As 2024 unfolded, Rapido, which started as a bike-taxi aggregator, navigated a road full of both opportunities and challenges.

The ever-expanding consumer base promised growth, but the market was tightening, with new contenders like Namma Yatri intensifying competition in an already crowded mobility sector.

For the Swiggy-backed Rapido, 2024 demanded more than innovation—it required a strategic pricing play, a revamped app experience, and a robust plan to solidify its position as a mobility service platform.

“We expanded our offerings with the launch of Rapido Cabs, taking our mission of providing affordable and reliable rides to a pan-India scale. It’s been an ambitious journey, but seeing the trust and adoption from our users has been incredibly rewarding,” Aravind Sanka, co-founder of Rapido told Moneycontrol while speaking about the company’s journey so far.

While it introduced auto-rickshaws in 2020 in a few cities including Hyderabad and Bengaluru, Rapido added cabs at the end of 2023 in more cities and last-mile delivery services at the beginning of 2024, catering to a wider range of transportation needs.

No longer just a bike-taxi aggregatorHyderabad-based Rapido, founded in 2015 by Sanka, Pavan Guntupalli and Rishikesh SR, has long made its mark as an affordable and efficient transportation alternative in India’s bustling and congested cities.

However, as the mobility landscape evolved, so did the company. Recognising the need to diversify, Rapido expanded its offerings beyond bike-taxis to become a broader mobility platform while continuing to dominate the bike-taxi segment.

The shift was driven by the changing preferences of consumers and the growing demand for cost-effective solutions.

Pavan Guntupalli, co-founder of Rapido, during the Moneycontrol Startup Conclave held in August, said the company's focus is on urban mobility challenges.

"We already have auto share services in cities like Bengaluru. We’re currently working on solutions to ease the commute in tier-1 cities like Bengaluru, Delhi, and Mumbai. Our goal is to enable better transport solutions and decongest roads through more sharing and leveraging existing infrastructure."

Ride-hailing aggregator Uber on October 23 unveiled its 2024 India Economic Impact Report, compiled by consultancy firm Public First. The report said the ride-hailing auto market could grow by 50 percent over the next five years.

Established players like Ola and Uber continued to dominate the traditional taxi space in 2024, while new entrants such as Namma Yatri and regional aggregators brought hyperlocal solutions, challenging existing giants.

Namma Yatri which started its operations in 2022 with a USP of being a ‘zero-commission platform’, clocked about 60,000-80,000 rides a day in 2024.

At the same time, Ola Cabs and Uber were also experimenting with newer categories like Uber Bus, Ola Electric Bike Taxis and more, increasing competition for Rapido.

“Namma Yatri’s entry and other players’ aggressive expansion strategy was a tough competition for Rapido…However, what worked was the app’s experience and user loyalty,” said a mobility product developer requesting anonymity.

“Compared to other apps, Rapido’s user-friendly approach and marketing added value,” the person quoted above said.

Moreover, the company enhanced its app experience in 2024, a source said, integrating features like AI-powered route optimisation and dynamic pricing to offer better service during peak hours.

Meanwhile, rising fuel prices and an increased focus on sustainability pushed consumers to consider more economical and eco-friendly options, creating a fertile ground for Rapido’s two-wheeler-focused service to flourish. The firm capitalised on these trends, carving out a niche in the metro cities.

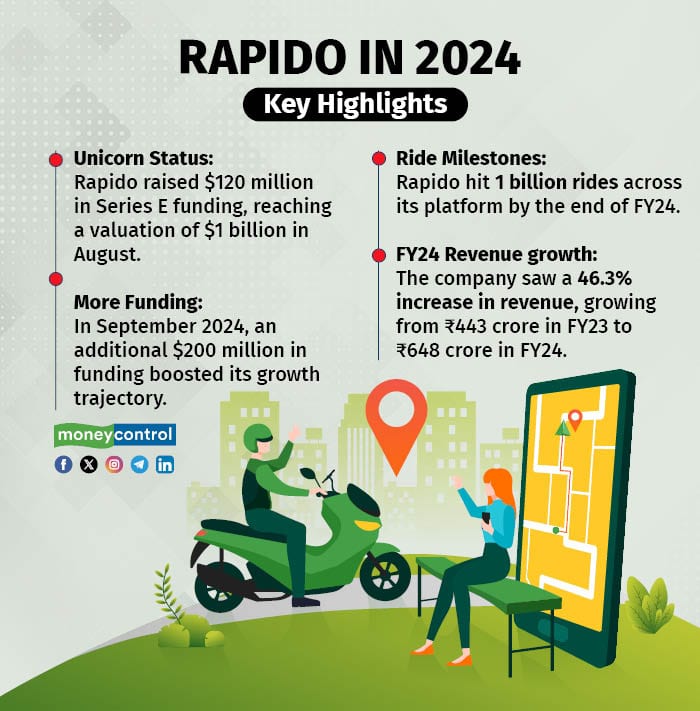

Turning a unicornOne of Rapido’s defining moments in 2024 was achieving unicorn status. Rapido joined the unicorn club after raising around $120 million (Rs 1,000 crore) in its Series E funding round led by its existing investor WestBridge Capital.

A unicorn is a privately-owned business valued at $1 billion or more.

Investors further doubled down on the firm with around $200 million in funding in September 2024.

