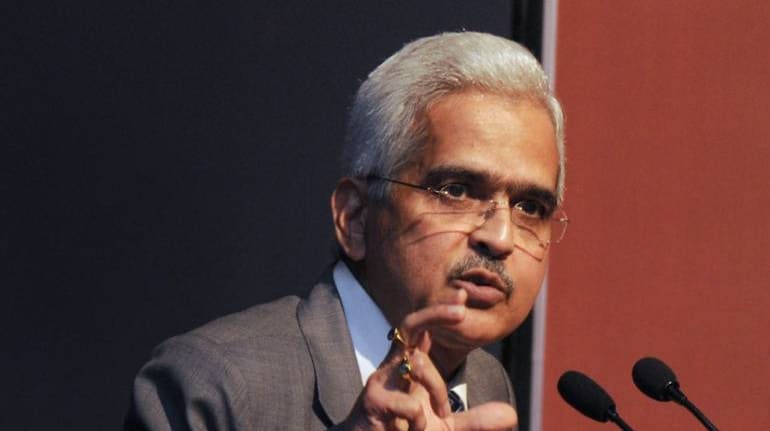

Following are the highlights of Reserve Bank of India Governor Shaktikanta Das' first interview since the beginning of the nationwide lockdown announced over a month ago.

In an hour-long interview to Cogencis, Das said even though there is an animated discussion on the subject of the central bank monetising the government's budget deficit amidst the ongoing fight against COVID-19 pandemic, he has not taken a view on the issue yet.

Key highlights:

*Fiscal measures key to combat economic impact of COVID-19

*FY21 fiscal gap going beyond 3.5 percent becomes unavoidable

*RBI has not taken a view on the monetisation of government deficit

*On the issue of monetisation, RBI must keep operational realities in sight, preserve RBI's balance sheet strength

*Will evaluate alternative funding sources for fiscal deficit

*Won't make specific comment on the private placement of bonds with RBI

*Will take a judicious, balanced call if RBI will take bond private placements

*Not taken any view on COVID bonds

*Repo rate, as decided by MPC, is the "single" policy rate; alone conveys the stance of monetary policy

FISCAL PACKAGE

*Government working on an economic package to tackle COVID-19 impact

*Meeting FY21 fiscal gap of 3.5 percent very challenging

*Expect the government to take a judicious and balanced call on fiscal deficit

*Government took steps to aid vulnerable, disadvantaged sections

*GST collections to be significantly impacted by lockdown; can't rule out a hit on direct taxes also

*Must prioritise support steps, interventions when deciding fiscal package size

*Fiscal steps must be well-targeted to optimise the outcome

*Exit strategy for fiscal interventions equally important

*Fiscal measures for COVID package must have sunset provisions

*Must balance economic needs with sustainable fiscal gap level

*Fiscal gap must be consistent with economic/financial stability

*Extent of overshooting of fiscal deficit aim depends on government

*Government will take measures that give maximum impact

PRIVATE PLACEMENTS

*There is animated public discourse on RBI monetising deficit

*Debate on monetising deficit not new within RBI

*Past RBI governors had to contend with monetisation debates

*Debate on deficit monetisation brought solutions like FRBM Act

*Past RBI governors found solutions based on the conditions then

*Monetisation must meet macroeconomic stability goal; macroeconomic stability is RBI's main mandate

*Always maintain all instruments both conventional and unconventional tools are on the table

*Will take a judicious view when the time comes on COVID bonds

*Not participated in any primary auction of T-bills, bonds so far

*RBI's operations, debt management warrant participation in the secondary market

*RBI's market operations at times are for elongation of debt maturity

*Market operations also aim to fill the maturity spectrum gap in RBI holding

EXIT PLAN

*Calibrated roadmap for entry and exit of accommodation is a must

*Questions on RBI, government exit plan for COVID package are pertinent

*Decision on entering, exiting from "chakravyuh" is important

*Exit plan from "chakravyuh" must be made when entering it

*Exit from "chakravyuh" must be carefully thought through

*Extraordinary steps must be taken in time, withdrawn in time

*Don't want the market to think RBI is going into a tightening mode

*Will exit special measures when am confident the economy is near normal

*Exit from special measures should not be premature

*Won't delay withdrawal of special measures beyond a point

*At the current juncture, all decision-making is tough

*COVID-19 has posed extraordinarily challenging situation

REVERSE REPO

*Repo rate, as decided by MPC, is the "single" policy rate; alone conveys the stance of monetary policy

