The stressed asset recovery branch of Bank of Baroda (BoB) has taken part- possession of one of the famous malls, Nirmal Mall, in the Mulund area of Mumbai on January 24.

This followed the failure on the part of Nirmal Mall to repay a loan amount of Rs 161 crore. The bank had first issued a demand notice to Nirmal Mall and its Managing Director Dharmesh Jain to repay the amount within 60 days on December 6, 2019.

The part-possession was carried out under the Sarfaesi (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest) Act, 2002.

Also read: About 21% shopping centres in India are ghost malls: Knight Frank

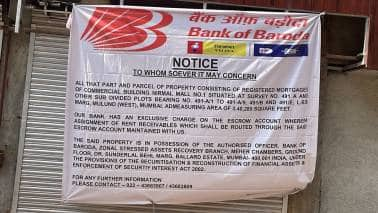

Notice by BoB

According to BoB’s possession notice, the bank had issued a demand notice on December 6, 2019, calling upon the borrowers Nirmal Lifestyle Ltd and Dharmesh Jain (guarantor) to repay the amount mentioned in the notice (Rs 161 crore) plus unapplied / unserviced interest and other charges thereon within 60 days from the date of receipt of the said notice.

On January 24, 2023, the bank took possession of around 3.40 lakh sq ft of the mall. “In total, the area of the mall is 51,700 sq m,” a BoB source said.

A source from BoB said: "Earlier, we had taken a symbolic possession and had put the property on auction at a reserve price Rs 339 crore in 2021. Now, we have got orders from the court and taken official possession with the help of local police. We have followed due process and the portion mortgaged to us will again be auctioned."

"Of the 51,700 sq m, only 3.4 lakh sq ft was mortgaged to BoB. We will again put the portion we have taken in possession for sale via auction, and the reserve price might be higher this time," he said.

The spokesperson of Nirmal Lifestyle in an email response to Moneycontrol said, “We are in talks with the bank and we are confident that we will find an amicable solution with them shortly.”

Also read: Nirmal Developers’ land parcel in Mumbai to be auctioned for 'delayed' possession to homebuyer

Bank’s warning to borrowers/public

The bank’s notice outside the mall reads: "The said property is in possession of the authorised officer, Bank of Baroda, Zonal Stressed Assets Recovery Branch under the provisions of the Securitisation & Reconstruction of Financial Assets & Enforcement of Security Interest Act, 2002."

"The Borrowers / Guarantors/Mortgagers / Directors in particular and the public in general are hereby cautioned not to deal with the property and any dealings with the property will be subject to the charge of the Bank of Baroda for an amount of Rs 161 crore and interest thereon," it reads.

Most of the mall empty

According to local brokers from Mulund, except for a few handful of brands with their retail outlets on the ground floor facing the main road, most of the mall have been empty since the last few years.

Nirmal Developers is a prominent real-estate developer from the Mulund area. However, the firm is in trouble owing to financial constraints. The firm has several projects around the Mumbai Metropolitan Region (MMR), and possession to homebuyers is allegedly delayed.

In the past, lenders have approached the National Company Law Tribunal (NCLT), alleging unpaid dues running into hundreds of crores of rupees, and the NCLT had held many hearings.

The Maharashtra Real Estate Regulatory Authority (MahaRERA) is also hearing many cases.

In December, the Maharashtra government had issued an auction notice for selling 2,634 sq m of land at a base price of Rs 31.81 crore in the Mulund area.

The auction notice followed recovery warrants by the MahaRERA over delays in handing over flats. However, the auction was postponed citing technical reasons.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.