Krishna Karwa

Moneycontrol Research

Highlights:

- Reliance Retail’s e-commerce platform may be launched in the second half of 2019

- Established players such as Amazon and organised retailers could feel the heat

- Telecom and retail are the new value drivers for Reliance Industries

- Close to 44 percent of RIL’s current market capitalisation may be attributable to Reliance Retail alone

--------------------------------------------------

Reliance Retail (RR), India’s largest retailer, has announced an ambitious plan to launch its own e-commerce platform later this year. While consumers have a lot to cheer about, for RR’s competitors, alarm bells could be ringing. For Reliance Industries' (RIL) shareholders though, the announcement could be music to their ears.

What would work in RR's favour?

Domestic entity

To protect the interest of brick and mortar retailers, the government has tightened rules for foreign-funded e-commerce marketplaces (ECMs). RR’s proposed e-commerce portal would not feel the heat because its capital will come from RIL.

Strong network

As on December 31, 2018, RR’s network spanned 9,907 retail stores and 514 petroleum outlets respectively, spread across 6,400 cities and towns in India. Thanks to RIL’s capital investments in retail, the store count is rising rapidly, in spite of a very high base.

Co-existence of online and offline retail is integral to reap the benefits of both. While RR is presently active on both fronts, a full-fledged e-commerce application will bolster its online presence considerably.

Multiple products

RR’s product range spans food, grocery, apparel, lifestyle accessories, jewellery, consumer durables, footwear and cellular devices. This advantage would come in handy when RR's own e-commerce platform goes live. Availability of multiple brands across categories would be a one-stop convenient solution for shoppers. Simultaneously, the visibility of RR's private labels is slated to gain momentum.

Growing customer base

Reliance Jio is the fastest growing telecom network in India, with over 290 million subscribers. RR’s loyalty programme covered over 50 million customers by the end of 2018. This, in itself, presents a huge set of established buyers for the venture. Given the growing popularity of e-commerce in India, a further increase in customer coverage is likely.

Brand partnershipsExisting and upcoming brands, both Indian and foreign, have been entering into agreements with e-commerce majors to boost their brand image and sales. As Amazon and Flipkart struggle to cope with FDI challenges, branded players will probably consider RR’s e-commerce portal to promote themselves. RR's extensive pan-India reach should help it enter into tie-ups with mom-and-pop stores in remote areas as well. This will facilitate last-mile connectivity.

Implications for ECMs

For Amazon and Flipkart, restrictions pertaining to marketing of private labels, discriminatory/aggressive pricing and stake ownership in vendors have forced them to reorient the ways they do business.

RR’s entry into their domain, without any bar on operations or pricing, could result in a significant transition of customers from such ECMs to RR.

What about other organised retailers?

Retail is a highly competitive space, where margins tend to be very thin. ECMs have given stiff competition to all retailers in their endeavour to capture a larger share of the pie.

Organised retailers can heave a temporary sigh of relief in the aftermath of the government’s new rules pertaining to ECMs. However, once RR’s e-commerce application gets launched, they could feel the heat because of high competitive intensity.

Most ECMs incur losses in the initial years. This is due to heavy marketing spends, high inventory management and warehousing costs, expenses associated with customer grievance redressal and sales returns, interest waivers on certain EMI schemes, and steep discounting on products.

ECMs have been able to sustain their Indian operations because of robust financial backing from an international parent.

RIL will support RR in the latter’s journey to becoming an online retail mammoth, at least for the first few years. It remains to be seen how quickly this venture breaks even.

What lies ahead?

In the long-term, once RR’s e-commerce platform stabilises its operations and gains market share, its losses could start getting trimmed. This would have a positive rub-off on RR’s profitability, notwithstanding the fact that brick-and-mortar retail sales will continue to comprise a giant chunk of RR’s topline.

Over the next decade, Mukesh Ambani, RIL Chairman and Managing Director, aims to ensure that the new segments -- telecom and retail, jointly contribute at least 50 percent to RIL's consolidated sales.

Valuation upside

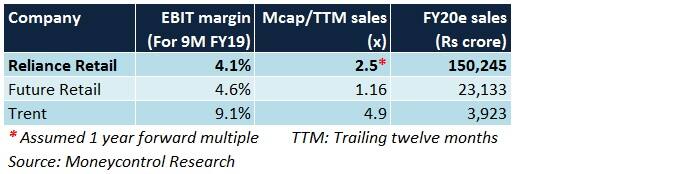

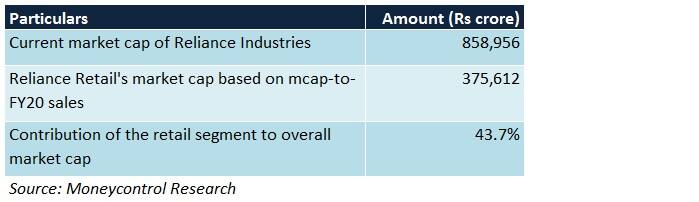

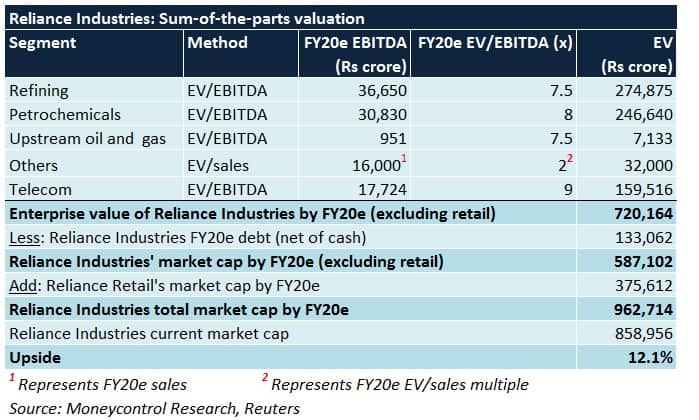

Going by a market cap-to-FY20 sales multiple of 2.5 times for RR, the contribution of RR to RIL’s current market capitalisation is close to 43.5 percent.

For the first nine months of FY19, RR’s sales constituted nearly 21.4 percent of RIL's consolidated turnover. This number is anticipated to increase as RR grows at a relatively faster pace than the company’s other capital-intensive verticals (such as petrochemicals, refining, oil and gas).

By virtue of economies of scale, should RR’s e-commerce portal demonstrate consistency in terms of margin improvement, it will help RR command higher valuation multiples in the long run.

Although we have seen a sharp rally in the RIL stock, we expect RR to be a latent value driver that investors have to watch out for.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!