The Indian stock market has hit record high on November 10 after progress in the development of a coronavirus vaccine raised hopes of a global economic recovery. Sensex is up 556.64 points or 1.31% at 43154.07, and the Nifty jumped 136.90 points or 1.10% at 12597.90.

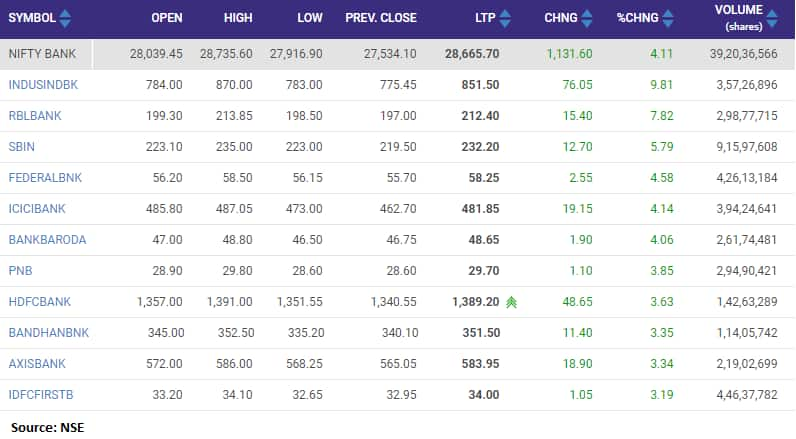

Among the sectors, banks and financials rallied the most with Bank Nifty jumping over 3 percent led by IndusInd Bank which spiked 10 percent followed by State Bank of India, RBL Bank, PNB, ICICI Bank and HDFC Bank.

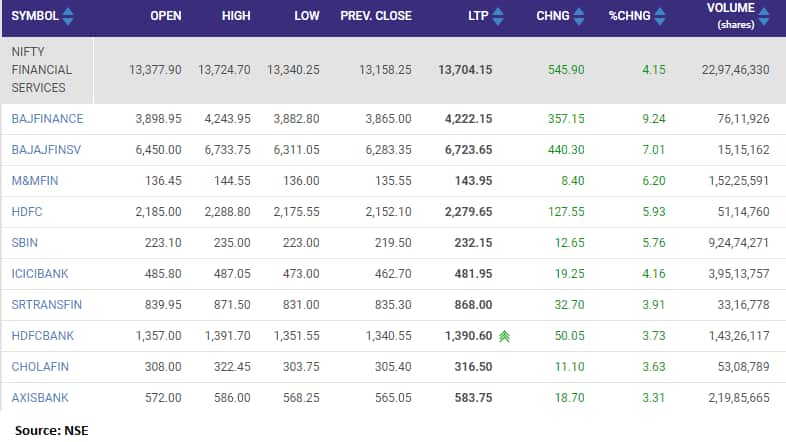

Nifty Financial Services was up 4 percent led by Bajaj Finance which rallied over 9 percent followed by M&M Financial Services, Shriram Transport Finance, HDFC, Cholamandalam Investment and Bajaj Finserv.

SBI was the most active stock on NSE in terms of volumes with 8,30,09,099 shares being traded followed by IDFC First Bank (4,26,02,725), Federal Bank (4,09,42,329), YES Bank (4,04,78,671) and ICICI Bank where 3,74,16,835 shares were being traded.

Among the banking names, the stocks that have hit new 52-week high included HDFC Bank and Kotak Mahindra Bank.

Domestic brokerage firm HDFC Securities has recommended a buy on ICICI Bank with target of Rs 503 per share and a buy on Axis Bank with target at Rs 590-640 per share. KR Choksey has a buy call on Bandhan Bank with target of Rs 431 per share.

Brokerage firm Kotak Securities recommends buying ICICI Bank with target at Rs 500.

YES Bank shares hit 5 percent upper circuit on BSE after CARE Ratings revised its rating on private lender's debt instrument. The rating agency has revised the bank's infrastructure bonds rating to 'CARE BBB' from previous 'CARE B'.

Pritesh Mehta, Lead Technical Analyst - Institutional Equities at YES Securities feels that within banking space, private bank index has witnessed consecutive fifth higher high & higher low, while PSU Bank index has gained positive traction and is expected to do well from near term perspective as the ratio of PSU Bank/Nifty has given consolidation breakout.

Manish Srivastava, Technical Analyst (Equity & Currency) at Rudra Shares & Stock Brokers has a buy on RBL Bank with target at Rs 216 per share.

The short-term range breakout has been witnessed in the stock which is supported by momentum and volatility indicators. The base formation can be seen near the 20 period simple moving average in the weekly time frame, he said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.