Rahul, a 65-year-old recently retired engineer, sat in his living room, sipping coffee and watching television. He had a smile on his face. He eyes were on the stock market ticker on the TV screen and he was intently listening to commentators discussing stocks. He recalled how he had first started investing in equity when he was 25 years old (40 years ago). He had started out by investing Rs 10,000 each month and increased his investment by 10 percent each year. He never missed a single month’s instalment and, eventually, over the period of 40 years, his investments had grown to a whopping Rs 35 crore. He had stayed invested through market ups and downs, knowing that equity investing would help him build serious wealth only if he stayed invested for the long term. Rahul made good use of the power of compounding by ensuring that all his dividends were reinvested to further grow his wealth. The power of compounding implies earning interest on interest. In the case of equity investing, reinvesting dividends paid out by companies is the way to use compounding to your benefit. Today, at the threshold of retirement, Rahul was glad and happy about his decision to invest in equity. Not only was he financially independent, he had sufficient wealth to leave behind quite a bit for his loved ones.

Investing for a comfortable retirement

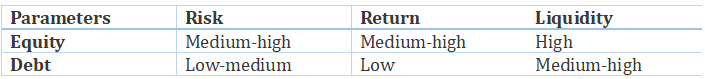

There are broadly two financial asset classes available for investing – equity and debt. You have the option of investing in equity directly (buying stocks of companies on the stock exchange through your stock broker) or through mutual funds (investing in various equity-oriented funds offered by mutual funds). In the case of debt, you have numerous options – fixed deposits, post office schemes, government and corporate bonds, and debt funds. Both these asset classes differ in terms of return potential, risk and liquidity.

Where investing for retirement is concerned, if you are young, investing regularly in equity and, more importantly, increasing your investments periodically and staying invested, will help you achieve sufficient wealth for a comfortable and fruitful retirement where you have funds not only for your sustenance, but also to pursue hobbies of your choice. Besides, cost of living is increasing with every passing year due to inflation. This means, to maintain your standard of living during retirement, you will need to spend much more. Let’s understand this with an example. Let’s say your monthly household expenditure is Rs 50,000 (i.e., Rs 6 lakh per annum). Assuming you are 30 years old today and plan to retire at the age of 60 (30 years later), considering an inflation rate of 6 percent, your monthly household expenses will inflate to about Rs 34.5 lakh per annum (Rs 2.87 lakh per month). Investing in equity will help you earn returns that will exceed the rate of inflation. In other words, you will be able to comfortably bear the rise in the cost of living.

The importance of asset allocation

You may wonder how much you should invest in equity; you could follow a simple rule of thumb, which is – 100 minus your age is the percentage of your portfolio that should be allocated towards equity investment.

For instance, if you are 35 years old, you should invest about 65 percent of your portfolio in equity (100 minus 35). With every passing year, you must reduce your equity exposure with increase in age. That way, as you near retirement, you would have achieved your required corpus while, at the same time, reducing the risk inherent in your portfolio.

One must understand that all equity shares are not the same. You can broadly divide stocks of companies in three categories based on market capitalization – large caps, midcaps and small caps. Market capitalization of a company is computed by multiplying the number of shares outstanding by its market price per share. For example, if a company has issued 1 lakh shares and the current market price of the company’s share is Rs 100, its market capitalization is Rs 1 crore (1 lakh x 100). As per categorization by SEBI, the 1st to100th company in terms of full market capitalization are termed as large cap stocks; the 101st to 250th company in terms of full market capitalization are termed as midcap stocks and the 251st company onwards in terms of full market capitalization are termed as small cap stocks.

The risk and return profile of large caps, midcaps and small caps differ. While large caps are less volatile, over the long term, they tend to deliver lower returns than midcaps and small caps.

To achieve your target kitty for a comfortable retirement, investing a substantial percentage of your portfolio in equity is important. However, as mentioned above, all equity is not the same. You could tweak your allocation across large caps, midcaps and small caps depending on your risk tolerance. It’s advisable to invest about 25 percent in stocks or multi-cap funds and the balance could be invested in equity funds (large cap funds, midcap and small cap index funds, ETFs). Here is an indicative asset allocation strategy for investors across three different risk categories:

Note: These are indicative percentages for investors in the age bracket of 25 to 50 years.

Investing in equity is lucrative provided you make your investments with sufficient research and knowledge. For investors who don’t have the time, inclination or knowledge of investing, it would be advisable to consult a SEBI Registered Investment Advisor to arrive at your asset allocation and build your investment portfolio.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!