Just a month after Covid struck in March 2020, Manish Singh, 31, lost his job. He had just started working barely a year back, after a 7-year break from the corporate sector. Jobs were hard to come by as Covid spread, and the harsh lockdown compounded his worries.

Singh started borrowing money from non-banking finance companies (NBFCs) and loan apps, as banks didn’t touch him becuse he lacked a credit history. When he landed a job after six months, he was inundated with offers for credit cards and personal loans from banks. Singh took multiple credit cards and personal loans thinking he would borrow from banks to repay his earlier app and NBFC loans.

He ended up having nine credit cards; his debt ballooned to nearly Rs 30 lakh across 19 different types of personal and credit card loans. His plans started to unravel when Singh couldn’t repay his debts on time. Bank recovery agents not only chased him, but also his mother, hacked into her mobile to access her contacts, and started harassing them. That’s when he got in touch with FREED, a debt counsellor. Today, nearly four years after his woes started, he has settled eight loans. There’s still work to be done, but Singh is on his way to recovery.

Growing borrowingsIndia's borrowings are growing. Per the Reserve Bank of India (RBI), unsecured loans stand at Rs 16.37 lakh crore as on January 2024, up from Rs 10.34 lakh crore as on January 2022, a jump of 26 percent on a compounded basis. Unsecured loans include credit card dues, consumer durables loans, and ‘other personal loans,’ per the RBI’s ‘Statement of Deployment of Gross Bank Credit by Major Sectors.’

The number of credit cards issued in India has also grown, per RBI statistics. Average credit card spends have also gone up steadily. <see table>.

Number of credit cards in India has grown

Number of credit cards in India has grownAs per a CRIF High Mark (an RBI-licensed credit bureau) report titled ‘How India Lends’ for financial year (FY) 2023, personal loans comprised 14.1 percent of all the loans disbursed during the year in terms of value, second only to home loans (40.7 percent). The difference between the two is natural as home loans are of a much higher value. But in terms of volume (number of loans), the two largest types of debt in FY23 were personal loans and credit card dues.

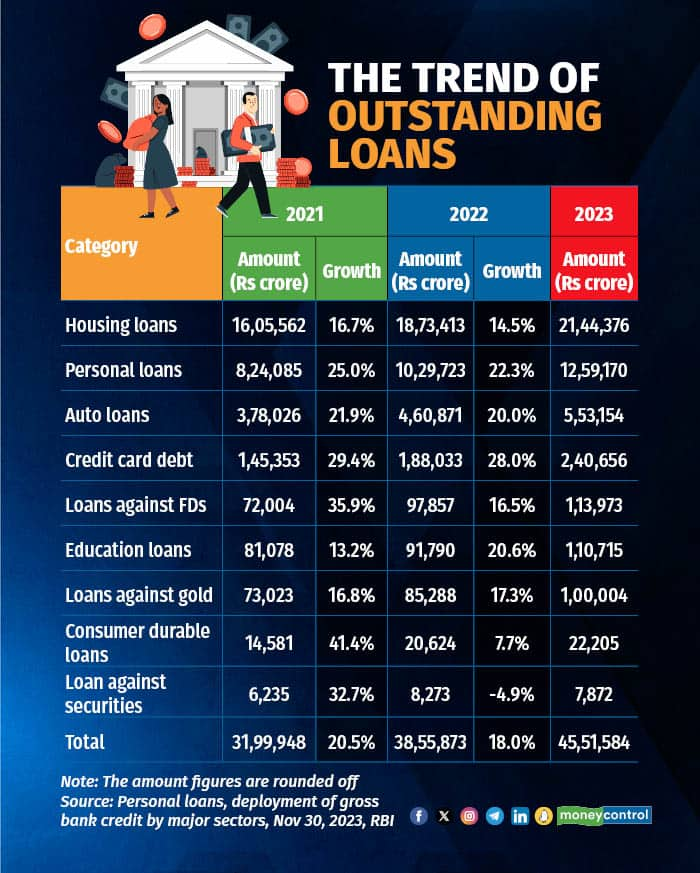

Housing and personal loans account for a lion's share in the outstanding loan basket

Housing and personal loans account for a lion's share in the outstanding loan basketHowever, the issue is not just loans, but the defaults. A FREED estimate pegs the total value of troubled loans at $27 billion <see table>.

