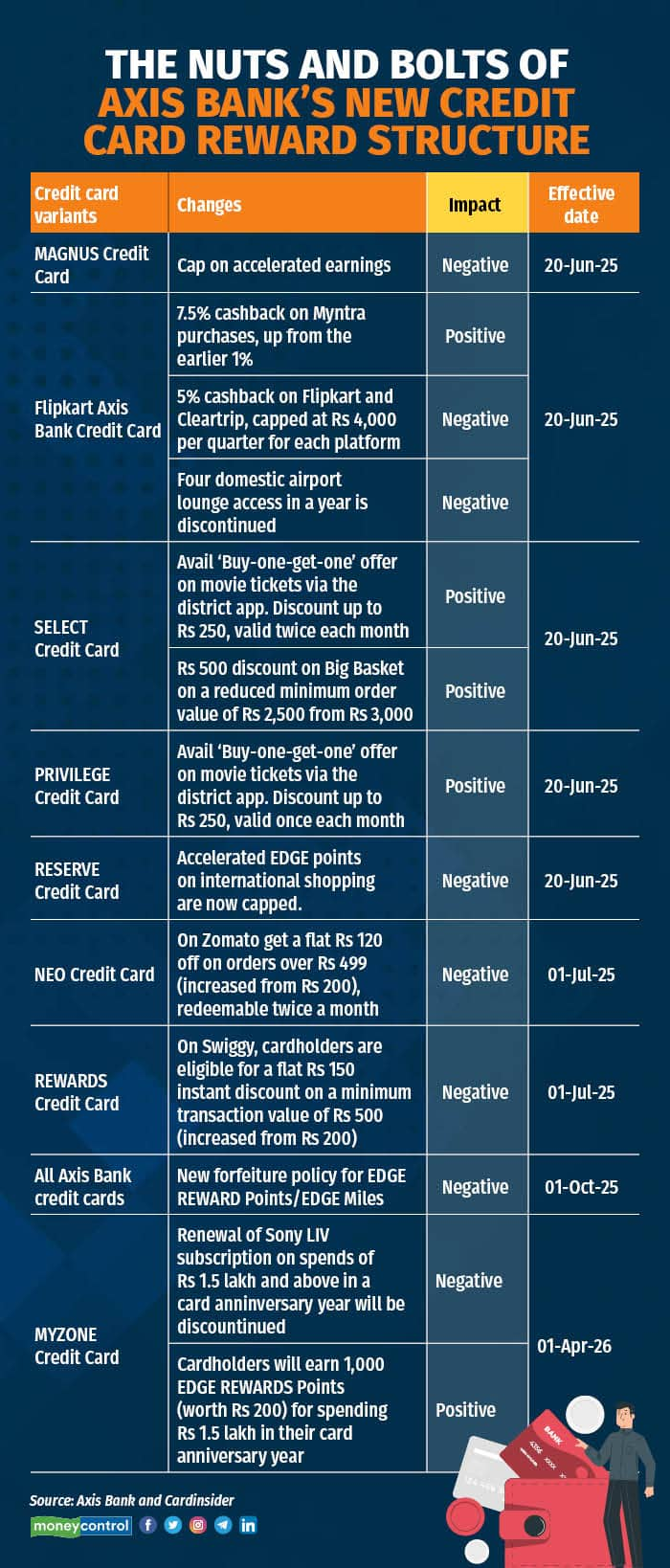

Axis Bank has announced revision in benefits, terms and conditions for most of its credit cards, effective June 20, 2025, and October 2025.

From credit card users’ perspective, the changes are a mixed bag. Some revisions will have positive ramifications, while others mean higher costs and reduced benefits.

Some popular Axis Bank credit cards like Magnus for Burgundy and Flipkart will see significant downgrades, while other cards, such as Select and Privilege will see enhancement in benefits, as per the bank’s official communication to its customers.

