After two years of calm, the rupee’s sudden slide is starting to strain Indian corporate earnings, sparking a rush among some companies to hedge their currency exposures.

InterGlobe Aviation, which runs India’s largest airline, saw its foreign-exchange losses jump threefold to 14.6 billion rupees ($169 million) in the December quarter. The nation’s largest carmaker Maruti Suzuki also cited currency variations as a negative for margins.

A few smaller companies have also announced currency-related losses, with more expected as the earnings season progresses.

The rupee has weakened 2.4% versus the dollar over the past two months, the most in emerging Asia, fueling speculation that the Reserve Bank of India may have eased its tight control over the currency. While the central bank’s approach over the past two years curbed volatility, it may have also led companies to overlook foreign-exchange risks.

Now, with economic growth slowing and global volatility rising, companies find themselves strained to hedge their exposures just as rupee declines are expected to deepen.

“There was some complacency that had set in because the rupee was so stable,” said Neeraj Gambhir, group executive for treasury, markets and wholesale banking products at Axis Bank Ltd. As currency volatility surged, there were more hedging inquiries, he said.

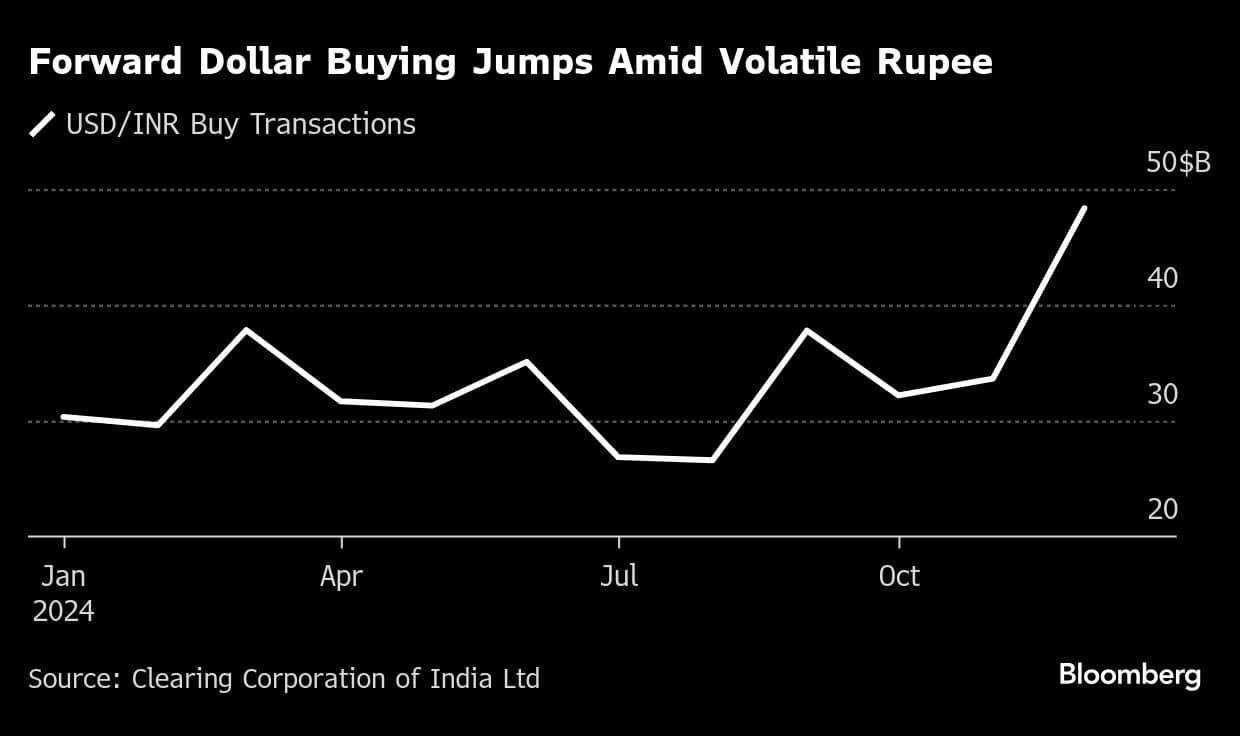

Companies bought $48 billion of forward cover in December, the highest for 2024, according to data collated from the Clearing Corp. of India. That pushed up hedging costs by more than a percentage point last month.

Smaller companies are also feeling the heat — NIIT Learning reported a forex loss of 14 million rupees in the December quarter, while Tanla Platforms faced a currency impact of 44 million rupees.

IndiGo will explore if it can extend its hedging beyond the current 12 months, Chief Financial Officer Gaurav Negi said last week. The company is taking cover for up to 70% of its exposure till one year, he said.

India still has one of Asia’s lowest ratios of foreign debt to gross domestic product, which acts as a buffer against surging volatility. It stood at $411.8 billion, or 11.1% of GDP, as of the third quarter of 2024, according to Nomura Holdings Inc.

“While there might be some mark-to-market losses on unhedged exposure and rolling over could be tricky in the event global financial conditions tighten, there do not appear to be any systemic risks,” Nomura economists led by Sonal Varma wrote in a note.

Even so, the rupee losses underscore warnings from former policymakers about the need to let the currency float more freely.

“If the RBI intervenes to stabilize the exchange rate against fundamentals, market participants will outsource their risk management to the central bank,” Duvvuri Subbarao, who helmed the central bank during the global financial crisis, said in an interview earlier this month.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.