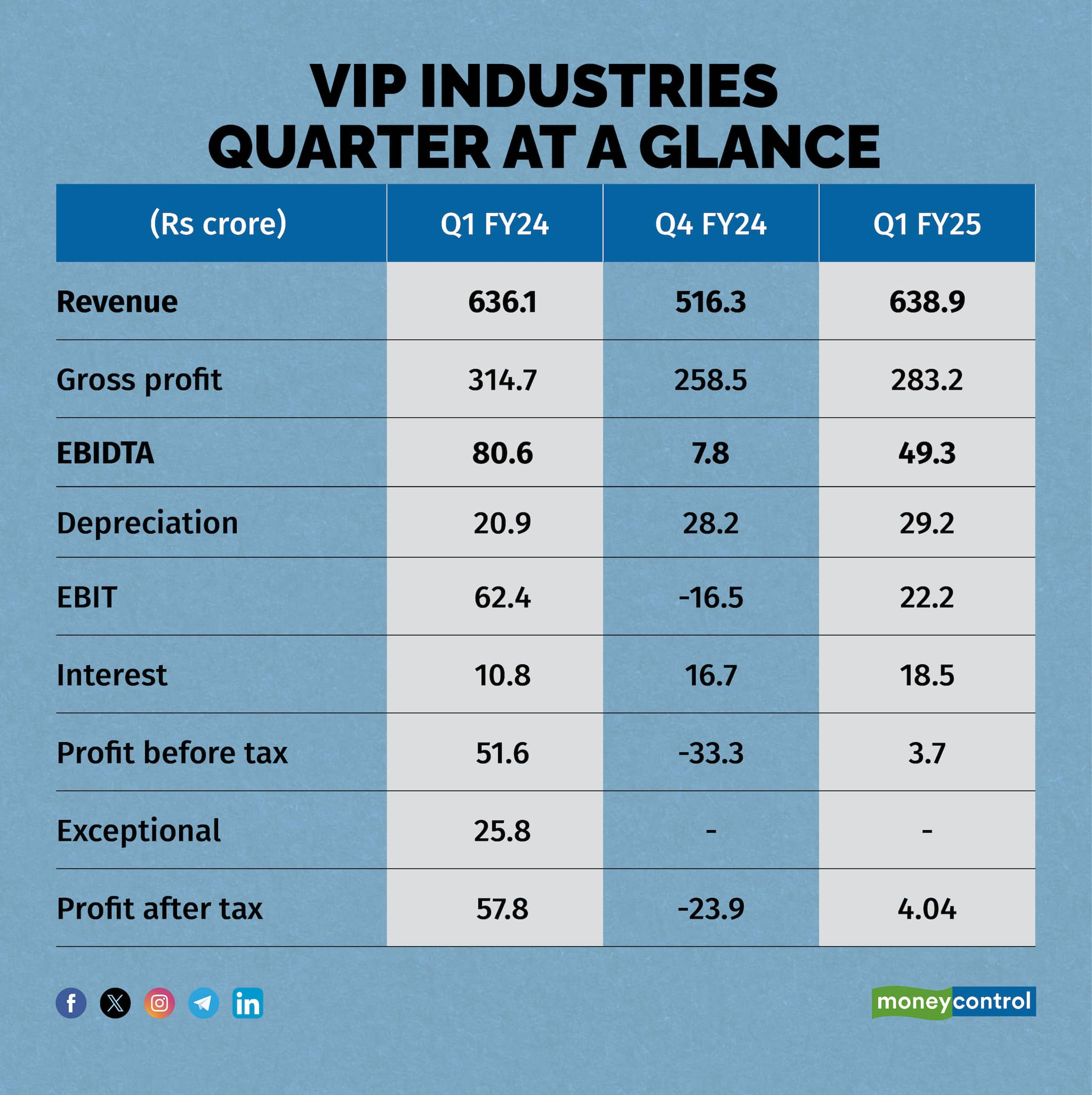

Highlights

A soft start to FY25

Source: Company

Market share gains and volume growth

The market conditions were tough due to heat waves, the general election, lower wedding days, etc. Amid these challenges, VIP improved its market share among the three organised players by 2 percent sequentially from 36 percent to 38 percent and expects another 2 percent gain in Q2.

While revenue growth was flat, the underlying volume growth was 11 percent. In fact, April was particularly challenging and value and volumes have recovered in the subsequent month. The adverse product mix, thanks to a 73 percent YoY growth in e-commerce volumes that is dominated by low-end products with heavy discounts, also contributed to suppressed realisations. The demand was weak in the mass premium category.

Source: Company

Much needed inventory liquidation impacted margin

At the end of March ’24, the company was sitting on an inventory of Rs 916 crore that is down to Rs 798 crore at the end of June ’24. The inventory of soft luggage is down from 9.5 lakh pieces to 6.3 lakh pieces and this should get liquidated by September this year. Therefore, Q2 will also have this liquidation impact and the numbers should start looking up from the second half of the year. The company also expects its balance sheet quality to improve meaningfully post the inventory reduction.

Thanks to the soft luggage inventory liquidation, higher sales through lower margin e-commerce, and lower production at the Bangladesh facility (fixed overheads had to be absorbed), the company saw a reduction of over 570 basis points in gross margin. Operating margin fared relatively better thanks to the reversal of employee performance benefit.

VIP is targeting a meaningful margin expansion – 15 percent operating margin by Q4 FY25, through the combination of cost optimisation, pricing, and product mix. It has hired consultant BCG for this exercise.

