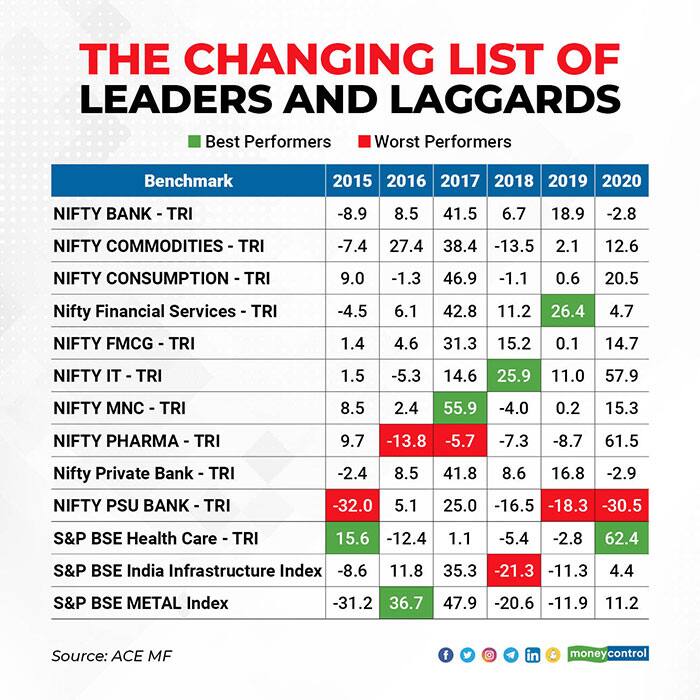

The Nifty Pharmaceutical index gave negative returns for four successive years from 2016 to 2019. Was it a good investment avenue at the start of last year? Similarly, the Nifty Commodities index fell 13 percent in 2018 and barely returned two percent in 2019. If you had just gone by their past returns, you may not have invested in them at the start of last year. And you would have ended up missing out on the subsequent rally.

So, how do you identify the ‘next big theme’? There’s a mutual fund that aims to do just that. But it’s a scheme with high risks and potentially high returns. ICICI Prudential Thematic Advantage Fund (IPTAF) works on such a premise.

What’s on offer

Although the scheme was launched in 2003, the fund’s current avatar is just 2.5 years old. Its long-term history should be ignored if you want to get a true picture of this fund’s performance.

At its core, it’s a fund-of-funds (FOF) scheme that invests at least 80 percent of its assets in theme or sector funds. The scheme invests in various thematic and sector funds within its own house. The idea is to invest in themes that are expected to do well in the near future and generate more returns than what the market does.

The Nifty 200 TRI is the benchmark for the scheme. Sankaran Naren, Dharmesh Kakkad and Manish Banthia are the fund managers of the scheme. The scheme manages assets worth Rs 38 crore.

"Investors may find it difficult to enter and exit a sector or theme at the right time,” says Chintan Haria, Head-Product Development & Strategy at ICICI Prudential AMC. “The investment strategy of this scheme is to buy when a theme is attractive and sell when it has delivered, with a view to making risk-adjusted returns in the medium to long term,” he adds.

What works

The scheme is specifically meant for informed investors who want to invest in themes that may click in the future. With a bouquet of thematic and sector funds under its belt, IPTAF aims to do just that.

But is the fund good at identifying the next big theme? Between January and May 2020, the fund increased its allocation to the healthcare sector. In this period, it reduced its allocation to the infrastructure fund. But by the start of 2021, it had again increased its investments in infrastructure, banking and commodities.

In February 2020, IPTAF increased allocation to ICICI Prudential India Opportunities Fund – a thematic offering that buys stocks in special situations – to 37 percent, but exited it fully in April 2021.

“A thematic FOF such as this gives the flexibility to move across themes and offers good re-allocation of the portfolio without any tax impact arising from rebalancing investments,” says Ravi Kumar TV, Founder of Gaining Ground Investment Managers.

Over a three-year period, the scheme has given 17.88 percent return, compared to 13.23 percent managed by flexi-cap funds and 11.53 percent from thematic funds, as per Value Research.

What does not work

Portfolios of theme and sector funds are concentrated. Since IPTAF invests in a bunch of them, it may be perceived as a less concentrated offering compared to a single theme fund. However, it may have significant allocation to one or more themes. For example, as on May 31, 2021 the scheme has around 45.5 percent of its corpus in ICICI Prudential Infrastructure Fund.

Investing in just as many schemes calls for correct identification of the sectors and getting in and out of them at the right time. The fund management at ICICI Prudential AMC, though, has a good track record in gauging the country’s macroeconomic scenario. Still, a concentrated portfolio makes it a highly risky fund.

Despite being a fund of funds, it is treated on par with debt schemes for taxation purpose.

Should you invest?

Invest in this fund if you wish to add a returns kicker to your core portfolio, which should mostly have diversified equity and debt funds. You must be willing to take the risks that a sector fund brings. First-time mutual funds investors can avoid this scheme.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.