It also fuelled the company’s aspirations to diversify into new verticals, including last-mile delivery and logistics, leveraging its growing fleet and technological backbone.

RapidoWhat worked for Rapido

RapidoWhat worked for RapidoA critical factor in Rapido’s 2024 success was its ability to address the needs of both its riders and customers. For its captains, or driver-partners, Rapido provided flexible earning opportunities and introduced training modules to improve safety and service standards.

“This year alone, we welcomed over 2 million new Captains across all three of our services—Bike, Auto, and Cabs—helping them earn a livelihood and build a better future for themselves and their families,” Sanka told Moneycontrol.

“Ending the year with 1 billion rides across our platform feels like a defining moment,” he added.

SaaS model successWhile Namma Yatri was the first to launch a subscription model among drivers, Rapido’s quick introduction of a SaaS model among drivers and driver partners also helped in sustained revenue growth.

“A big part of enabling this growth was transitioning from a commission-based model to a SaaS approach. This shift allowed us to streamline our operations and ensure our captains could maximise their earnings while maintaining flexibility,” Sanka said.

Rapido's revenue from operations grew 46.3 percent to Rs 648 crore in FY24 from Rs 443 crore in FY23, its consolidated financial statements filed with the Registrar of Companies showed.

Expanding pan-IndiaIn 2024, Rapido took a step in its evolution by expanding its cab services across India as against its core Karnataka and Hyderabad markets, marking a significant shift from its origins as a bike-taxi platform.

The company introduced its cab offerings in multiple cities, tapping into the growing demand for affordable transportation.

Along with cab services, the firm also introduced newer features that resonated well with the younger population as it started promoting inclusivity with its Women Captain initiative, empowering female riders to become captains and fostering a safer, more diverse driving community.

Additionally, the firm also launched Rapido Pet which caters to pet owners by allowing them to travel with their pets, ensuring a comfortable and hassle-free auto ride for both passengers and their furry companions.

Riding the quick commerce growthThe firm also quickly hitched itself to the quick commerce frenzy.

In an interaction with Moneycontrol in October, Sanka said that the firm is entering the quick commerce delivery segment for hyperlocal deliveries. It recently signed a partnership with Zepto, Pincode and KPN Farm Fresh.

After the coronavirus pandemic, quick commerce has become a significant growth driver for the Indian market, with most fast-moving consumer goods companies identifying it as their fastest-growing sales channel.

Going all-electricThe company’s decision to introduce an electric bike fleet in major cities will also help the firm in addressing several regulatory concerns.

“Some cities we will move to 100 percent electric in the next one year. For example, in Delhi we will be going 100 percent electric in the next one year. About 25 percent of our bike-taxi services are already electric there and we will slowly move towards other states as well,” Sanka said.

Rapido is working with original equipment manufacturers and fleet operators including Zypp Electric and Gogoro. The firm also runs its own electric vehicle (EV) fleet in three-wheeler autos in Bengaluru.

The shift could also give Rapido a first-mover advantage in the bike-taxi sector, as competitors such as Ola and Uber are already experimenting with green solutions.

Facing hurdlesIn 2024, Rapido also had to confront significant challenges, which tested the resilience of its operations.

A big one was also around its bike-taxi service, where its captains, or drivers, faced significant opposition, particularly from auto drivers who saw them as competition.

There were reports of tensions escalating to the point where bike-taxi captains' helmets were damaged by auto drivers. In addition, transport department officials, posing as customers, booked rides through the Rapido app. When the captains arrived to pick them up, their vehicles were seized by authorities, adding to the difficulties faced by the riders.

However, Rapido found support in a significant legal development. In response to a petition filed by The Bike Taxi Welfare Association, the High Court in mid-2024 directed the state government to take action against auto-rickshaw drivers who harass, intimidate or attack Rapido riders.

This ruling not only provided relief to Rapido's captains but also reinforced the platform's legal standing, offering a stronger foundation for the company to continue expanding its operations in a challenging regulatory environment.

Tackling new challenges in 2025 Rapido

RapidoDespite the gains, the road ahead is anything but smooth. Rapido faces a new set of challenges in 2025 that will require it to evolve even further.

“Firstly, it will need to contend with intense competition from both established players like Ola and Uber and emerging regional players, which could pressure its market share and pricing strategy.

Additionally, expanding its EV fleet and ensuring sufficient charging infrastructure in underserved areas could prove challenging, especially in smaller cities where infrastructure gaps remain,” said an urban mobility expert, requesting anonymity.

Regulatory hurdles including the EV policy as well as the much-awaited Motor Vehicle Aggregator policy will continue to be a concern, with governments potentially introducing new laws for ride-hailing and bike-taxis, which could affect operations.

The company which is competing with funded players like Namma Yatri, Uber and Ola will also have to now focus on profitability.

Rapido has cut its losses by around 45 percent to Rs 371 crore in FY24 from Rs 675 crore in FY23 on the back of a reduction in its overall expenses. However, with further expansion and its need to raise more money, investors will demand a clear path to profitability.

2024 was clearly a year of transformation for Rapido, marked by significant milestones and strategic expansion. As it accelerates into 2025, the company’s ability to stay ahead of the curve will determine whether it continues to lead the charge in India’s evolving mobility landscape.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.