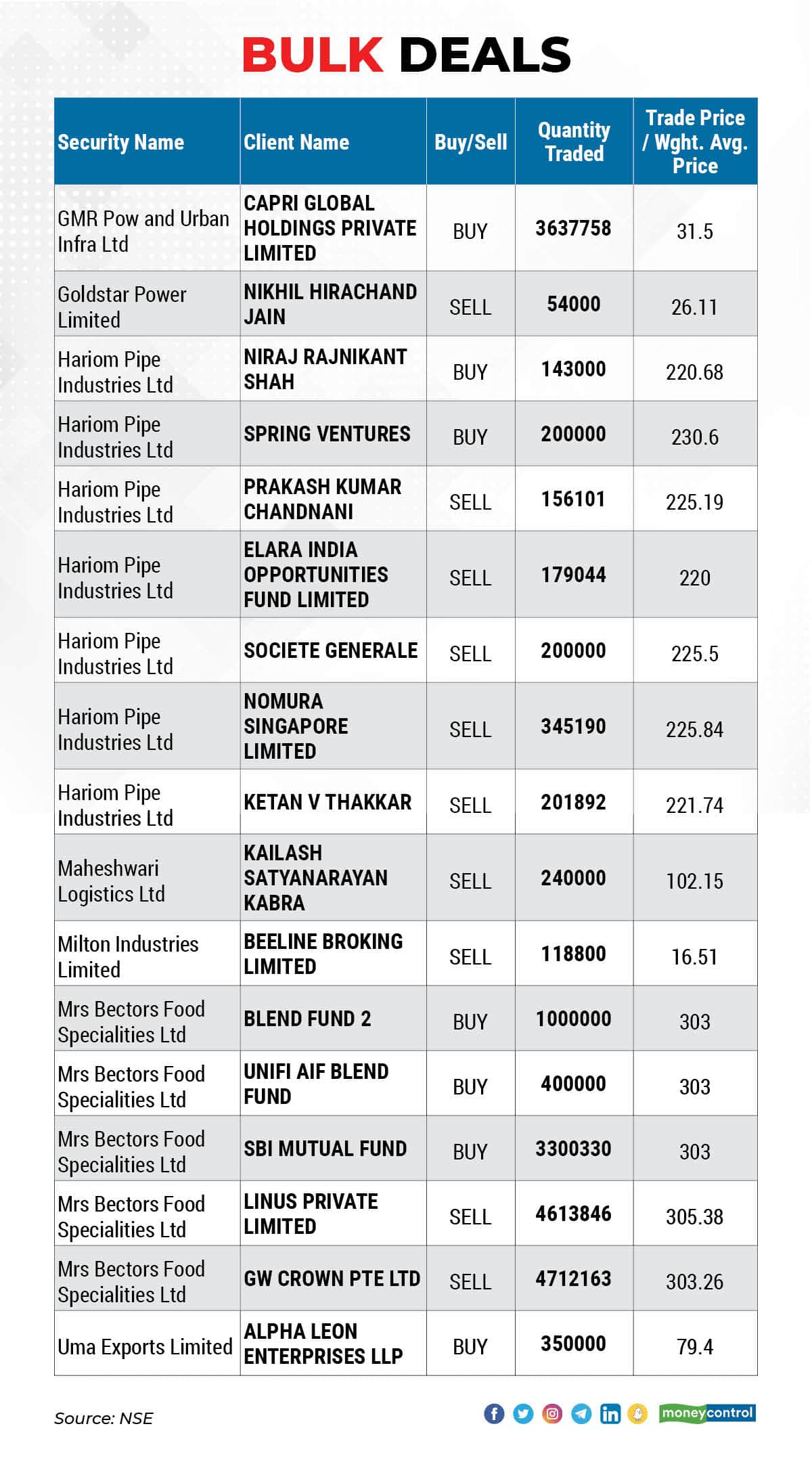

The counters of Mrs Bectors Food Specialities Ltd and the latest entrant at the bourses, Hariom Pipe Industries Ltd saw quite a few ‘bulk deals’ on April 13 (Wednesday).

Hyderabad-based iron and steel products maker Hariom Pipe Industries had a successful debut on the bourses on April 13 when it listed at Rs 214 per share, a premium of 39.87 percent to its issue price of Rs 153 per share. It closed the day at Rs 231 per share, which is a gain of 50.98 percent from its issue price.

Nomura Singapore Ltd sold 3,45,190 shares of Hariom Pipes via the open market transactions route at an average price of 225.84 per share. The total deal worked out to Rs 7.80 crore. Nomura held a 1.74 percent stake in the company before this deal. Its reduced stake in the company now stands at 0.39 percent.

Another foreign portfolio investor (FPI) Societe Generale liquidated 0.79 percent of its stake in the company through open market transactions as it sold 2,00,000 shares at an average price of Rs 225.5 per share, valuing the deal at Rs 4.51 crore. Its stake in the company now stands reduced to 1.83 percent from 2.61 percent held earlier before this deal.

The maiden public issue fetched Hariom Pipe Industries Rs 130 crore which the company intends to utilise it for capital expenditure and working capital requirements. The IPO price band was Rs 144 - Rs 153 per share.

Elara India Opportunities Fund Ltd. is the other financial institution that sold 1,79,044 shares totalling to 0.7 percent stake in the company at an average price of Rs 220 per share which valued the deal at Rs 3.94 crore.

Other bulk deals in the company include sales by two individual stakeholders Prakash Kumar Chandnani and Ketan V Thakkar who sold 1,56,101 and 2,01,892 shares each at an average price of Rs 225.19 and Rs 221.74 per share, respectively.

Mrs Bectors Food Specialities Ltd saw GW Crown Pte Ltd liquidating its entire stake of 8.01 percent in the company as it sold 47,12,163 shares through open market route at an average price of Rs 303.26 per share. The deal was worth Rs 143 crore.

The Jalandhar-based bakery firm, also saw Linus Private Ltd exiting the company as it offloaded 46,13,846 shares, aggregating to a 7.84 percent stake in the company, at an average price of Rs 305.38 per share. The deal value worked out to be Rs 141 crore.

Meanwhile, as per the bulk deal data available with the National Stock Exchange, SBI Mutual Fund bought over 33 lakh shares of Mrs Bectors Food. The company's other bulk purchases of 10 lakh shares and 4 lakh shares were made by Unifi AIF Blend Fund and Blend Fund, respectively.

The shares of Mrs Bectors Food Specialities declined 8.5 percent on April 13 to close at Rs 308.75.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.