Canada, which is frequently voted one of the best countries in the world to live in, has one of the best residency-by-investment visas globally.

Moneycontrol and Firstpost bring you a series on golden visas. After the UAE Golden Visa, we look at Canada’s program, which is among the top five residency-by-investment visas, as per 2025 Global Residence Program Index by Henley & Partners, an investment migration consultancy.

Residency by investment is a way to secure immigration, permanent residency or eventually citizenship in another country. These visas provide wealthy individuals the opportunity to effectively "purchase" residency rights.

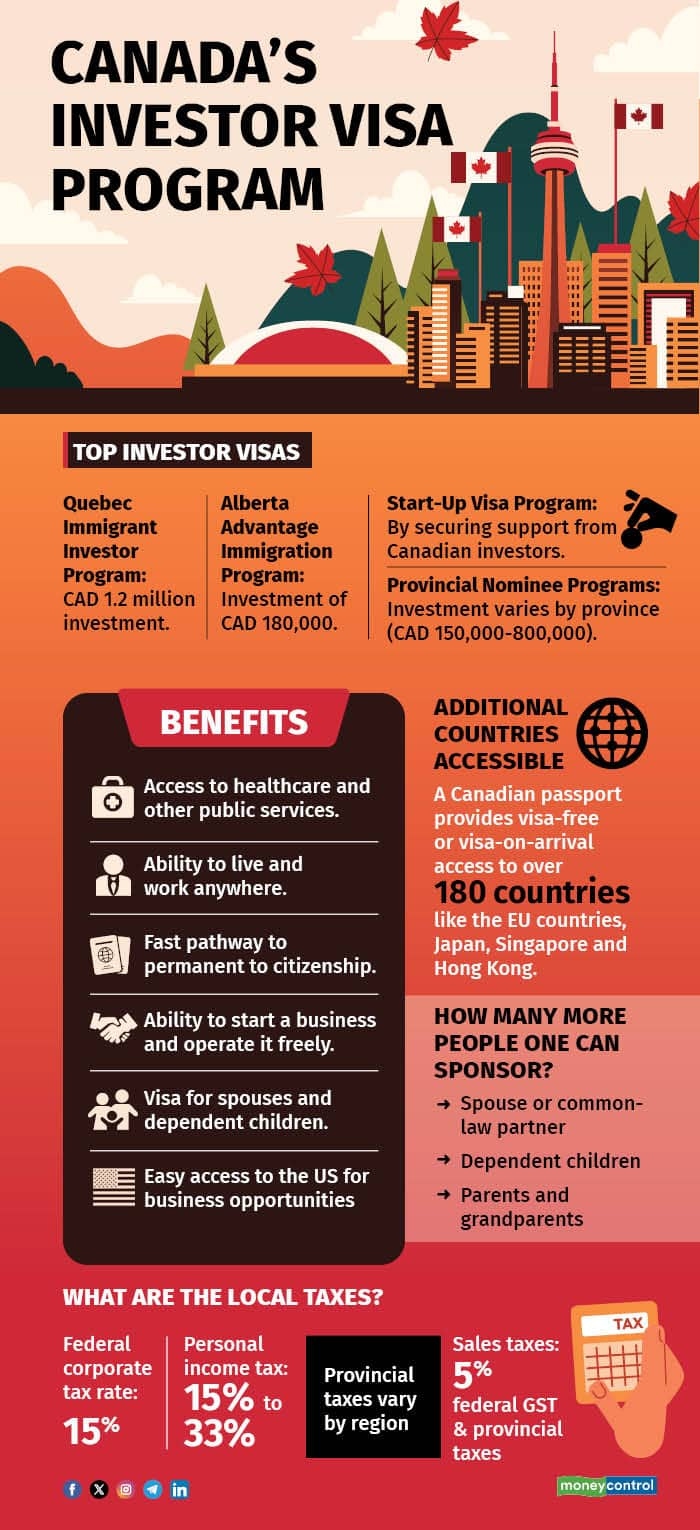

The Canada Investment Visa, also known as the Canada Immigrant Investor Program (IIP), has been paused since 2014, but wealthy Indians can still pursue other immigration pathways such as the Alberta Advantage Immigration Program (AAIP), Quebec Immigrant Investor Program (QIIP), and the Start-up Visa Program.

What’s the lure of Canada’s visa program?

According to the 2024 Best Countries ranking from US News & World Report, Canada was the fourth best country to live in.

“Canada offers a stable and high-quality economy, with a favourable business environment and low corporate taxes, making it an attractive destination for investment. The country is renowned for its education system, healthcare, and high standard of living, which appeal to wealthy Indian families,” said Gaurav Nalawade, Country-Head India, RIF Trust.

Also read | Why Switzerland’s golden visa is a hit among the uber rich

According to Nalawade, permanent residents and citizens of Canada enjoy visa-free travel to over 180 countries, enhancing global mobility. Further, the country’s favourable tax treaties, including those with India, make it an attractive option for efficient tax planning.

One of the most important reasons for wealthy individuals to consider Canada is the easy access to the United States with a Canadian passport, which allows for seamless travel and business opportunities across North America.

What are the types of investment programs in Canada?

1. Quebec Immigrant Investor Program (QIIP)

Investment: CAD 1.2 million (about Rs 7.2 crore) in a government-backed passive investment for 5 years.