*Reverse repo rate essentially a liquidity management tool

*Discussed LAF corridor, reverse repo rate with MPC earlier

*Reverse repo decision is very much in the domain of RBI

*Briefed MPC on the rationale behind the reverse repo rate cut; took MPC into confidence

*Low reverse repo an adverse rate for liquidity absorption

*Low reverse repo to deter banks from parking funds with RBI

*Must see low reverse repo rate as a transient arrangement

*Market should not be complacent on transient arrangements

*Transient moves due to liquidity management imperatives

*LTROs, TLTROs are at or aligned to the repo rate

TLTRO 2.0

*Had a sense TLTRO 2.0 response may not be as good as TLTRO

*TLTRO 2.0 auction results convey a "telling message" that banks not willing to take risk beyond a point

*On TLTRO 2.0, we are reviewing the whole situation and will decide on the approach to TLTRO 2.0 based on the review

*Challenge of ensuring credit to smaller NBFCs remains

*To take steps to address liquidity of NBFCs as necessary

*On liquidity to NBFCs, RBI remains in a battle-ready mode

STATES

*Constantly monitoring cash balances of individual states

*Hiked WMA limit of states in view of the need for more cash

*Mindful that states need enough cash for the fight against COVID

*RBI can activate standing deposit facility at any moment

*Not any taken final view on standing deposit facility rate

CREDIT RATING, FX MARKET

*Investors trust India irrespective of credit rating

*Investors trust India irrespective of rating upgrade or downgrade

*On ratings, investors much better informed on India versus earlier

*FX market has been orderly during COVID crisis

*Fall in rupee is less when compared with other emerging economies

*Won't rule out the possibility of FX inflows picking up

*FX inflows can rise due to liquidity in advanced economies

*Liquidity from advanced nations can spill over to India

*India's macroeconomic fundamentals are strong

*Indian economy stronger compared with 2008 financial crisis

*Have enough foreign exchange reserves

*In case FX outflows happen, will be able to deal with any eventuality

*Policy responses have to be out of the ordinary

RBI AUTONOMY, ROLE

*RBI's autonomy is never in doubt

*All decisions are independently taken by RBI

*RBI takes own decisions but engages with stakeholders

*Stakeholder consultation essential part of RBI's approach

*Government is much more than a stakeholder

*Consultation flows both ways between government, RBI

*Past stint with government helps me take balanced calls

*No compromise on core principles of central banking

*Shouldn't underestimate RBI's role in tackling COVID crisis

*Monetary policy, liquidity management very powerful tools

COVID-19

*This is a time of trial, an endurance test

*We live in extraordinary times

*We Indians must remain resilient

*We must believe in our capacity to come back stronger

*Dealing with a pandemic superimposed on a slowdown

*Response to COVID crisis has to be coordinated

*All arms of public policy need to work together on COVID response

*Government has a very important role in response to COVID crisis

BANKS

*March 27 norms allow banks to offer a moratorium on all loans

*Bank boards must OK policy on offering moratorium on loans

*Onus on banks to offer loan moratorium based on their assessment

*Based on capital, NPA ratios, Indian banks are healthy, safe

*To take calibrated steps to protect banks' books in future

*We are constantly monitoring banking sector

*Have strengthened supervisory systems, mechanisms

NBFCs

*To take a more granular look at financial companies if vulnerability seen

*Supervisory systems for financial companies more proactive now

*No policy view on limiting deposit-taking only to banks

*Examining harmonising norms across bank licence windows

*In many cases, courts have reversed orders in our favour

*SC has observed RBI is "not just another regulator"

FINTECH SPACE

*India is an innovator, pioneer in payments space

*Unified Payments Interface has been commended globally

*With our advice, National Payments Corp set up a global arm

*National Payments Corp arm to internationalise UPI, RuPay card

*UPI can be a vehicle for cross-border money transfer, remittance

*Want fintech companies to flourish on regulatory sandbox

*Want credit flow to happen through new methods via fintech

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.