Several key financial updates are set to impact individuals and investors in the month of June.

For one, capital markets regulator, the Securities and Exchange Board of India (SEBI), has revised cut-off timings for overnight mutual fund transactions. Further, the Reserve Bank of India (RBI) is likely to announce an interest rate cut on June 6 during the monetary policy announcement.

Moreover, changes to credit card terms and benefits by Axis Bank and Kotak Mahindra Bank may also affect your finances.

SEBI revises cut-off timings for overnight fund transactionsThe regulator has introduced new cut-off timings for overnight mutual fund schemes, aiming to improve operational efficiency and fund management. The revised schedule is part of SEBI’s ongoing efforts to align mutual fund processes with global best practices and enhance investor convenience. The new timings will be effective from June 1.

The rule on revised timings states that if an application is received by 3 PM, the applicable Net Asset Value (NAV) will be of the previous day. For applications received after 3 PM, the NAV of the next business day will apply. Additionally, for applications submitted online, a cut-off time of 7 PM will be applicable for overnight fund schemes.

Will RBI further cut repo rate?The central bank has reduced the repo rate by 25 basis points (bps) twice this year, in February and April, to boost growth, thus bringing the current repo rate to 6 percent.

Economists are optimistic about an additional 25-bps rate cut in June, as retail inflation remains below the RBI’s medium-term target of 4 percent for a third consecutive month.

According to a Moneycontrol poll, economists and bank treasury heads expect the RBI's Monetary Policy Committee (MPC) to cut the repo rate by 25 bps in its June 6 review.

Existing borrowers with repo rate-linked loans will see an equivalent reduction in their home loan interest rates. New borrowers also stand to gain, but as per BankBazaar data, some private sector banks have not passed on the entire rate cut benefit to fresh home loans.

