Tirth Pandya’s parents wanted to upgrade to a luxury car to celebrate their 30th wedding anniversary. His father, who was deliberating multiple options, finally chose two SUVs recommended by Tirth: the GLE 400d (booked in May 2022) for his daily commute, and the Mercedes Benz G63 (booked in June 2022) for weekend getaways. Delivery of both models is expected only this year.

“Since those are CBUs (Completely Built up), allocations are lower for dealers and take time. But they (his parents) are ready to wait and don’t have a better alternative. I recommended they opt for SUVs that will be more comfortable than sedans,” said Pandya, a second-generation real estate and petrol pump entrepreneur in Ahmedabad.

Along similar lines, Abhinav Aggarwal, residing in Gurugram, had booked an XUV 700 in 2021. But he cancelled his booking after waiting for more than a year and eventually chose an SUV sold by other OEMs as they had a shorter waiting period.

“I was driving a sedan and was planning to buy a sedan but my folks and family members suggested I go for an SUV because that has a style statement,” said Aggarwal, who works in a government organization.

It is due to the buying pattern of customers such as Pandya, Ahuja, and Aggarwal that the demand for SUVs continues to skyrocket, leading to inordinate delays in post-purchase deliveries. Industry analysts reckon that while the auto sector’s chip shortage is gradually easing, leading to improved supply, one of the primary reasons for the long waiting periods is the limited production capacity of auto manufacturers.

For instance, Maruti Suzuki, which has a current booking backlog of around 4,00,000 vehicles (including 1,40,000 SUVs), churns out only 1.5 lakh cars every month. Similarly, Mahindra & Mahindra (M&M), which manufactures 40,000 utility vehicles every month, has a booking pipeline of 2.66+ lakh SUVs.

“The easy availability of finance and increase in disposable income is making customers upgrade from hatchbacks/sedans to SUVs. Production still remains a bottleneck to match the demand,” said Puneet Gupta, director, S&P Global Mobility.

Per data shared by JATO Dynamics, a data intelligence firm, Mahindra and Mahindra (M&M) has a waiting period of 18-36 Weeks for the Thar and 60-62 weeks for the XUV700. While the Tata Nexon has a waiting period of four to six weeks, one can expect delivery of the Hyundai Venue and Creta only after 12-20 weeks and 12-14, weeks respectively, according to JATO Dynamics (see table below).

Similarly, Hyundai Alzacar has a waitlist of eight to 12 weeks for the petrol variant and 20-24 weeks for the diesel variant. Car market leader Maruti Suzuki has a 40-42 week waiting period for the Ertiga, the JATO Dynamics data showed.

Maruti Suzuki has revealed that its recently unveiled Jimny, which has already garnered 20,000+ bookings, will have a waiting period of one year. There is also a 6-month waiting period for the Grand Vitara, which was launched last year.

Dissecting the PV market

While the Indian Passenger Vehicle (PV) market continues to witness positive growth in numbers post Covid, the Sports Utility Vehicle (SUV) segment may turn out to be the biggest volume puller in 2023.

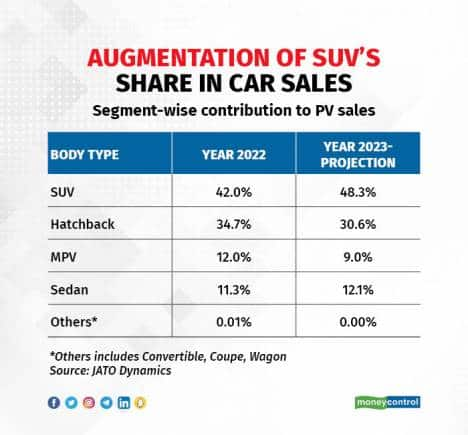

According to a research study carried out by JATO Dynamics, the contribution of SUVs may go up further, from 42 percent to 48.3 percent of the total passenger vehicle market. Of the 39,17,791 units of Passenger Vehicles expected to be sold, 18,92,364 will be SUVs, the data intelligence firm stated (see table below).

Last year, SUVs accounted for 38,20,578 units out of the 16,03,348 passenger vehicles sold in the country, said JATO Dynamics. The firm claimed that the contribution of hatchbacks will drop from 34.7 percent (13,26,324 units) to 30.6 percent (11,98,486 units) and MPVs from 12 percent (4,57,239 units) to 9 percent (3,52,455 units).

Carmakers upping the SUV ante

So far, SUVs have contributed 11.4 percent of Maruti Suzuki’s total sales during the ongoing financial year. In the next fiscal year, the company anticipates the volume share to be around 25 percent of its total sales, riding on the availability of new models such as the Fronx and Jimny and with full-year sales of the Vitara and Brezza (launched last year).

Shashank Srivastava, Senior Executive Officer, Sales & Marketing, Maruti Suzuki, stated, “The key drivers for robust SUV sales are the continued consumer preference for SUV design elements of high and upright driving position, larger ground clearance, flexible interior space management, along with the status attached with SUV ownership in India. Moreover, the price points of compact SUV segment vehicles overlap with premium hatchbacks and entry sedans, thus making overlapping possible across segments.

Similarly, Hyundai Motor India Limited (HMIL) reported its best-ever annual sales in 2022, on the back of robust demand for its sports utility vehicles (SUVs), which contributed around 53 percent of its overall sales.

Talking to CNBC TV18 recently, Tarun Garg, the newly appointed Chief Operating Officer of Hyundai India, acknowledged that there has been a rise in consumer preference for the SUV segment with Hyundai as well as with the industry.

“As far as industry is concerned, SUVw contributed 42 percent to the overall industry in 2022, whereas for Hyundai the number was 53 percent. We believe that there is a lot more upside still to it and we at Hyundai probably are looking at somewhere between 55 to 60 percent of SUVs in the calendar year 2023. And I believe that even industry would somewhere be between 45-50 percent,” Garg told CNBC.

Mahindra and Mahindra, in a post-Q3 FY 23 earnings media interaction, revealed that SUVs such as the Scorpio-N, XUV700, and Thar have generated high volumes during the past few quarters and foresee a similar trend in the upcoming quarters. The company’s Year to Date (YTD) total volumes as on January 2022, in passenger vehicles, stood at 2,92,898 and SUV volumes stand at 2,90,764 units. The Mumbai-based automaker also claimed that it continues to maintain the leading position in SUV revenue market share with 20.6 percent in the third quarter.

“The increase in vehicle launches over the years has led to a wide variety of choices in cars for the Indian consumer. This, coupled with increased affordability due to rising disposable income, has taken the overall SUV market share to almost 50 percent in passenger vehicles,” Veejay Nakra, President, Automotive Division, M&M Ltd., told Moneycontrol. He added, “We also see that the urban Indian consumer is intending to live life to the fullest, going outdoors and aspiring to travel and explore, especially post-pandemic, thus opting for larger, more capable SUVs as their preferred vehicle of choice.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.