The problem of debtHow debt counsellors help

The problem of debtHow debt counsellors help Debt counsellors are individuals or firms that help you overcome your debt problem. But it's not as if your debt is waived: if you owe money to your bank, you still need to pay up.

Debt counsellors help you negotiate better with your banks and NBFCs. “It has to be a win-win scenario for both the lender as well as the debtor (where the bank doesn’t make a loss, and recovers as much money as it can, instead of facing the prospect of total default), and the debtor too benefits.

``If the debt is pardoned, there wouldn’t be any incentive for the defaulter to pay up,” explains Aparna Ramachandra, Founder-Director, Rectifycredit.com, a Mumbai-based credit counsellor with a national presence. She gives the example of a client with a mountain of debt, a credit score of 315 (the highest being 900), and 48 loan accounts (across personal loans and credit cards). Ramachandra worked with this client over the course of 18 months and helped her repay most of the debt.

Debt counsellors typically get business based on word-of-mouth. A simple Google search of ‘debt Counsellors in India’ lists quite a few , but it’s tough to verify their credentials. Yet, it’s an improvement from a similar search Moneycontrol had done more than a year ago. Sometimes, they are discovered by chance. Buried under his mountain of debt, Singh googled to find out if there is a debt consolidation loan — one single loan which he could avail of to pay off all his existing loans, and then deal with just that one lender. That's how he came across FREED.

Ritesh Srivastava, who started FREED in 2020, says that most of his firm’s first-time clients are already overdue for more than 90 days, and their loans are classified as non-performing assets (NPAs). Which means that they are already being chased by recovery agents. Srivastava says that after carefully assessing the defaulter’s finances, job, and personal life situation, they work out a payment plan. FREED gets in touch with all the lenders to whom the client owes money. and works towards a resolution.

“We don’t approach them to pardon the loans. The attempt is to negotiate better terms and conditions, like extending the loan payment period,” adds Ramachandra.

Both Srivastava and Ramachandra admit that banks and lenders are now more willing to engage with credit counsellors than before. “As opposed to barely 10-12 percent recovery of NPAs, we try and get them as much as 50-60 percent of the debt; it makes sense for the banks to talk to us more openly,” says Srivastava.

FREED sets up an escrow account, and the client is encouraged to deposit a sum of money, however small, every month in this. This, Srivastava says, instills discipline, and as the corpus grows, loans are repaid and debt is reduced.

Singh says that the “biggest service” FREED could provide was to get banks to stop the harassment and menacing phone calls and threats from recovery agents. This, Srivastava, says, happens when debt counsellors are able to convince banks that the recovery will happen, all that the defaulter needs is some time and guidance.

Identifying red flagsTake a close at your situation to check for ticking time bombs, say experts. “If you are applying for loans and getting rejected,” that is a big red flag, according to Ramachandra. She adds that if you are unable to repay your credit card bills in full at one shot and this happens repeatedly, you’re headed for trouble.

Maharashtra-based Santosh Tekale, 39, didn’t pay his credit card bills on time. His total unpaid debt piled up to close to Rs 5 lakh across 10 loan accounts. He has closed six of his loans and is on his way to recovery.

“When your expenses exceed your income, or you dip into your savings to pay your credit card bill, that’s a red flag,” says Srivastava.

The history of debt counsellors in IndiaDebt counselling is not new in India. VN Kulkarni, a retired banker, tells Moneycontrol that in 2007, Bank of India (his former employer) started a debt counselling centre in central Mumbai. Inaugurated by the then RBI Governor Dr YV Reddy, Abhay Credit Counselling announced, through an ad in local newspapers, that it was going to be open three days a week, including weekends. Kulkarni remembers that the centre was soon jam-packed.

“People came in crying, they didn’t know how to settle their debts, which in many cases was very high. They were harassed by recovery agents. Some people told us that they had no option but to contemplate suicide,” he says.

