Indian market regained momentum in the last two months largely on the back of buying in largecaps, and at the cost of the small & mid-cap spaces.

Analysts have shifted attention away from mid & smallcaps in 2018 following relentless selling in these stocks.

Apart from regulatory headwinds, high valuations, concerns regarding corporate governance issues, global headwinds in terms of a trade war and crude oil prices, fall in the rupee, and slower-than-expected economic growth weighed on Indian markets, especially on mid & smallcaps.

However, some midcaps managed to buck the trend and witnessed buying momentum amid selling in the broader market.

After the recent classification changes brought in by the Securities and Exchange Board of India (SEBI) in terms of market capitalisation, a few stocks have now entered the large-cap space. These are the ones where average market capitalisation rose above Rs 30,000 crore over the last six months.

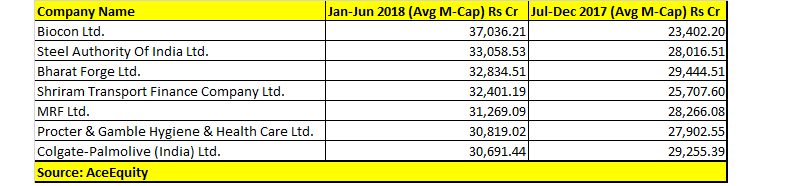

According to data compiled from AceEquity, we identified seven stocks where average market capitalisation of last six months (January-June 2018) rose above Rs 30,000 crore compared to average market capitalisation recorded in the second half of 2017 (July-December 2017).

Seven stocks which turned largecaps from midcaps include Biocon, SAIL, Bharat Forge, Shriram Transport Finance, MRF, P&G Hygiene & Healthcare, and Colgate Palmolive India.

“Midcaps have a tendency to outperform the key benchmark index but multibaggers have their own personality. Nifty rose 28 percent while the Midcap index has posted the 48 percent return in the calendar year 2017,” Ritesh Ashar, CSO, at KIFS Trade Capital told Moneycontrol.

“Typically what performance was expected from the midcaps was up to the mark and it has marked positive alpha. In that scenario surprisingly mid-caps turned in to large cap. As we have seen a globally recognized method for determining the stock is on the basis of market cap irrespective of their past performance. So the mentioned example could be considered as a large caps,” he said.

As per the circular released by SEBI on October 6, 2017, Indian Mutual Funds Schemes have to be strictly categorised into various baskets with a well-defined classification of Large Cap, Mid Cap, and Small Cap stocks. Indian Mutual funds will have to re-align the schemes within one month.

According to a report by Edelweiss which highlighted the definition of large cap, midcap, and Smallcap:

a.) Large Cap: 1st -100th companies (cut-off stood at 6M Avg M-cap of Rs 30,600 crore)

b.) Mid Cap: 101 st - 250th companies (cut-off stood at 6M Avg M-cap of Rs 9,980 crore)

c.) Small Cap: 251st onwards companies

So what should investors do?Analyst: Ritesh Ashar, CSO, at KIFS Trade CapitalBiocon: Buy above Rs 640In the recent scenario, the stock is unfolding into a corrective pattern where it is on verge of completing its correction at an important Fibonacci retracement of 38.2% of the previous bull move.

Intermediate resistance is placed near Rs 640. If bulls manage to surpass the mention level, we may see further escalation towards uncharted territory.

SAIL: Hold as stocks likely to trade sidewaysAfter a spectacular rally by marking positive alpha in 2017, the stock has lost some steam. It unfolded into a corrective pattern and we may see the stock to trade in a tight range of Rs 70 on the lower side and Rs 100 on the higher side. Traders can use these levels for trading accordingly.

Bharat Forge: Book profits at higher levelsRecently, on the higher time frame charts mainly on the weekly charts, the stock is trading in a lower top lower bottom pattern. The intermediate resistance is placed near Rs 656. Investors are advise to book profit at a higher level.

Shriram Trans Finance: Use rallies to exitOn higher time frame charts, mainly on the weekly, the stock is trading in a lower top lower bottom pattern. The intermediate resistance is placed near Rs 1,360. Investors are advised to use every rise as an exit strategy.

MRF: HoldOn the higher time frame charts, mainly on the monthly chart, the stock is trading in a clear uptrend and whenever higher time frame charts are bullish then every 5 percent correction could be capitalized as a buying opportunity. Once the momentum starts, the price tends to remain in a motion more or less in the same direction.

P&G Hygiene & Healthcare: Book Profits

P&G Hygiene & Healthcare is oscillating in escalating channel on the monthly chart where the channels overhead resistance is placed near the 11,000 mark. We advise traders to book profit near 11,000 and wait for the further confirmation. Intermediate support place near 10,000.

Colgate Palmolive India: Go LongIf we look at the FMCG sector, RRG (Relative rotation graph) on the weekly time frame indicate that FMCG is moving in a leading quadrant wherein relative strength and relative momentum is very high.

We are expecting FMCG continue to travel towards northern trajectory. In that space Colgate Palmolive on the higher time frame mainly on monthly moving in a clear uptrend. Investors’ are advised to go long in Colgate with a time horizon of 6 months.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.