Fixed deposit interest rates remain attractive to many investors, with small finance banks continuing to offer the highest returns on term deposits. As of December 24, 2025, several lenders are offering interest rates of up to 8 percent per annum on fixed deposits with tenures ranging from one year to five years, while private and public sector banks are largely maintaining stable rates. Have a look at the interest rates by different banks before making investment decisions.

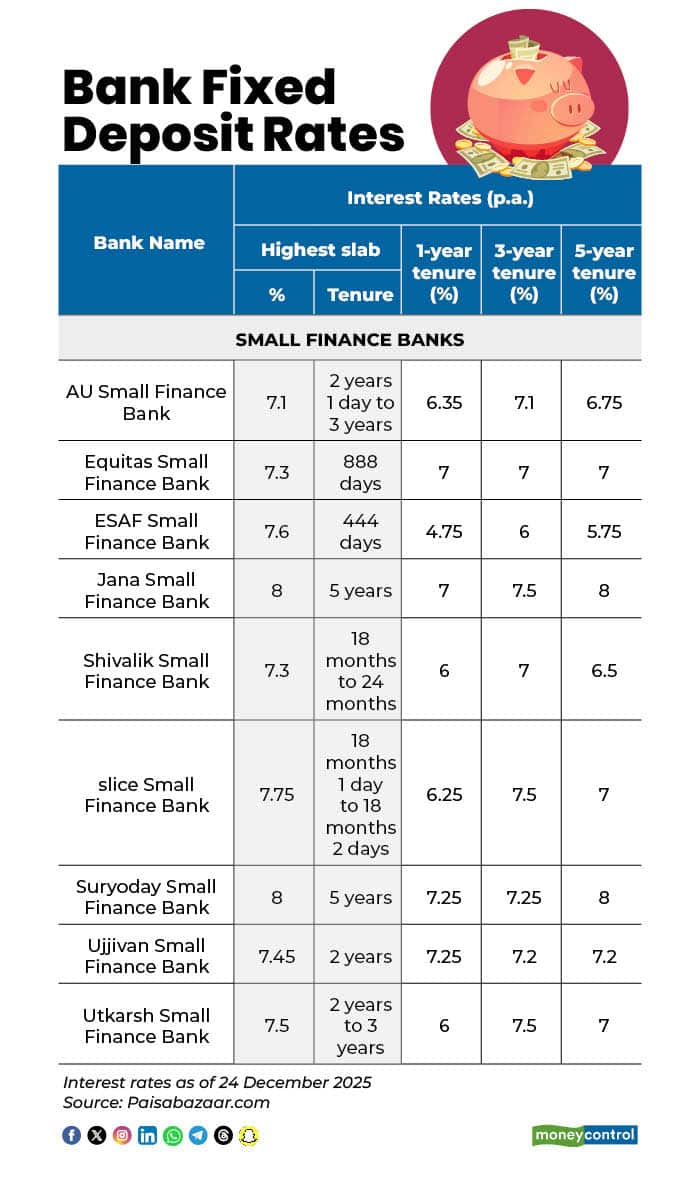

Small Finance Banks

Jana Small Finance Bank is offering fixed deposit interest rates of up to 8 percent per annum, for tenures between 1 year and 5 years.

Suryoday Small Finance Bank is offering fixed deposit interest rates of up to 8 percent per annum, with tenures ranging from 1 year to 5 years.

Slice Small Finance Bank is offering fixed deposit interest rates of up to 7.75 percent per annum, for deposit tenures between 1 year and 5 years.

ESAF Small Finance Bank is offering fixed deposit interest rates of up to 7.60 percent per annum, with tenures ranging from 1 year to 5 years.

Utkarsh Small Finance Bank is offering fixed deposit interest rates of up to 7.50 percent per annum, across tenures ranging from 1 year to 5 years.

Here is a list curated on FD rates offered by Small Finance Banks, according to Paisabazaar.com

Private Sector Banks

Bandhan Bank is offering fixed deposit interest rates of up to 7.20 percent per annum, for deposit tenures between 1 year and 5 years.

RBL Bank is offering fixed deposit interest rates of up to 7.20 percent per annum, for deposit tenures ranging from 1 year to 5 years.

IDFC First Bank is offering fixed deposit interest rates of up to 7 percent per annum, across deposit tenures between 1 year and 5 years.

Yes Bank is offering fixed deposit interest rates of up to 7 percent per annum, with tenures between 1 year and 5 years.