Many years later, in 2017, two entrepreneurs, Abhishek Agarwal and Rajiv Raj, started CreditVidya. Madan Mohan, a veteran banker who had experience in credit counselling (he headed ICICI Bank’s Disha Credit Counseling) came on board as an advisor. Mohan, 72, and now retired, says that it is important for debtors to stop taking any more loans once they decide to enroll with a credit counselling centre. “If there is a serious intent to repay the loans, banks are willing to listen and settle. Banks are always open to getting something, rather than nothing,” he says.

Is bankruptcy possible in India? What if you don’t have any money to repay and you want to declare bankruptcy?

Part III of the Insolvency and Bankruptcy Code (IBC), set up in 2016, lays out processes for dealing with individual bankruptcies. However, this has yet to be notified. In simple words, the path to declare individual bankruptcy has been laid out, but the government has not yet legalized most parts of it. Only the part that pertains to individuals who stand guarantors to corporate loans has been operational, since November 15, 2019. Barring this exception, the enacted parts of IBC deal with corporate bankruptcy where companies can declare bankruptcy, and lenders then get to salvage whatever they can of the remains, and move on.

Bindu Ananth, Chair of Dvara Research, a policy research think tank, explains that IBC for individuals is also meant to give deserving individuals a fresh start. Ananth was part of a working group set by the Insolvency & Bankruptcy Board of India to suggest the path for insolvency resolution process for individuals. A fresh start here means that if the IBC court (the adjudicating authority overlooking a case) certifies that the debtor is truly broke and cannot return back a penny to his creditors, the debts are pardoned and the person can then make a fresh start.

That doesn’t mean anyone can just throw their hands up and say they cannot pay. The IBC has laid out four conditions that debtors must meet to be eligible for a fresh start process. For instance, their annual income must be less than Rs 60,000, they shouldn’t have assets in excess of worth Rs 20,000, the aggregate value of qualifying debts should not exceed Rs 35,000 and so on. A qualifying debt is one which is sought by the debtor to get permanently pardoned, as well all their other debt. There are exceptions. For instance, secured debt cannot be pardoned. Any debt which has been incurred three months prior to the date of the application for fresh start process, is also excluded. Creditors too will be allowed to contest here because a debtor’s successful application for bankruptcy would mean a total loss. For those debtors who do not qualify for a fresh start, other forms of relief have also been imagined via an insolvency resolution process.

Whether a debtor declares bankruptcy- and here we mean he literally has no money to pay back; laws kept aside for a moment- or has money to pay but debt gone out of control, Ananth says individuals can feel lost at the lack of information. “There is no legal recourse. Especially if the debtor has fallen behind on paying back unsecured debt (personal loans, credit cards, and so on). The lenders might resort to strong-arm tactics, but you have the recourse of the banking ombudsman. Ultimately, it is a commercial negotiation with banks,” says Ananth.

Experts say that those parts of the IBC that remain to be notified (which is most of Part III, except the individual guarantor sub-part) could be picked up for implementation after the upcoming Central Government elections. Meanwhile, experts also say that even if the personal insolvency provisions get notified, the qualification criteria (for a person to declare his bankruptcy and seek a discharge from paying back his loans) might be too restrictive. Indradeep Ghosh, Executive Director at Dvara Research and Ananth’s colleague is currently conducting his research- in association with a Delhi-based think tank named Insolvency Law Academy (ILA)- to ascertain how wide an audience exactly could the personal insolvency benefit. The paper that he currently is working on is part of a much wider research that- among many other things- also aim to remove the stigma of being declared insolvent. “We should make sure that even if personal insolvency laws get notified (implemented), people come forward to take the benefit and not feel ashamed in doing so. The intent is not to put burden on the banks, yet at the same time, humanize the insolvency process so people do not feel ashamed,” says Ghosh.

The way forwardWhat form the IBC’s individual bankruptcy norms take when they do get notified remains to be seen. Till then, debt counsellors can help you get out of debt.

Remember: debt counselling too is no magic solution. It only works when the debtor is disciplined.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.