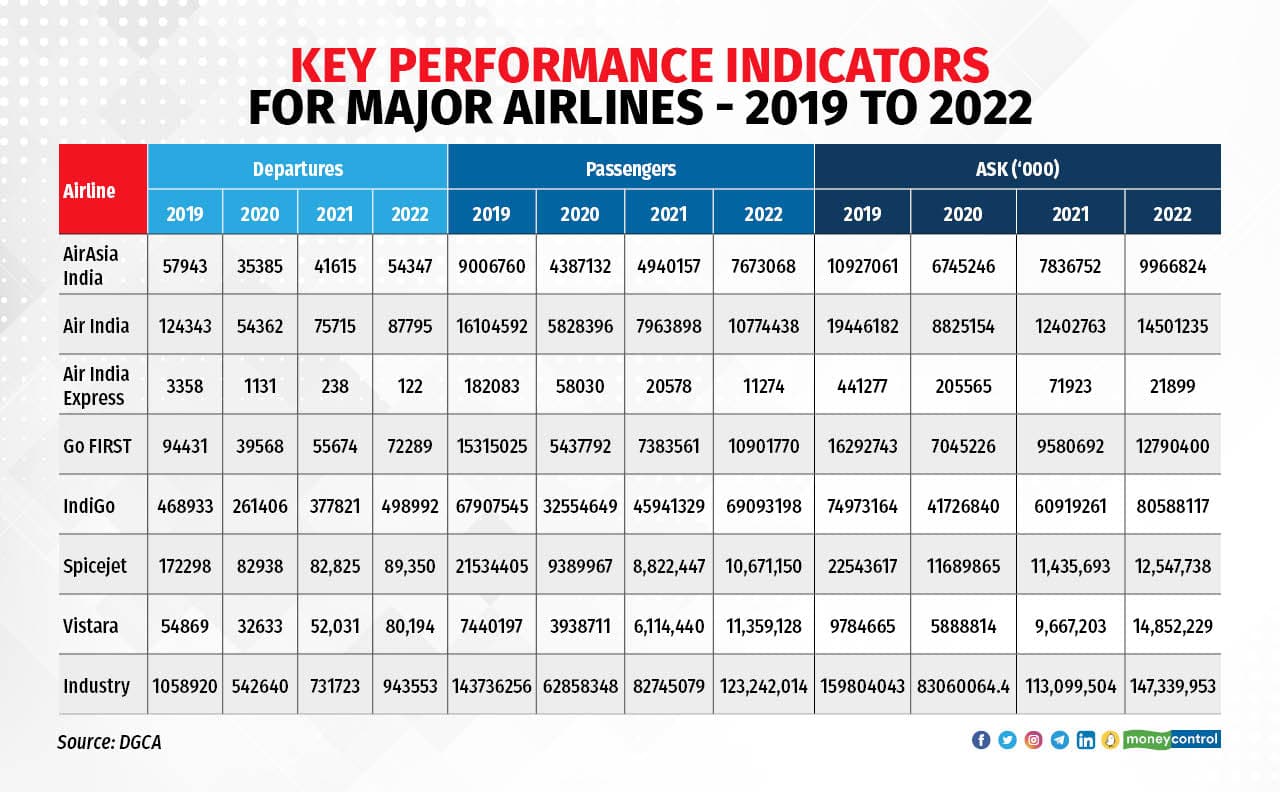

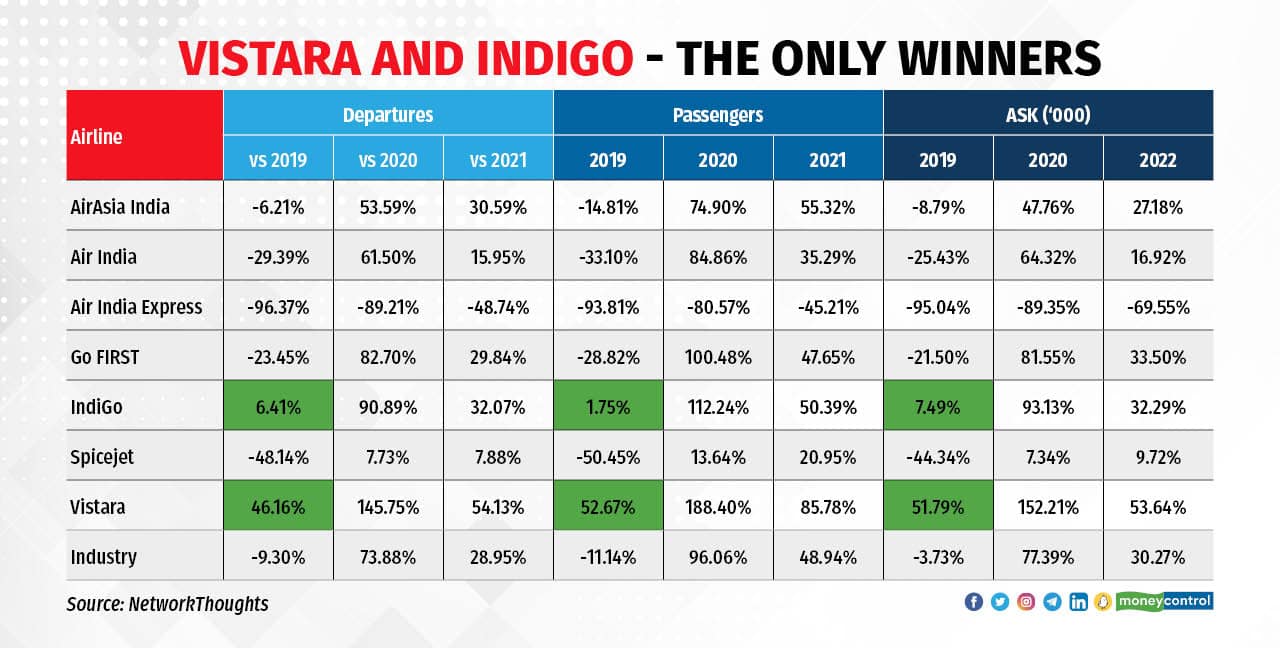

As the year ended, the domestic segment was making a strong comeback on a yearly basis. Airlines operated 29 percent more departures, carried 49 percent more passengers and deployed 30 percent more capacity by Available Seat Kilometres (ASKs)as compared to 2021. When compared against pre-COVID (2019), the departures were short by 10 percent, but capacity by ASKs were short only by 3.5 percent, while passenger numbers were 11 percent shy of 2019. Yet the industry-wide story has two sides, which are opposite to each other.

Traditionally, data is benchmarked against the previous year but the pandemic has taken all sorts of data analysis for a toss. To benchmark against 2019 is a challenge in itself since India saw the demise of Jet Airways and the year was an aberration again.

Vistara - the winner!

If there is one airline which made the most of the pandemic, it has to be Vistara. The airline had nearly recovered to 2019 levels in the previous year itself and it effectively used 2022 to build on that, further cementing its position.

To translate it to numbers, it had 1.5 times more departures than 2021 on the back of a similar increase in capacity by ASKs and carried 85 percent more domestic passengers. The airline has been consistently adding capacity during the pandemic and taking in as many aircraft as possible.

It has been outpacing other carriers for two consecutive years in the pandemic, even as sister carrier AirAsia India has been struggling and the Tatas now have a mega carrier to look at in the form of Air India.

Vistara also recorded an operational breakeven for the first time in its history. If going out with a bang has a name, it can well be called Vistara as it is slated to merge with Air India by March next year.

IndiGo - the runner up!

To match the performance of Vistara in pure percentage terms, it would mean adding a whopping 100+ aircraft for IndiGo’s size. The airline did induct 50+ aircraft in 2022, but they also came with a little less than that being phased out as the airline continues its focus on fleet renewal. IndiGo was the only other airline to have a positive increase over 2019.

The airline added 6.4 more additional departures, with 7.5 percent capacity by ASKs and carried 1.75 percent more passengers in 2022 as compared to 2019. The lower number of incremental passengers is an indicator of how the airline has been focusing on yields over load factors to bridge the gap between cost and revenue since the environment is materially different from what it was in 2019.

