August was a tumultuous month for equity investors, as Indian benchmark indices the Sensex and the Nifty slipped by about 1.5 percent, mirroring a global trend.

US’ Dow Jones and S&P 500 lost roughly 2 percent, while the UK’s FTSE 100 and Germany’s DAX were down 3 percent each in August. The volatility can be attributed to a variety of factors such as global economic indicators, geopolitical events, and sector-specific trends.

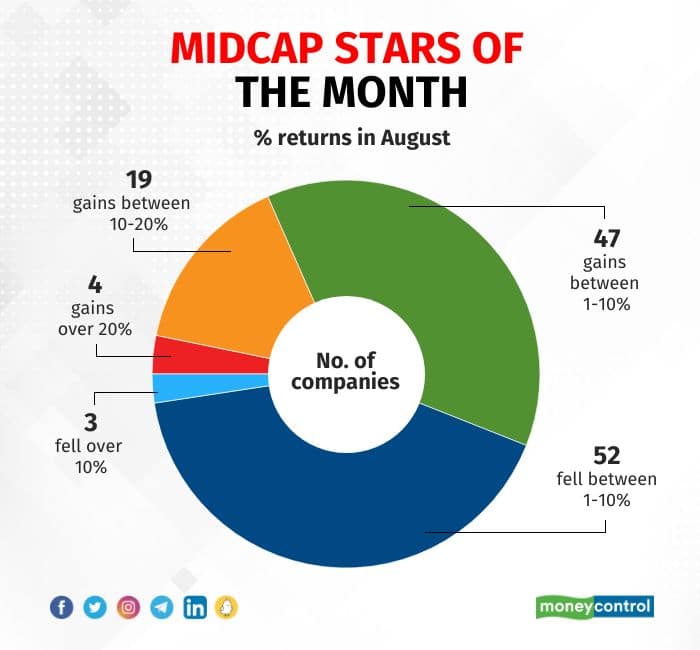

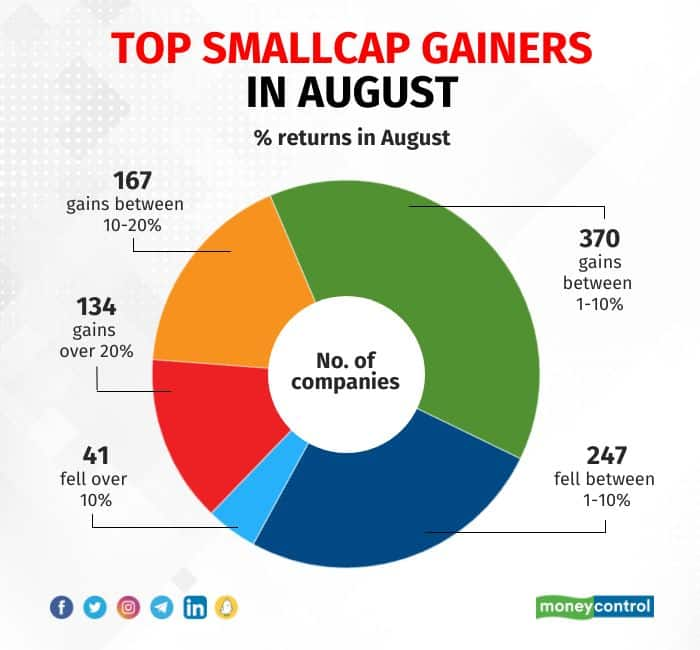

But, midcap and smallcap indices defied the trend to shine bright. Several BSE500, midcap, and smallcap categories gained 15 to 50 percent in August. Analysts said investors are now focusing on fundamentally strong stocks.

Nearly 200 BSE 500 stocks hit a 52-week high in August, while 65 midcap and 440 smallcaps rose to their one-year highs.

In the midcap category, Gland Pharma, IRFC Ltd, Supreme Industries Ltd, and JSW Energy gained the most.

Among smallcaps, BF Utilities Ltd, DB Realty Ltd, Jai Balaji Industries Ltd, and Digispice Technologies Ltd stood out as top performers.

In the BSE500 index, Swan Energy Ltd, Suzlon Energy Ltd, Indiabulls Housing Finance Ltd, and Kalyan Jewellers Ltd were the leading performers.

Analysts attribute the gain to a variety of factors. Increased investment by domestic institutional investors (DIIs) played a vital role, reflecting growing confidence in the potential of mid and small-cap businesses. The buying spree points to strong faith in the future of these sectors, they said.

The strong quarterly performance of companies in these categories has been a driving force. Consistently impressive financial results demonstrate effective management, operational flexibility and adapting to market changes. This boosts investor confidence and creates a favourable atmosphere for more investment, analysts added.

Deven Mehata, equity research analyst, Choice Broking, said notable momentum was observed in sectors like defence, hospital, chemicals, fertilisers, electrical, infra, railway, paper, pipe, real estate and cement. These sectors have reinforced the narrative with strong financial performance momentum and reasonable valuations.

The defence sector saw huge interest, supported by solid order books and a strong quarterly outlook. The expanding order books guarantee years of substantial growth, creating a favourable investment position in terms of risk and reward, analysts said.

Chemical stocks, which have been hammered, saw signs of buying interest during the month. This renewed attention is due to a sudden increase in chemical prices in China and initial indications of inventory reduction.

The primary reason for the enthusiasm is that the chemical sector stands out as having lower valuations compared to the rest of the market, Sagar Lele, smallcase Manager & Founder of Rupeeting, said.

Devarsh Vakil, Deputy Head of Retail Research at HDFC Securities, noted significant buying interest in infrastructure stocks. In the run-up to a string of state elections later this year and the national elections in 2024, it is expected that orders will be released, prioritising the execution of previous projects.

Infrastructure contractors can expect increased orders and improved cash flows. Long-term investors may find favourable entry points in real estate and building construction material companies such as pipe and cement, Vakil added.

Market Outlook

The market pressure may persist in the short term due to recent developments that cast doubt on the Reserve Bank of India's rate stability, analysts said.

Factors such as uneven rainfall, unpredictable vegetable prices and July's inflation rate of 7.4 percent surpassing the RBI's comfort zone to reach a 15-month high are causing increased concern. The combination of high valuations and record premiums adds to the challenging situation, they said.

"We expect the corrective trend to continue and the Nifty to test 18,900-19,100 zone ahead. To negate this view, we need a decisive close above 19,600. Meanwhile, participants should continue with a stock-specific approach and maintain positions on both sides" said Ajit Mishra, SVP, Technical Research, Religare Broking.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.