The latest report by the World Gold Council is projecting a more modest growth for the precious metal in 2025, on the back of its best year in over a decade, clocking 28% gains till November.

"All eyes are on the US. Trump’s second term may provide a boost to the local economy but could equally elicit a fair degree of nervousness for investors around the world," said the Gold Outlook 2025 report released on December 12.

The possibility of a trade war during US President-elect Donald Trump’s second term will be a major overhang. "Thrill-seeking investors may benefit from an early wave of risk-on flows, but potential trade wars and inflationary forces may spill over into an expected subpar economic growth," said the World Gold Council.

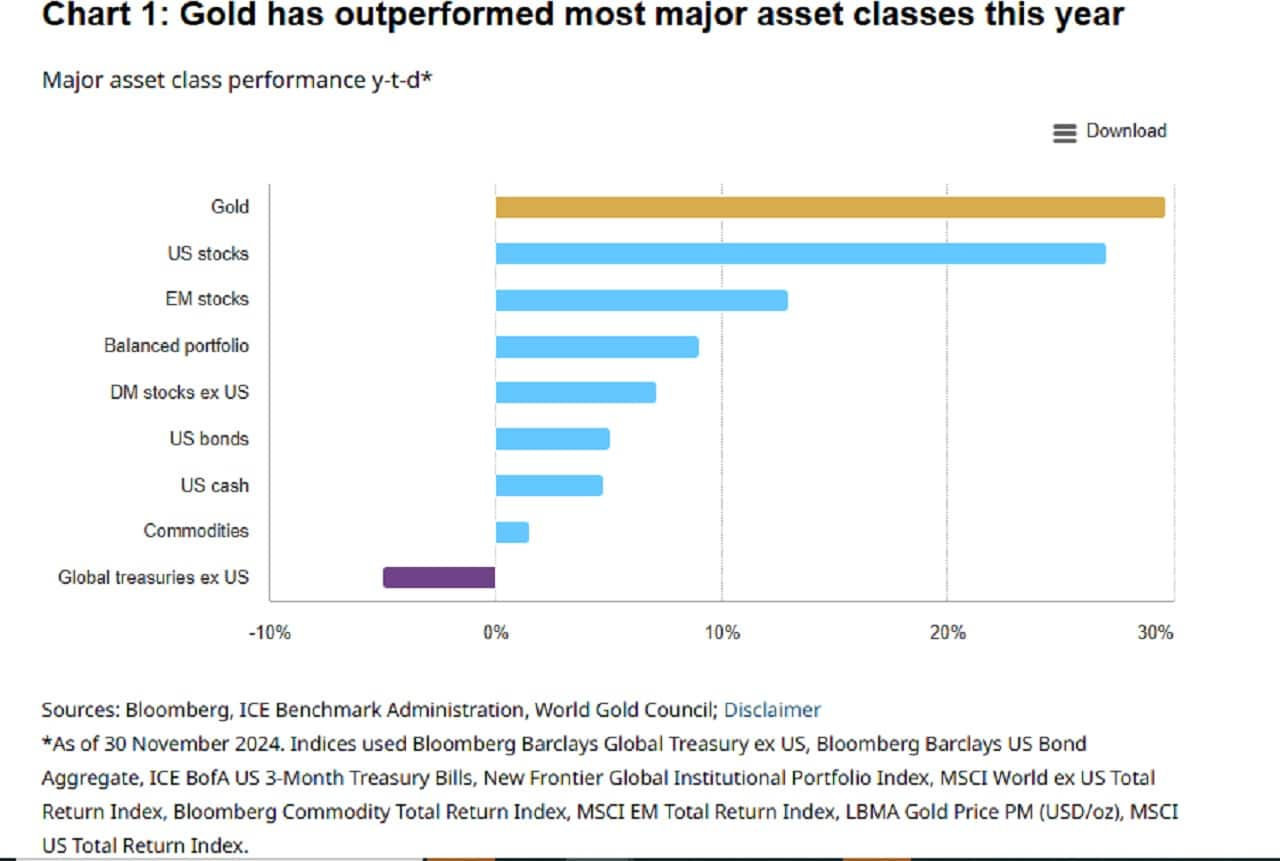

Gold rose by more than 28% till November in dollar terms, and staged 40 record highs with total demand in the third quarter surpassing $100 billion for the first time. Central banks continued to add gold to reserves, even picking up speed in early October. In this context, gold remained one of the best performing assets of the year.

The report suggests an upside could come from a stronger-than-expected central bank demand in 2025, or from a 'rapid deterioration' of financial conditions, which may lead to flight-to-safety.

Asia made up over 60% of the annual demand, excluding central banks, with China and India remaining the largest markets for gold. Demand in India was helped by a reduction in import duty, in the second half for the year.

Going forward, China's consumer demand will likely depend on its economic growth, and there is a chance that it may face competition from equities and real estate.

The report said India seems to be standing on a 'better footing'. "Economic growth remains above 6.5%, and any tariff increase will affect it less than other US trading partners given a much smaller trade deficit. This, in turn, could support gold consumer demand," said WGC.

The financial investment products based on gold have seen remarkable growth in India, said the report, adding that they have been a 'welcome addition to gold’s ecosystem'.

Gold rose by more than 28% till November in dollar terms, and staged 40 record highs with total demand in the third quarter surpassing $100 billion for the first time. Central banks continued to add gold to reserves, even picking up speed in early October. In this context, gold remained one of the best performing assets of the year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.