On a sequential basis, the airline carried 1.5 times the number of passengers it carried the previous year on the back of a 32 percent increase in departures as well as capacity by ASKs.

Shrinking fast

The only carrier which shrank on the domestic routes as compared to 2019 was Air India Express. Under the Tatas, the focus has shifted back to international routes - the very reason for which it was formed -- and rightly so the domestic routes have taken a hit. By end of 2023, a new Air India Express, which would include present day AirAsia India would have a mixed presence across domestic and international.

Air India, now under the Tatas, is still away by one-third in passenger numbers when compared to 2019, indicating that its work is cut out ahead as more aircraft join in from the end of this quarter.

Go FIRST, which had a major challenge with groundings due to the non-availability of engines, managed to do a better job, being 28 percent short of departures when compared to 2019 with passengers being 23 percent less than 2019.

The real worry stems from SpiceJet, which has shrunk a lot. In 2022, the airline carried only half the number of passengers it did in 2019. This came on the back of a drop in departures by 48 percent and capacity by ASKs dropped by 44 percent. Barring Air India Express, it had the slowest growth over the previous year as it carried only 20 percent more passengers, much less than the industry's 48 percent increase. The departures and capacity deployed was in single digits.

Key Performance Indicators for major airlines - 2019 to 2022

What next?

This year and the next are going to change Indian aviation in a big way. AirAsia India will merge with Air India Express by November this year. By March next year, Vistara will merge with Air India. The Tata group of airlines will also start seeing new planes starting as early as next month, leading to an increase in capacity.

Akasa Air will complete 20 aircraft - the fastest for any airline -- and start applying for international services. As the supply chains streamline, IndiGo would get more aircraft in its fleet. The question then circles back to just two airlines, Go FIRST and SpiceJet -- how will they sustain and what is the profile of passengers that they will serve? For now, its time for the winners - Vistara - to bask in the glory and others to catch up.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.