Eligibility: Business management experience and net worth of CAD 2 million (About Rs 12 crore).

2. Alberta Advantage Immigration Program (AAIP)

Investment: Minimum CAD 180,000.

Eligibility: Business management experience and commitment to creating jobs in Alberta.

3. Start-Up Visa Program

Investment: Secure support from designated Canadian investors.

Eligibility: Must have an innovative business idea that can create jobs.

Rohit Bhardwaj, Country Head – India, Henley & Partners, said, “The Canada Federal Startup Visa Program is intended to help Canada develop a strong startup ecosystem by supporting foreign entrepreneurs who can build scalable businesses, create jobs, and contribute to the Canadian economy. Successful applicants receive a five-year permanent residence permit. A minimum stay requirement of 730 days is needed to renew this permit.”

Also read | New Zealand revises 'golden visa' rules. Do wealthy Indians stand to gain?

4. Provincial Nominee Programs (PNP)

Investment: Varies by province (typically CAD 150,000 to CAD 800,000).

Eligibility: Business or investment criteria set by the province.

5. Saskatchewan Immigrant Entrepreneur Program

Investment: Typically, CAD 200,000.

Eligibility: Business experience and job creation in Saskatchewan.

6. Manitoba Business Investor Stream

Investment: CAD 250,000 to CAD 350,000 depending on location.

Eligibility: Business experience and investment capacity.

7. British Columbia Entrepreneur Immigration Program

Investment: Minimum CAD 200,000.

Eligibility: Viable business plan and experience in business management.

How many more people can one sponsor?

• Spouse or common-law partner

• Dependent children: You can sponsor children under 22 who are not married or in a common-law relationship.

• Parents and grandparents: You can sponsor them under super visa scheme, though there are annual quotas and specific financial criteria.

Canada’s investor visa versus others

According to experts, among all the investment programs globally and in Canada, the Alberta Advantage Immigration Program (AAIP) stands out as one of the most affordable investment immigration options, requiring just CAD 180,000 (about Rs 1.08 crore), compared to much higher thresholds in other countries.

In comparison to other residence-by-investment or business-led investment programs in English speaking countries such as Australia, the UK, the US and New Zealand, Canada visa program might look more appealing cost wise and flexible for many Indian families.

Also read | Education loans for studying abroad: who offers the cheapest interest rates?

For example, the US EB-5 program demands USD 800,000 (About Rs 7 crore), the UK Tier 1 Investor Visa requires 200,000 pounds (about Rs 2.25 crore), and Portugal’s Golden Visa needs an investment of EUR 500,000 (About Rs 4.7 crore).

“Canada’s investor visa programs, such as the Alberta Advantage Immigration Program (AAIP), offer a clear and fast pathway to permanent residency and citizenship with a respected immigration process. In comparison, the US EB-5 program is more complex and often results in longer wait times for securing permanent residency,” said Nalawade.

Further, the UK’s Tier 1 Investor Visa requires five years to secure permanent residency, with a total of six years to become a citizen. Meanwhile, Portugal’s Golden Visa offers residency with minimal stay requirements and citizenship after five years but lacks the extensive social benefits Canada provides.

What is the process for applying?

For AAIP, interested applicants first submit an Expression of Interest (EOI) to the Alberta government, detailing their qualifications, business experience, and investment plans for Alberta.

If the applicant is invited, they can then proceed with applying for the Alberta Provincial Nominee Program (PNP), and if successful, they will receive a nomination for permanent residency.

After receiving the nomination, applicants can apply for permanent residency through Immigration, Refugees, and Citizenship Canada (IRCC).

Also read | Gold nears Rs 90,000: Time to buy, hold, or book profits?

To be eligible for Canada’s Start-up Visa Program, applicants must meet several criteria.

“First, the applicant must have a business idea that is innovative, can create jobs for Canadians, and can compete on a global scale. If the applicant does not have a suitable business idea, he can be paired with other start-up founders,” said Bhardwaj.

Applicants must demonstrate proficiency in either English or French through a language test. The minimum required Canadian Language Benchmark (CLB) is CLB 5 in speaking, reading, writing, and listening.

Further, applicants must show they have enough money to support themselves and their family members when they arrive in Canada. The required amount depends on family size and define minimum amount limits set.

Are there any residency requirements in Canada?

The AAIP requires applicants to reside in Alberta for at least two years within the first five years of receiving permanent residency. To apply for Canadian citizenship, applicants must meet the general residency requirement of living in Canada for three out of the last five years. This ensures a pathway to both permanent residency and eventual citizenship, with the commitment to reside in Alberta.

What are the local taxes on business and individual income?

Canada has a federal corporate tax rate of 15 percent, with personal income tax ranging from 15 percent to 33 percent. Provincial taxes vary by region, with corporate taxes and personal income tax rates ranging from 5 percent to 25 percent. Sales taxes include a 5 percent federal GST, along with provincial sales taxes (PST or HST), depending on the province. Local municipalities levy property taxes based on property value.

The Double Taxation Avoidance Agreement (DTAA) between Canada and India ensures that individuals and businesses are not taxed twice on the same income. The DTAA allows taxpayers to claim tax credits or exemptions for taxes paid in the other country, preventing double taxation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.