Anubhav SahuMoneycontrol research

Rain Industries reported a disappointing set of numbers for the March quarter as sales of carbon products witnessed a sequential decline. However, the company's pricing trend remained strong and it also announced that it would be raising its capacity to manufacture adhesive resins. The improving outlook for the US aluminum industry has acted as a key lever.

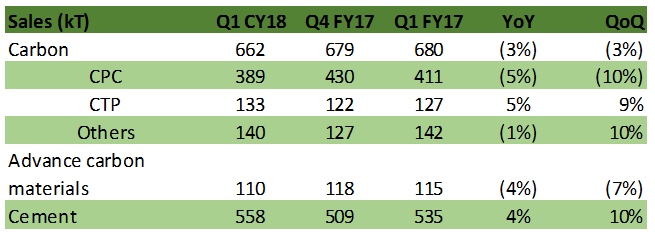

Volume growth mixed: CTP positive but CPC meets a bump

Source: Company

For the quarter ended March, Rain Industries' net sales were up 34 percent year-on-year. The 3 percent decline it witnessed in volumes, both annually and sequentially were offset by higher realisations.

The lackluster volumes of carbon products sold were mainly due to calcined petroleum coke (CPC), sales of which declined by 10 percent quarter-on-quarter because of delays in shipments to domestic clients. The delays were primarily due to negotiations about the pass through of higher import duty.

Sale volumes of coal tar pitch (CTP) remained strong, rising 10 percent sequentially due to healthy demand.

While the company's earnings before interest, tax, depreciation and amortisation (EBITDA) grew 50 percent on year, it came in lower than its EBITDA in the December quarter as the contribution of CPC products to overall sales fell.

Rain Industries also reported a fall in its finance cost, which was a result of the company refinancing its debt at the beginning of 2018.

Table: Product volume trend

Source: Company

Regrouping of segments

The company has created a new segment, called advanced carbon materials (ACM), which includes its erstwhile chemical segment and some value added products from the carbon segment.

The March quarter proved to be a good one for the new segment, as sales realisations improved 10 percent sequentially. Robust demand for resin from the adhesives industry was an important driver.

The strong demand for resin has also prompted the company to announce that it would be expanding its capacity to manufacture water-white resin (dicyclopentadiene) by 30 kilotons. The resin plant would be set up in Germany with a fund outlay of $66 million.

Other capacity expansion plans

The expansion of the company's coal tar distillation facility in Belgium is on track and the additional capacity is expected to be commissioned by the end of 2018. However, its 370-kiloton calcination plant in Vishakhapatnam has been delayed and is expected to be operational only by July-September next year.

Aluminum production restarts in the United States

While the prices of CPC may be nearing their peak, the biggest driver of volumes for CPC products is the potential restart of aluminum production in the United States. Given the Trump administration’s emphasis on curtailing imports and encouraging domestic aluminum production, Rain Industries' management expects the United States' aluminum production capacity to increase to around 1.3 million tons in 2018, from 768,000 tons in 2017. This augurs well for the company’s CPC plant in USA, which has a production capacity of 1.5 million tons.

Outlook

We have revise our estimates on Rain Industries for the medium term, taking into account its weak quarterly numbers and the delay in the commissioning of its CPC plant. However, we remain constructive on the stock, given end market trends, revival of demand in the USA, elevated pricing trends, and the advance carbon materials segment's improving margins.

The stock is currently trading at 7.2 times its estimated earnings for 2019. Other stocks in the non-ferrous metals segment are trading at an average of nine times their estimated earnings for 2019. Given the current consolidation, this provides a decent opportunity to enter the stock, in our view.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.