Shabbir Kayyumi

The Cup & Handle pattern is believed to be one of the most reliable and popular patterns among traders community. In technical analysis, a Cup & Handle pattern describes a specific chart formation that projects a bearish-to-bullish trend reversal. A Cup & Handle reversal pattern forms after a down trend, and its completion marks a trend reversal to up trend.

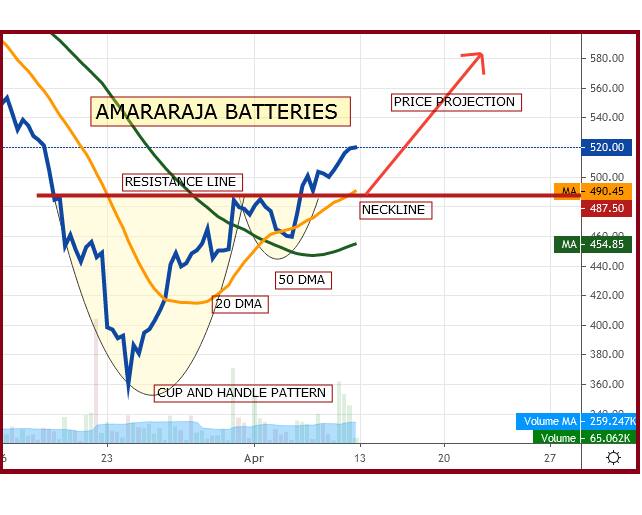

In the standard Cup & Handle pattern, we connect the high after Cup with the high created after the handle. A trend line is drawn by connecting these highest points of the two peaks, which is called as “Neckline". This trend line is the most important component of C & H pattern.

Why to buy Amara Raja Batteries?

C&H patterns are an integral part of technical analysis, but successful traders combine these techniques with technical indicators and other forms of technical analysis to maximize their odds of success.

Amara Raja has recently crossed the strong resistance line standing around Rs 490 levels indicating strong bullish breakout. Recent formation of cup and Handle pattern breakout on a close above Rs 490 marks suggests buying in the stock for higher targets of Rs 590. Decent volume participation while giving breakout is also giving support to C&H pattern.

Cup & Handle pattern and Buy signal on Amara Raja Batteries

Buy Signal:

> A close above neckline (490) of Cup & Handle pattern is indicating trend reversal to uptrend.

> Short- term moving average 20 DMA (490) defines short-term trend is providing support to buyers as prices are sustained and trading around it.

> Mid- term moving average 50 DMA (455) defines mid-term trend is very well augur with bulls as prices are sustained and trading above it.

> Decent volume participation while pattern breakout will also give additional confirmation.

Profit booking:

Target as per Cup & Handle pattern is calculated by adding height of Cup to neckline which comes to Rs 590, however one can book profits near previous swing high which is around Rs 580.

Stop loss:

Entire bullish view negates on breaching of Handle on closing basis and one should exit from long position. In case of Amara Raja, it is placed around Rs 444 levels.

Conclusion:

We recommend buying Amara Raja Batteries around Rs 500 with a stop loss of Rs 444 for higher targets of Rs 590 as indicated in above chart.

(The author is Head of Technical Research at Narnolia Financial Advisors Ltd.)

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.