IndusInd Bank is offering fixed deposit interest rates of up to 7 percent per annum, for tenures ranging from 1 year to 5 years.

Here is a list curated on FD rates offered by Private Sector Banks, according to Paisabazaar.com

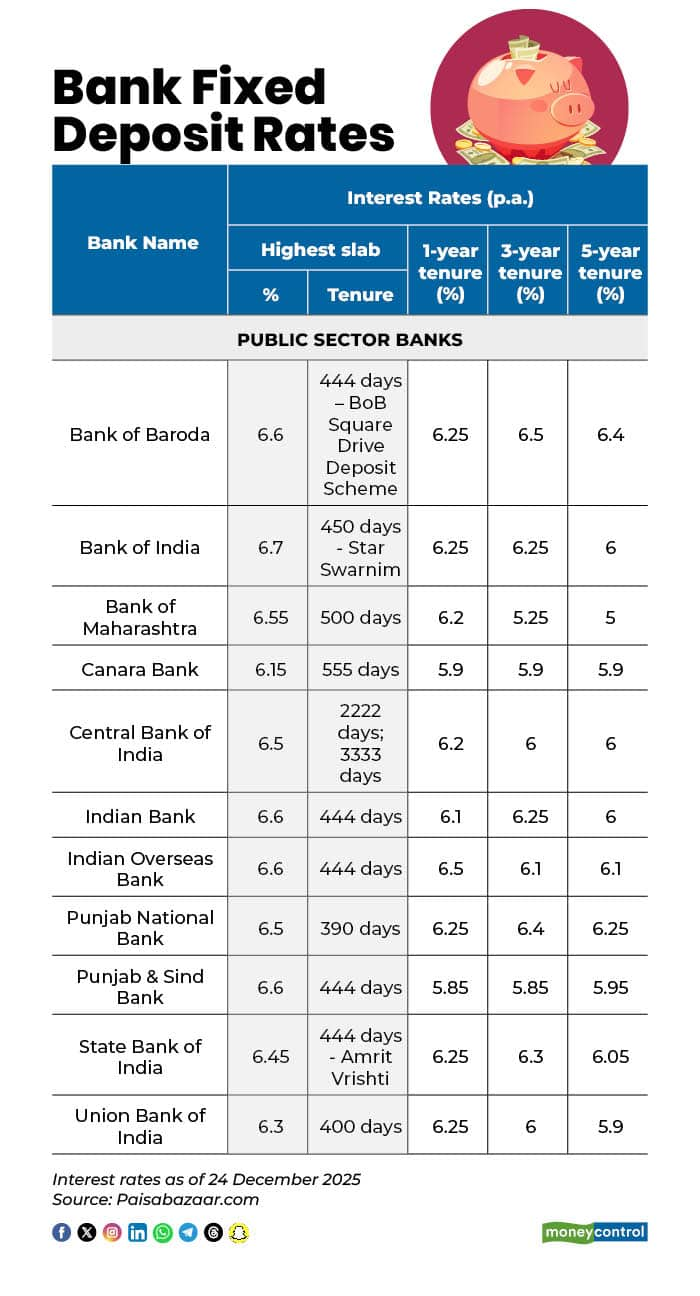

Public Sector Banks

Bank of India is offering fixed deposit interest rates of up to 6.70 percent per annum, for deposit tenures between 1 year and 5 years.

Bank of Baroda is offering fixed deposit interest rates of up to 6.60 percent per annum, across tenures ranging from 1 year to 5 years.

Indian Bank is offering fixed deposit interest rates of up to 6.60 percent per annum, for tenures ranging from 1 year to 5 years.

Punjab National Bank (PNB) is offering fixed deposit interest rates of up to 6.50 percent per annum, across deposit tenures between 1 year and 5 years.

Canara Bank is offering fixed deposit interest rates of up to 6.15 percent per annum, with tenures ranging from 1 year to 5 years.

Here is a list curated on FD rates offered by Public Sector Bank, according to Paisabazaar.com

Foreign Banks

Deutsche Bank is offering fixed deposit interest rates of up to 7 percent per annum, with tenures ranging from 1 year to 5 years.

HSBC Bank is offering fixed deposit interest rates of up to 5.50 percent per annum, for deposit tenures between 1 year and 5 years.

Here is a list curated on FD rates offered by Foreign Banks, according to Paisabazaar.com

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.