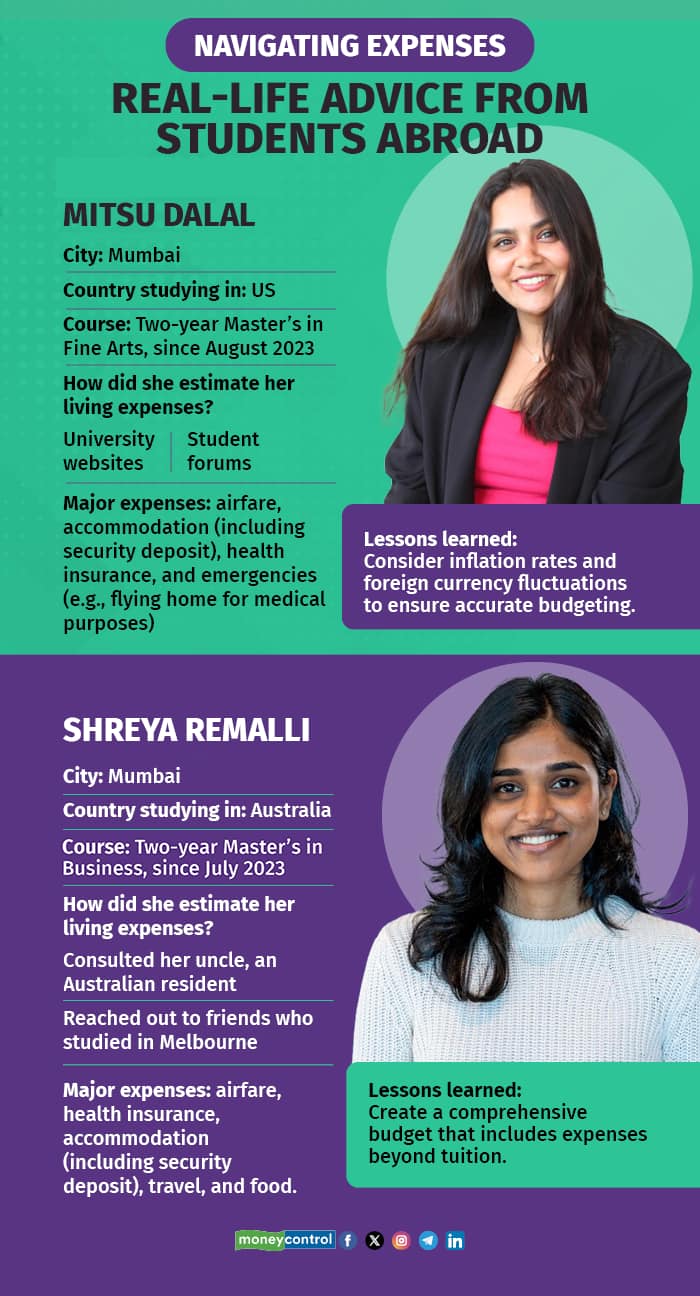

Mitsu Dalal, 26, from Mumbai, is currently pursuing a two-year Master’s in Fine Arts from a Savannah State University in Georgia, USA. Her course started in August 2023.

She encountered a variety of expenses — expected and unexpected — on landing in the States. Recalling a particularly challenging experience, Dalal says, "I had to suddenly fly to India for a medical emergency, for which I had to borrow money to book a ticket at a steep price."

In order to manage finances effectively while studying abroad, she tracked her monthly expenses carefully, adhered to a strict budget, and identified unnecessary expenses she could cut back on.

“This cultivated financial discipline,” says Dalal.

“Besides tuition fees, which comprise a significant chunk of the costs, students need to budget for additional expenses,” says Rozy Efzal, Co-Founder and Director, Invest4Edu, a fintech platform offering education planning and investment services.

There are instances of students forgetting to budget pre and post-departure expenses, says Efzal, which can add up to quite a tidy sum.

How to estimate expenses

One of the primary sources for estimating expenses is the university website, which provides approximate living expenses, beyond tuition fees. “The website gives an idea of the overall cost of living, including the cost of books, medical insurance, and more,” says Dalal.

Dalal also did thorough research by joining student forums comprising those who had completed two semesters at the university.

Take another example. Shreya Remalli, a 28-year-old from Mumbai, has been pursuing her two-year Master’s in Business from Monash University, Melbourne, Australia, since July 2023.