“Cards being a dynamic segment, evaluating usage of the benefits offered on various products is an ongoing and periodic exercise. The recent adjustments to the usage of accelerated rewards structure reflect our ongoing efforts to encourage responsible spending,” says Arnika Dixit, President & Head- Cards, Payments and Wealth Management, at Axis Bank. These changes impact a very small fraction of cardholders and do not alter the core features of the credit cards. Simultaneously, the bank has also introduced new offers on credit cards based on genuine customer preferences, she adds.

Magnus credit card rewards slashedAxis Bank has revised the rewards structure for the Magnus/Magnus for Burgundy Credit Card, effective June 20. Cardholders now earn 12 EDGE REWARD points per Rs 200 spent up to Rs 1.5 lakh per month. Beyond Rs 1.5 lakh, they'll earn 35 points per Rs 200 until their spend reaches their credit limit plus Rs 1.5 lakh, after which the rate drops back to 12 points per Rs 200.

Ankur Mittal, co-founder of Card Insider, a platform that tracks credit card business, notes that the change effectively caps the high rewards rate, previously unlimited beyond a Rs 1 lakh spend, impacting heavy spenders. This means, for instance, users of the Magnus for Burgundy Credit Card, who previously earned high rewards on big-ticket purchases like luxury cars and booking international vacations, will see reduced benefits.

Also read | Beyond tuition fees: The real cost of studying abroad

Flipkart Axis Bank Credit Card: More cashback on Myntra, but less elsewhereThe Flipkart Axis Bank Credit Card will now come with a cap on accelerated earnings. For instance, cashback while shopping on Myntra has increased from 1 percent to 7.5 percent, but it's now capped at Rs 4,000 per quarter. Sumanta Mandal, founder of credit card review platform TechnoFino, points out that the increased cashback using this card on Myntra will boost the value proposition for fashion enthusiasts and frequent shoppers on this platform.

The 5 percent cashback on Flipkart and Cleartrip remains, but now has Rs 4,000 per quarter cap for each, replacing the previous monthly unlimited cashback offer. “The primary appeal of this card was the unlimited 5 percent cashback on Flipkart, which now appears to be fading,” says Mandal. This may impact high spenders who previously benefited from higher monthly rewards, according to Mandal.

“There is no change to the reward earn or cashback rate for any customer. The recent change only introduces a cap on accelerated earnings to prevent misuse by a small group of users,” says Dixit of Axis Bank.

The bank has decided to discontinue the complimentary domestic lounge access benefit, which Mandal notes will significantly impact frequent travelers and reduce the card's overall value.

The bank has revised the accelerated EDGE rewards structure for a few credit cards, including the Magnus Credit Card, Reserve Credit Card and so on, where customers will earn accelerated benefits only up to their individual credit limit. Beyond this limit, rewards will be earned at the base earning rate. “This change arrests misuse by a few customers who were consistently exhausting their monthly credit limit, at times even at a single merchant — patterns indicating non-personal or commercial use of the product,” says Dixit of Axis Bank.

Also read | How Trump’s 3.5% remittance tax will affect US-based NRIs’ money flow to India

Simplified reward exclusion criteriaEffective June 20, on all the credit cards of Axis Bank, the categories excluded from earning cashback and fee waivers remain unchanged, but the way they're identified is shifting from specific 4-digit Merchant Category Codes (MCCs) to broader spend categories like utilities, telecom, wallet loads, rent, and so on.

“The change is introduced to simplify the identification of spend and reward categories, as many customers are unaware of where to refer to the 4-digit MCC,” says Dixit of Axis Bank. This change aligns with our goal to make the process more comprehensible for our customers. By moving to spend categories as defined by major networks, we make it easier for customers to understand, ensuring consistency and clarity in transaction classification, she adds.

“This change may lead to some ambiguity for users,” says Mandal.

Also read | Before you fly: Common mistakes travellers make when buying travel insurance

New forfeiture policy for EDGE REWARD Points and EDGE MilesStarting October 1, 2025, Axis Bank can forfeit unused reward points or miles if the credit card is closed and points aren't redeemed within 30 days, or if payments are overdue by more than 90 days. Mittal notes this policy change is standard across all Axis Bank credit cards.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.