The Rs 5,630-crore anchor book of Life Insurance Corporation of India (LIC) was fully subscribed On May 2. Not all mutual fund houses got the allotment despite the overwhelming interest, while some fund houses might have decided to skip the initial public offering (IPO) altogether.

Overall, there were 59.2 million shares offered in the anchor book, of which 42.1 million shares were bought by mutual funds.

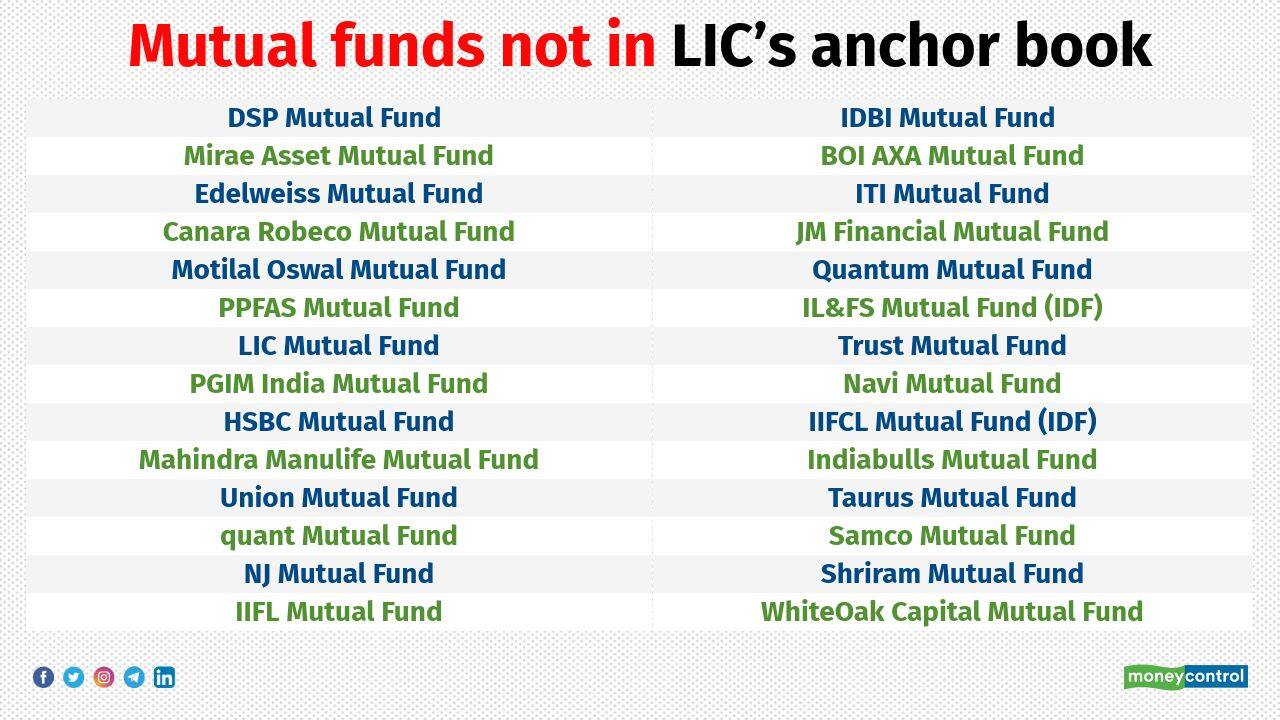

However, these are the mutual funds that didn’t feature in the anchor book.

There were 28 domestic mutual funds that were not part of the anchor book. Some of the major names that were absent included DSP Mutual Fund, Mirae Asset Management, Edelweiss Mutual Fund, Canara Robeco Mutual Fund, Motilal Oswal Mutual Fund, PPFAS Mutual Fund and LIC Mutual Fund.

Also Read: Large-cap, mid-cap, thematic MFs invest in LIC anchor book

As many as 15 domestic mutual funds participated through 99 schemes. The Rs 21,000-crore issue has mobilised Rs 5,627 crore from anchor investors. Of these, mutual funds have contributed Rs 4,002 crore, buying the shares at Rs 949 each, at the upper end of the IPO price band of Rs 901-Rs 949.

Government seeks stability post listing

Mutual funds that got allotment in the anchor portion are Aditya Birla Sun Life, Axis, Baroda BNP Paribas, Franklin Templeton, HDFC, ICICI Prudential, IDFC, Invesco, Kotak Mahindra, L&T, Nippon India, SBI, Sundaram, Tata and UTI.

Deepak Jasani, Head Retail research, HDFC securities says, “Not all AMCs get anchor allotment in any of the IPOs. In this case, these 28 AMCs are relatively small (except DSP, Mirae Asset and Canara Robeco) which have either not applied or not been allotted. It depended on the DIPAM and the investment bankers”.

Given that the current situation in the domestic and global market is not supportive, these AMCs may participate in the next dilution which will happen in the next financial year or so adds Jasani.

Shyam Sekhar, founder of Chennai-based wealth management firm ithought Financial Consulting LLP says, “Anchor portion allotment is done by selection. The government has decided to allot to the more stable AMCs those who follow more stable investment pattern. If you study the past IPOs which were successful, the very critical aspect was the post listing trade. If you see a company that did very well post IPO whose stock price was stable and went up after listing; what you need to see is who the anchor investors were how they played a part in stabilizing the post listing trade of the companies. So, the government has decided to choose investors who will act responsibly and judiciously in an IPO which is anyway valued very favourably. So, there is an implicit understanding that these investors will be relatively more stable owners of this equity over the next one year. The government seeks stability through this IPO for the shareholders of the company.”

Also Read: LIC IPO opens tomorrow: Should you subscribe to the issue?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.