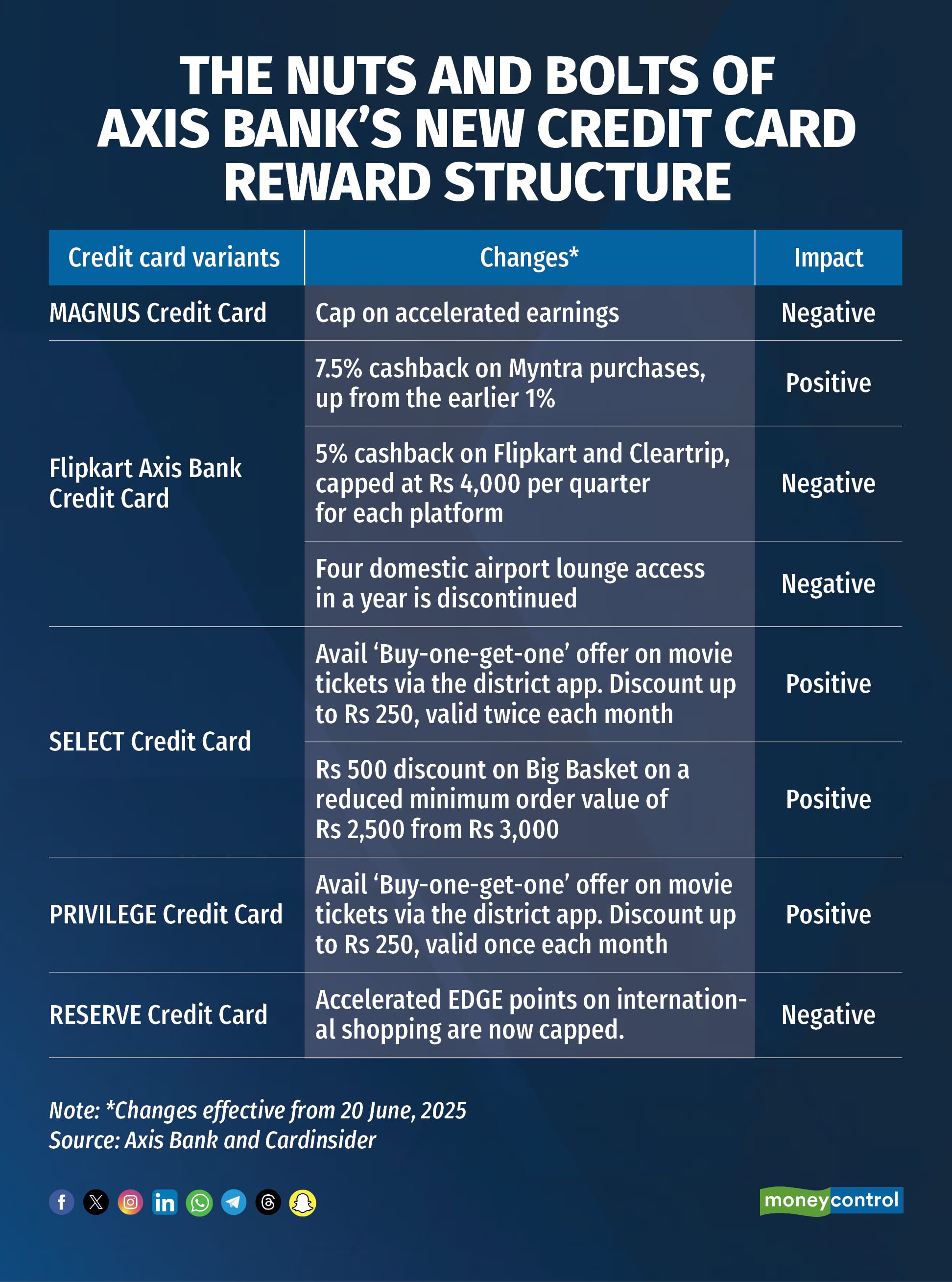

Axis Bank has announced a revision in benefits, terms and conditions for most of its credit cards, effective June 20.

From credit card users’ perspective, the changes are a mixed bag. Some revisions will have positive ramifications, while others mean higher costs and reduced benefits.

Some popular Axis Bank credit cards like Magnus for Burgundy and Flipkart will see significant downgrades, while other cards, such as Select and Privilege will see enhancement in benefits, as per the bank’s official communication to its customers.

For instance, Axis Bank has revised the rewards structure for the Magnus/Magnus for Burgundy Credit Card, effective June 20. Cardholders now earn 12 EDGE REWARD points per Rs 200 spent up to Rs 1.5 lakh per month. Beyond Rs 1.5 lakh, they'll earn 35 points per Rs 200 until their spend reaches their credit limit plus Rs 1.5 lakh, after which the rate drops back to 12 points per Rs 200.

Then, the Flipkart Axis Bank Credit Card will now come with a cap on accelerated earnings. For instance, cashback while shopping on Myntra has increased from 1 percent to 7.5 percent, but it's now capped at Rs 4,000 per quarter. The 5 percent cashback on Flipkart and Cleartrip remains, but now has a Rs 4,000 per quarter cap for each, replacing the previous monthly unlimited cashback offer.

The bank is also simplifying reward exclusions on its credit cards starting June 20, replacing specific Merchant Category Codes (MCCs) with broader categories like utilities, telecom, and rent to determine cashback and fee waivers.

Starting June 1, Kotak Mahindra Bank will introduce changes to its credit cards, including reward cuts and reduced cashback redemption values.

The bank will restrict reward points accrual on transactions in categories like education, utilities, and online gaming. Additionally, the cashback redemption value of points will be reduced, varying by card type: Kotak Royale, League, and Urbane cards will earn 7 paise per point, down from 10 paise, while Kotak 811 Credit Card holders will earn 10 paise per point, down from 25 paise, and Kotak Infinite Card holders will earn 70 paise per point, down from Re 1.

The bank is also introducing fee hikes on its credit cards. For instance, interest charges on most cards will increase from 3.50 percent to 3.75 percent per month, translating to 45 percent per annum.

Then on the card, 1 percent transaction fee will be applied to specific categories, including education payments, wallet loads over Rs 10,000, online gaming spends over Rs 10,000, and utility spends exceeding card-specific thresholds. Additionally, a standing instruction failure fee of 2 percent of the bounced amount (minimum Rs 450, maximum Rs 5,000) will be levied. A dynamic currency conversion fee of 2 percent will apply to select premium cards and 3.5 percent for other cards, except for Solitaire cards, which are exempt.

June 15 is the last date for first advance tax instalmentEven salaried individuals may be liable for advance tax if they have additional income sources, such as interest from deposits, rent, or capital gains, beyond their primary salary income. Assess your tax liability accordingly.

As per Section 208 of the Income-tax Act, 1961, individuals with an estimated tax liability of Rs 10,000 or more in the financial year, after accounting for tax deducted and collected at source (TDS and TCS), must pay advance tax.

Taxpayers must pay advance tax in four installments, with the first installment due on June 15, requiring 15 percent of the total advance tax liability.

If you miss advance tax payments or delay them, there is penal interest on the taxes due, under section 234C, at the rate of 1 percent per month/part of the month.

Also read | Smokers of the world, you have nothing to lose but your lives & moniesGet ready to file your income tax returnsThe Central Board of Direct Taxes (CBDT) has extended the deadline for filing income tax returns for the assessment year 2025-26 to September 15, from the original date of July 31. The extension implies that salaried individuals will get an additional 46 days to file returns. However, you can start poring over your bank and capital gains statements, salary slips and so on in June. This will help prevent the last-minute rush and any resultant mistakes. Once you obtain your Form 16 from your employer by June 15, you can initiate the process of filing income tax instead of waiting till September 15 to ensure that any I-T return filing portal glitches or heavy traffic closer to the due date do not hamper this exercise.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.