Tata Asset Management has launched Tata BSE Business Group Index Fund, a first-of-its-kind investment scheme designed to provide investors an exposure to India's leading conglomerates.

The new fund offer (NFO) for Tata BSE Select Business Group Index Fund opened for subscription on November 25, and will close on December 9.

What’s on offer?

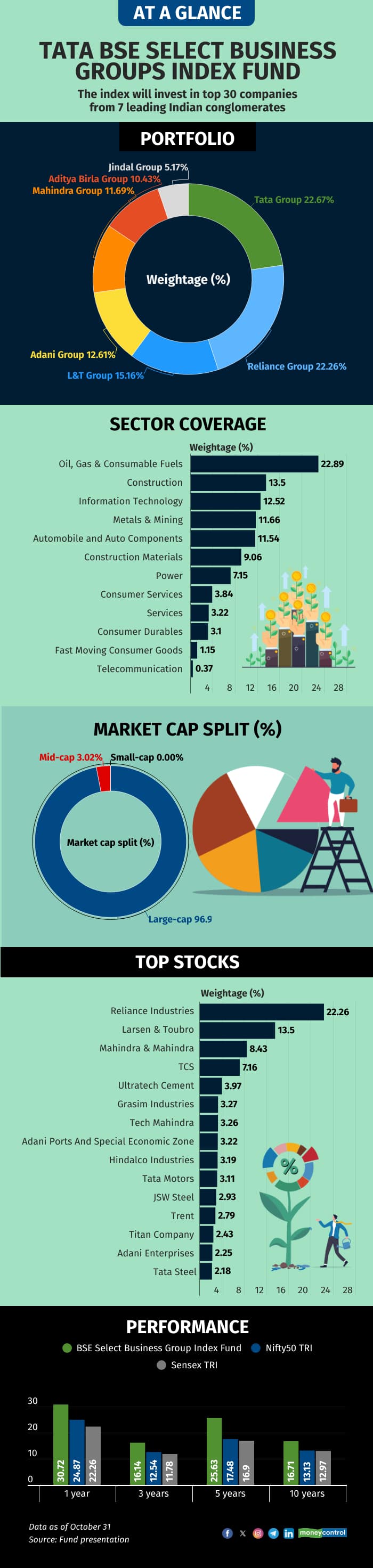

The Tata BSE Select Business Group Index Fund tracks the BSE Select Business Groups index, comprising companies from seven of India’s largest business groups. These conglomerates span 19 industries. The fund will include 30 companies from the key sectors driving India's future growth, with the financial services sector excluded to focus on other industries.

The index methodology of the Tata BSE Business Group Index Fund comprises 30 stocks, representing companies from the seven largest business groups in India. The largest company is based on the six-month, average free-float market capitalisation from every group. The next 23 companies are ranked on the basis of the six-month average free-float market capitalisation.

Also read | Top 10 forex cards to save you money while travelling abroad

The seven business groups are Tata Group, Reliance Industries, Adani Group, Aditya Birla Group, L&T, Jindal Group, and Mahindra Group. The weightage for each group is capped at 23 percent, based on their free-float market capitalisation.

Currently, the Tata Group has a weightage of 22.7 percent, followed by Reliance Industries at 22.3 percent, and L&T Group at 15 percent.

In terms of individual stocks, RIL was the heaviest, with a weightage of 22.26 percent at the end of September. L&T was at 13.50 percent, M&M at 8.43 percent, Tata Consultancy Services (TCS) at 7.16 percent and Ultratech Cement at 3.92 percent.

Among sectors, Oil, Gas & Consumable Fuels have the highest weightage of 22.89 percent, followed by civil construction at 13.50 percent, information technology at 12.52 percent, metals & mining at 11.66 percent and auto and auto components at 11.54 percent.

Eleven Tata Group companies, the highest, are represented in the index, followed by eight from the Adani Group and three each from the Aditya Birla Group and Jindal Group stables.

The index is adjusted in June and December.

What works?

The business groups’ diversified operations, technological advancements, and strong market presence position them as key contributors to the nation's economic aspirations.

The good narrative behind this strategy is that most of these businesses are owned by large groups, which have been tested through many market cycles.

These companies have benefited from common promoters, with arguably the largest balance sheet. This makes them more immune to market and business cycles and also to larger economic headwinds that might come their way.

Anand Vardarajan, Chief Business Officer, Tata Asset Management, said: " These businesses have demonstrated their ability to adapt and thrive in a dynamic market environment, making them one of the attractive bets for long-term investors.”

What doesn’t work?

The strategy of investing based at the group level may not work at all times as companies within a business group has unique characteristics that may not align simultaneously. Moreover, every company within a group functions with its own distinct profit and loss framework and governance structure.

Also read | Beyond college funds: Why parents need to invest for a skills-first future

Also, remember that banks and financials, which are the mainstay of the Sensex, with a combined weightage of around 30 percent, are absent from the select business groups index. Fast Moving Consumer Goods (FMCG) and pharmaceutical companies are largely missing from the business groups index.

Should investors go for it?

If you are looking for steady, lower-risk growth or consistent income, investing in leading business organisations can be a smart strategy.

Also, through this fund, investors can get exposure to new-age/upcoming growth-oriented sectors like electric vehicles and battery technology, green energy and smart cities, AI and quantum computing and defence and aerospace, among others.

According to Deepak Chhabria, CEO of Axiom Financial Services, investors who have a high-risk profile and believe in this theme can look to take a small allocation to the fund.

“However, investing is all about looking at the company's financials, business and sectoral outlook. And there are many companies which may not be part of the top business groups, but have a phenomenal track record and performance,” said Chhabria.

Also read | This MC30 equity fund can limit your portfolio risk in the current market volatility

Amol Joshi, Founder, PlanRupee Financial Services, concurs, saying that there are many standalone companies, including in the mid-cap and small-cap space that one would tend to miss out.

“Most investors would do well investing in a diversified fund, be it large-cap or a combination of large- and mid-cap funds. If you have a really long-term horizon, mid-and small-cap will be ideal. This fund is not something that is a must-have in a portfolio,” said Joshi.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.