Flipkart co-founder Sachin Bansal has turned into a serial investor in his second stint, investing nearly $200 million into flagship companies since his exit from the ecommerce company last year. Bansal had walked away with nearly $1 billion after selling Flipkart to Walmart for $16 billion.

He is now busy re-purposing that capital to build a robust portfolio, mainly in the financial sector and the mobility space and to also back other entrepreneurs in the country.

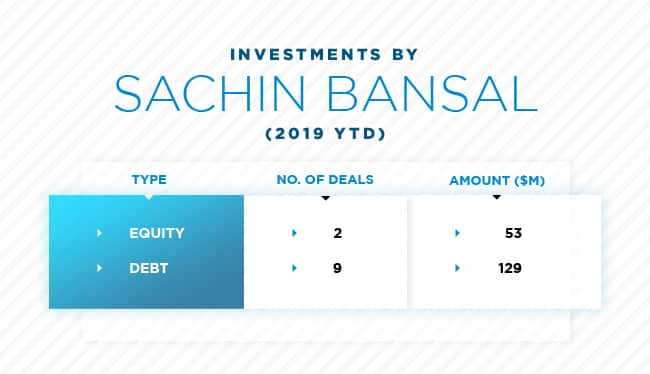

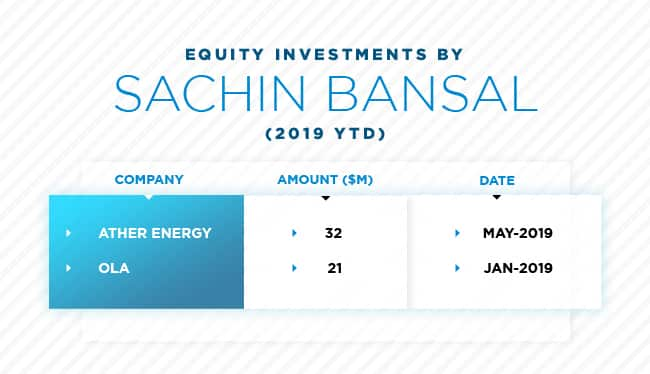

According to Venture Intelligence, that tracks venture capital and private equity investments, Bansal has made $53 million worth of equity investments — mainly in Ola and Ather Energy — while also making a number of debt investments after his exit from Flipkart.

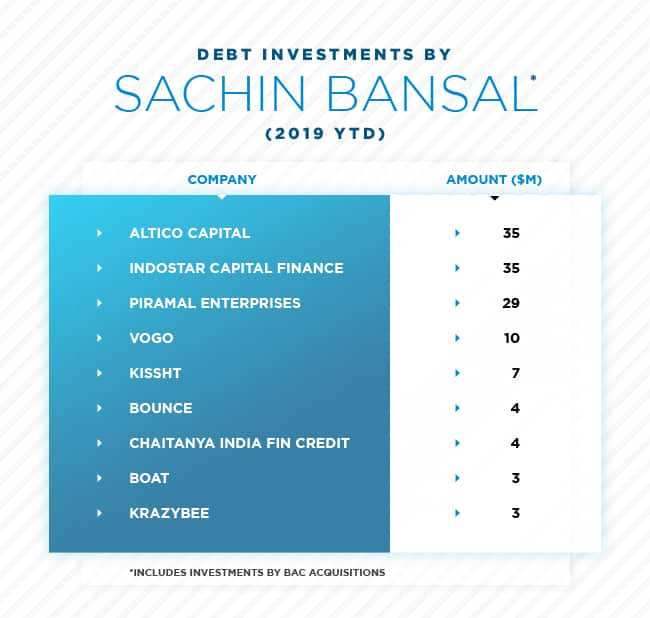

In fact, Bansal set up BAC Acquisitions as a holding company to direct debt investments through, and so far, these investments have been largely focused on the financial sector along with the mobility space.

Bansal has made debt investments of $129 million so far, directly and through BAC, in companies such as Indostar Capital Finance, Vogo, Bounce and Piramal Enterprises, according to Venture Intelligence.

Earlier in the year, Bansal invested $21 million in Ola. He has committed to invest up to Rs 650 crore or nearly $100 million in the company. In May, Bansal pumped in $32 million in e-scooter maker Ather Energy, a startup that he had backed in 2014 as an angel investor.

While Bansal seems to be making a profession out of investing after the Flipkart era, he had been an active angel investor even during his Flipkart days, having made nearly 20 angel investments in a range of startups such as Unacademy, Team Indus and Tracxn.

However, some industry members feel Bansal's new focus this time may not be on angel investing but on building a strong portfolio in the financial services sector.

"His investments seem to be focused on buying assets and work towards building a financial services conglomerate down the line," said a venture capitalist, requesting anonymity.

Bansal, however, is yet to respond to CNBC-TV18's queries.

Here's a look at Bansal's big investments:

(Image source: CNBC-TV18)

(Image source: CNBC-TV18)

(Image source: CNBC-TV18)

(Image source: CNBC-TV18)

(Image source: CNBC-TV18)

(Image source: CNBC-TV18)

(By Mugdha Variyar)

Source: CNBC-TV18

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.