For years, financial planners have cautioned retail investors against buying life insurance-cum-investment policies, due to higher commissions, charges and steep exit barriers.

State-owned Life Insurance Corporation of India’s (LIC) core products – traditional endowment plans – have often been criticised for their opaque charge structure and higher surrender costs. Over the years, a plethora of cases where distributors across life insurance companies mis-sold such products to unsuspecting, gullible policyholders have come to light.

Also read: How highest-NAV guaranteed Ulips mis-sold years ago are coming to haunt policyholders

LIC, SBI Life receive lowest mis-selling complaints

However, the data on policyholders’ complaints, put out by LIC’s draft red herring prospectus ahead of its mega IPO, shows that the insurance colossus received amongst the lowest mis-selling complaints in the industry. LIC received 2.4 mis-selling complaints per 10,000 policies in April-September 2021, compared to SBI Life’s 7.6. Other life insurers fared much worse, with ICICI Prudential Life Insurance having received 34.4 mis-selling complaints per 10,000 policies, Bajaj Allianz Life 28.4, Max Life 23.8 and HDFC Life 18.3. For financial year 2020-21, LIC had reported even better figures with 2.1 mis-selling complaints per 10,000 policies. Complaints received under the ‘Unfair business practices’ are categorised as mis-selling complaints.

Mis-selling menace continues

But industry-watchers are not convinced about the low share of mis-selling complaints. “How many people actually read the policy documents? Many do not even realise that they have been mis-sold policies until they mature. And by then, it is too late. All along, it’s been easy to sell savings plans as the financial literacy levels in India have been low. It will not be easy to sell policies with high commissions and surrender charges to younger, financially-savvy individuals in future,” says a financial advisor who did not wish to be identified as he was associated with some life insurance majors in the past.

The mis-selling menace has plagued the life insurance sector for long, with individual agents as well as distributor bank officials being accused of pushing unsuitable life insurance policies. Complex product structures made it difficult for impressionable customers to decipher the workings. “There is no let-up in mis-selling complaints in our experience. We have come across cases where policies meant for younger customers being sold to older individuals,” says consumer activist Jehangir Gai. Mortality charges – cost of the life cover embedded in such policies - are linked to age, which eat into returns, denting older individuals’ maturity corpus. Earlier, many agents passed off long-term life insurance policies as single premium or short-term ones. Policyholders often discovered these features only after receiving renewal notices in the subsequent years. Savings and investment policies are often purchased by policyholders in a hurry during the annual tax-saving season (January-February-March) only to claim tax benefits of up to Rs 1.5 lakh under section 80C.

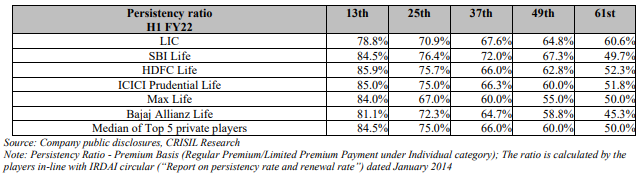

Despite the Insurance Regulatory and Development Authority of India’s (IRDAI) regulations to curb mis-selling, cap commissions as also mechanisms that life insurance companies have put in place, the menace persists. A low persistency ratio – or high lapsation rate – is a key fallout from such malpractices, as policyholders drop out once they realise the unsuitability. In case of LIC, one-third policyholders give up on their policies the year after purchase, while 52 percent do so after the fifth year (61st month), as per IRDAI’s handbook on Indian insurnce statistics for the financial year 2020-21. Here, persistency data is in terms of number of policies. Private sector, too, fares poorly on this count, with 13th and 61st persistency ratios of 69 percent and 41 percent respectively. That is, 31 percent of the policyholders choose to let go of their policies after a year and 59 percent do so after the five years. This, despite the fact that life insurance policies are meant to be long-term products with tenures of over 7-10 years.

To be sure, the industry's persistency ratios as on September 30, 2021 on the basis of premiums are better. LIC recorded 61st-month persistency ratio of 60.6 percent, while other top five private players reported persistency ratios of 45.3-52.3 percent during the period. Yet, the retention rate is low considering that life insurance policies have long-term premium payment terms.

Other complaints higher than peers

LIC, though, has not been able to replicate this performance in terms of overall complaints, which typically include policy processing, servicing, claim processing and so on. Under this head, LIC received 48.7 complaints per 10,000 policies, next only to ICICI Prudential Life’s 50 as on September 30, 2021.

The public sector giant’s claim settlement ratio, usually the highest in the industry, dipped to 94.2 percent in April-September 2021, lower than that of HDFC Life (98 percent) and Bajaj Allianz Life (95.1 percent) and though settlement of pending claims by the end of the financial year could push it up later. In FY 2020-21, it had settled 98.3 percent of the death claims received, rejecting 0.9 percent of the claims. Death claims refer to the amount paid out to policyholder’s dependents in case of her death.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.