Source: Company

Source: Company

Bangladesh facility – so far so good

Soft luggage is sourced from the Bangladesh facility located in an EPZ (export processing zone). Given the lower demand for soft luggage, the manpower strength in Bangladesh has been rationalised from 8000 to 3800. So far, there has been no disruption in production due to the recent political unrest and the company doesn’t see a risk to Bangladesh’s FTA with India. However, this area warrants a close watch.

Long-term demand trend encouraging

The boom in travel is continuing, with all leading indicators — growth in air passengers and record hotel occupancy — reinforcing the positive trend.

Travel is increasingly becoming a fixed part of household budget especially for the younger generation. Frequent travels are turning luggages into lifestyle products. Moreover, growing affluence, coupled with customers’ preference for branded products, is fueling the growth of the organised sector. The increased frequency and duration of travel is leading to the considerable shortening of the replacement cycle. Luggage is extending to customer cohorts beyond travel driven by event-based consumption like wedding, student travel, gifting, etc.

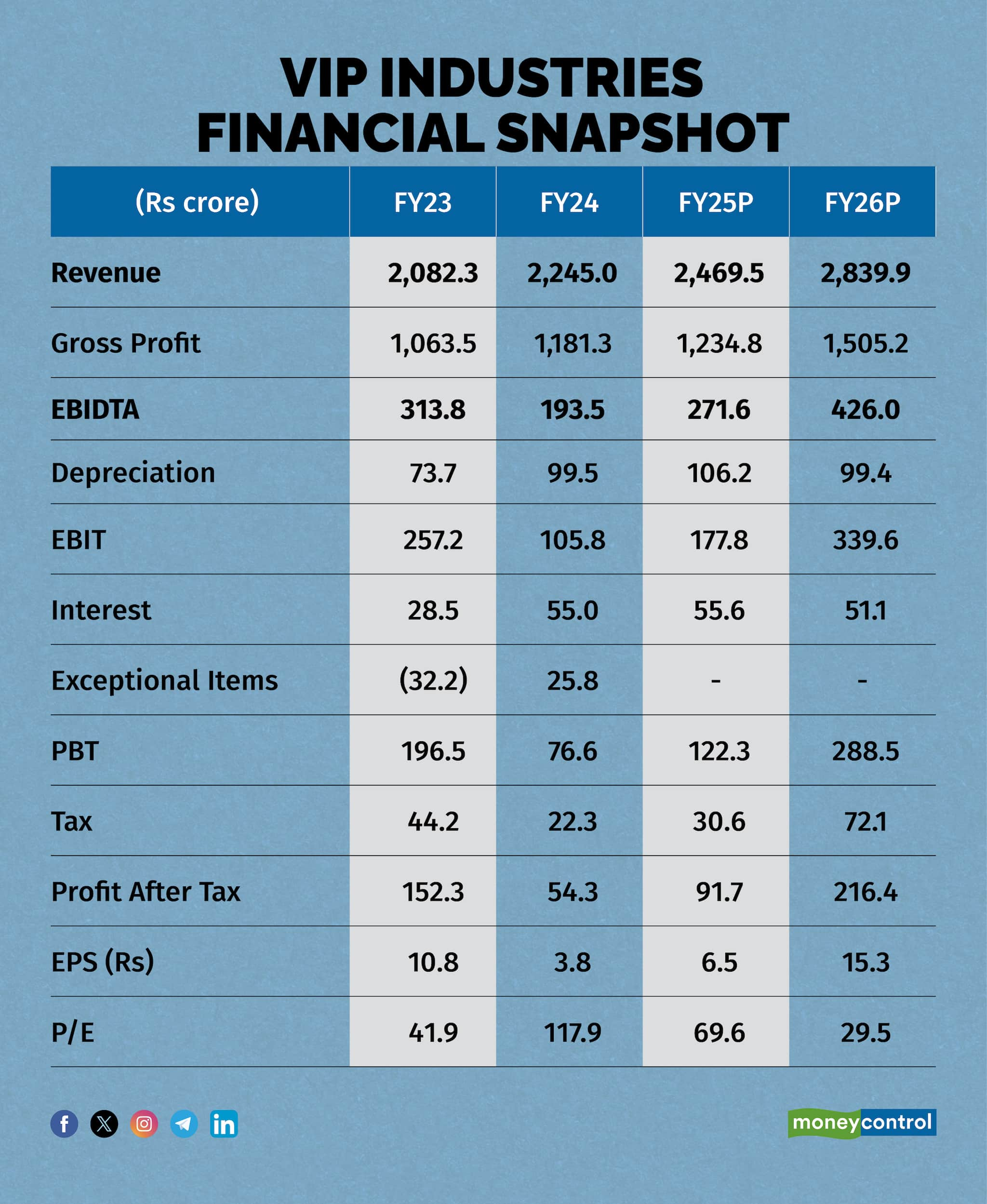

Outlook

VIP now faces formidable competition in the premium category from Samsonite and several foreign brands that are making inroads into the Indian market, not to forget the home-grown Safari targeting the segment with Urban Jungle. However, the opportunity size is also steadily growing. The market remains competitive and consumer sentiment remains weak with poor demand for mass premium categories.

Although Q1 was directionally positive, the road to full recovery can be bumpy.

Investors with patience and an appetite for risk can look at the stock as we see little downside risk at this price.

Source: Company, Moneycontrol Research

Source: Company, Moneycontrol Research

Risks: Inability to improve market share in light of heightened competition or problem in Bangladesh facility

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.