To budget for additional expenses while studying abroad, Remalli

consulted her uncle who lives in Australia, and also reached out to friends who had previously studied in Melbourne.

“The cost of living varies from city to city in foreign countries,” says Efzal. You can find estimated living costs on government websites.

“It's essential to consider the inflation of the country you're traveling to and foreign currency fluctuations against the Rupee when calculating your expenses,” says Neha Sharma, Director at Keystone Global, an education platform.

Here are some of the additional costs you need to budget for:

Pre and post-departure expenses

Expenses can be categorised as pre-departure and post-departure, both for academic and personal requirements.

Sharma advises students to create a comprehensive budget that includes expenses beyond course fees.

For example, Remalli budgeted for various expenses, including airfare from India to Australia, public transport costs in Melbourne, health insurance for two years, visa fees, medical checks for the visa application, food expenses, and accommodation costs.

Students should also consider that the average application fee for US universities is $150, which can vary by course or programme. Applying to five universities would cost around $750 (approximately Rs 64,000 at the current exchange rate).

Abroad, students are required to have health insurance. They can either purchase it from India before travelling or opt for the insurance provided through their university. Efzal says that Indian insurance policies typically cost between Rs 20,000 to Rs 50,000 annually, whereas university plans can be pricier, ranging from Rs 50,000 to Rs 1 lakh per year.

Efzal cautions that some foreign universities may not accept Indian policies, requiring students to purchase the university's recommended plan.

“Students must also account for rent, groceries, transport, phone plans, and travel back to India during the semester break or a festive season,” says Akshay Chaturvedi, Founder and CEO, Leverage Edu, a study-abroad platform for students.

Also read | Rupee depreciation: How Indian students can minimise impact on overseas education budget

Accommodation

Chaturvedi notes that many people overlook accommodation costs and security deposits for rented homes, pointing out that these expenses can vary significantly depending on the city.

For instance, if you live in a smaller town in the US, your rent would be around $700 (about Rs 60,000) a month. But in a city like New York, San Francisco, or Chicago, you would pay around $2,500 (~Rs 2.14 lakh) a month.

Dalal paid Rs 1.60 lakh, equivalent to three months' rent, as a security deposit to the landlord before leaving for the US. It was one of her biggest pre-departure expenses.

External coaching

Many students require additional coaching or tuition in their initial semesters due to their different academic / professional backgrounds.

Most bank education loans cover various expenses such as tuition fees, living expenses, health insurance, and study materials. Besides these costs, Bank of Baroda also considers additional expenses like laptops, stationery, lab fees, study tours, etc.

However, a Bank of Baroda spokesperson stated that their education loan does not cover external coaching. Therefore, students needing extra support in specific subjects must budget separately for this.

Also read | Travelling abroad to study? Here are the best ways to carry forex

Local travel

Efzal advises students to budget for short trips and weekend travel, which may cost between Rs 10,000 and 25,000 per trip depending on the location and activities. Additionally, for semester breaks, travelling back to India can be costly, with flight tickets ranging from Rs 60,000 to Rs 1.5 lakh per round trip, although booking in advance can help cut costs.

Dalal emphasises the importance of budgeting for emergency flights to India citing her own experience, where she incurred unexpected costs of $1,500 (around Rs 1.28 lakh) for a last-minute trip because of a medical emergency in the family. "I maintain a separate emergency corpus, untouched except for critical situations," said Dalal.

Also read | Planning to study abroad? Here's how to maximise your chances of winning a scholarship

Rising inflation and Rupee depreciation

As per Bloomberg data, the Rupee has depreciated close to 2.11 percent over the past 10 months, going from Rs 83.75 per USD in August 2024 to Rs 85.52 on May 16, 2025. In fact, it slipped to 87.96 against the dollar on February 10, before staging a recovery.

Eela Dubey, Co-Founder of EduFund, notes that Rupee depreciation increases foreign education costs even if tuition fees remain unchanged in Dollar terms.

Rahul Subramaniam, Co-Founder of Athena Education, points out that Rupee depreciation also impacts living expenses such as groceries, travel, accommodation, etc.

But currency fluctuations are unpredictable, making it tough for students and parents to accurately budget for overseas education.

“I'm now more mindful of my spending. I used to dine out frequently, but due to rising inflation and expenses, we prefer home-cooked meals," says Dalal, who also makes it a point to utilise student discounts on public transport and while shopping for groceries.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!