Intervention by the Reserve Bank of India (RBI) has increased sharply since the Indian Rupee started depreciating against the US Dollar amid global uncertainties.

This has led to the Rupee remaining least volatile among major currencies in the last few months. According to the Bloomberg data, Indian Rupee depreciated 3.60 percent since September, which was lower compared to Japanese Yen (-6.49 percent), Canadian Dollar (-5.71 percent), British Pound (-7.58 percent), Australian Dollar (-9.04 percent), and Euro (7.53 percent).

Also, the Indian currency is performing better against the Dollar compared to the South Korean Won which depreciated 9.83 percent and New Zealand Dollar depreciated 10.97 percent, Bloomberg data showed.

The volatility in the Indian Rupee inched up after India’s sluggish growth in the second quarter of the current financial year, widening trade deficit, rising crude prices, and a surge in the dollar index after the US Federal Reserve hinted at fewer rate cuts in 2025.

Adding to this, imposition of tariffs on Canada and Mexico by the US President Donald Trump also impacted Indian Rupee.

The central bank has been intervening in the foreign exchange market by selling Dollars in the spot as well as forward markets.

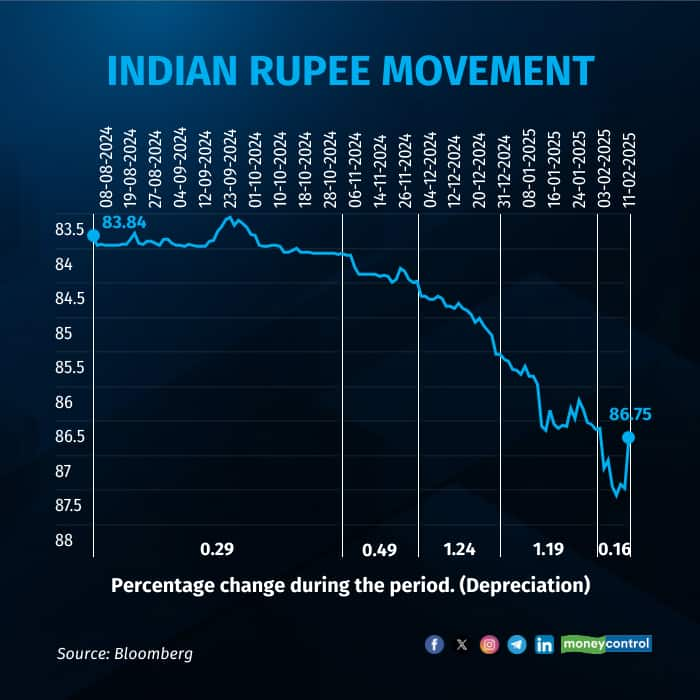

Since February 10, when the Indian Rupee touched a record low and reached the 88 mark against the US dollar, RBI increased its intervention.

“Over the past two trading sessions, the RBI has actively intervened in the forex market, selling Dollars to contain the Rupee's depreciation. This intervention has led to a sharp recovery in the Rupee, with USD/INR retreating from nearly 88 to around 86.65 in the spot market,” said Anindya Banerjee, Head Currency & Commodity, Kotak Securities.

Prior to this, data suggests that the forex reserves of the RBI had declined sharply by over $75 billion since September 27. This was the period, when the Indian Rupee depreciated from 83.70 against the US dollar as on September 27, to 87.96 against the greenback on February 10.

Also, between April and November 2024, the central bank sold gross dollars worth $195.568 billion, and the Indian Rupee during this period was in range of 84-86 against the dollar.

During the media briefing after the MPC last week, Governor Sanjay Malhotra had underscored the RBI’s existing position on the Rupee, and said, "Our stated objective is to maintain orderliness and stability, without compromising market efficiency."

However, a sharp slide of over 3 percent in the Rupee since December 2024 prompted a view within the currency market that the central bank is willing to ease its hold on the Rupee, unlike his predecessor. The Indian Rupee has been reeling under selling pressure and hitting fresh lows due to a strengthening of the dollar.

"...Our interventions in the forex market focus on smoothening excessive and disruptive volatility rather than targeting any specific exchange rate level or band. The exchange rate of the Indian Rupee is determined by market forces," Governor Malhotra added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.