Samvat 2075 turned out to be a roller-coaster ride for investors as global and domestic headwinds capped the upside. The Nifty touched 12,000 levels but the high was followed by a selloff; still the index up a little over 9 percent from the last Diwali.

The Nifty touched its all-time high of 12,103.05, while the Sensex touched a high of 40,308 on June 3 on the intraday basis, while broader markets underperformed.

BSE Smallcap index declined 9 percent, and the BSE Midcap index 2 percent, while the BSE largecap index added 10 percent in the last one year.

Indian markets rose a little over 9 percent from the last Muhurat trading day on November 7 when the index was at 10,598. However, plenty of action was seen in individual stocks.

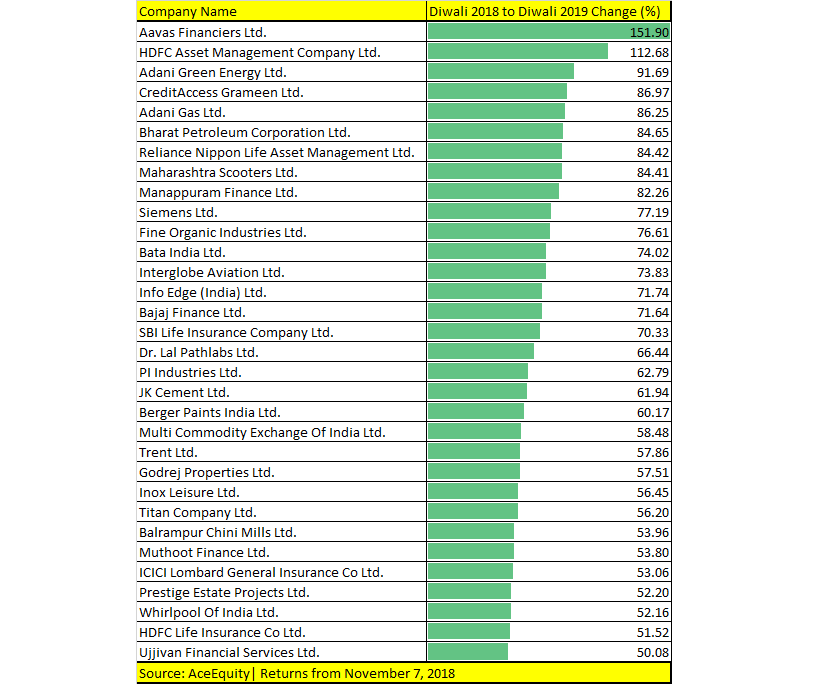

Since last Diwali, only two stocks -- Aavas Financiers and HDFC AMC --have more than doubled investors’ wealth from among the BSE500 index companies.

Stocks that rose 50-100 percent include Ujjivan Financial, ICICI Lombard, Trent, MCX, Dr Lal Pathlabs, Bajaj Finance, HDFC AMC, BPCL, Siemens and Fine Organic.

Note: The data is for reference and not buy or sell ideas.

The last year was eventful for Indian markets. The Modi government got a second term but slowdown, in both domestic and global economies, capped the upside for the markets.

It is a double whammy for the Indian market which is facing a slowdown and also stress in the financial sector. Since the ILFS crisis in September 2018, the financial sector has continued to see elevated stress across NBFCs and HFCs, say experts.

The stress has also spread to the banking sector, where many leveraged companies are a concern, they say. Economic parameters slumped with GDP estimates being revised down.

The government has taken a plenty of measures to boost the economy that hit a six-year low of 5 percent but a recovery looks unlikely in the near term. Most of the global institutions have trimmed their India forecast for FY20.

Markets are slaves of earnings, which have remained muted in the last one year. Experts say a double-digit earning growth is some time away, but not for the Nifty in FY21.

“Corporate earnings have been muted throughout the year and are expected to be tepid in near to medium term as well. Earnings risks continue to be tilted to the downside on account of the underlying weak demand scenario, the uneven asset quality trends in financials and the deflationary trends in commodity prices,” Siddhartha Khemka, Head, Retail research, MOFSL, told Moneycontrol.

“Thus, for 2QFY20, we expect Nifty sales/PAT to decline by 2%- 8%. The silver lining is that the festive season demand has begun on a positive note. Thus while we are expecting 12% EPS growth in FY20 for the Nifty, we are estimating strong revival of 28% growth in FY21,” he said.

Khemka advised investors to accumulate quality names for the long-term, even though the Nifty looks richly valued at 20x FY20E earnings, and several of its constituents are trading at a 30-40 percent discount to their long-period average valuations.

What to expect from Samvat 2076?

Most experts feel that the market is likely to head high and investors should use dips to get into quality names that should be able to outperform the index in the next 12 months.

There are plenty of opportunities that one can grab as the growth cycle is at the lowest point and some of the sectors are going through their worst phase. Some of the strong companies are trading at a steep discount to their record highs.

Going ahead, markets are likely to remain volatile in the near term till economic recovery is visible. “The 3 key factors to watch out for would be reducing stress in the financial sector, further stimulus announcements by the government to boost consumption and overall economic growth and resolution of the US-China trade war,” Motilal Oswal said in a report.

“We would suggest investors to take this as an opportunity to accumulate quality names for the long-term. We do believe that the Nifty is richly valued at 20x FY20E earnings, despite several of its constituents trading at a substantial 30-40% discount to their respective long-period average valuations.”

Shrikant Chouhan, Senior Vice President, Equity Technical Research, Kotak Securities, is of the view that from Samavat 2076, the golden era should start for Indian markets and it till go on till Samvat 2079.

The government had started addressing significant issues of India and “the mother of a bull run is not far away”. “We think between Samvat 2076 and Samavat 2077, the Nifty could see the levels of 14,400,” Chouhan said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.