Banks and other lenders have kept the ‘gifts’ coming for borrowers this festive season in form of concessional interest rates and processing fees.

Home and car loans are the two particularly favoured categories, with public sector banks taking the lead both categories.

Attractive rates

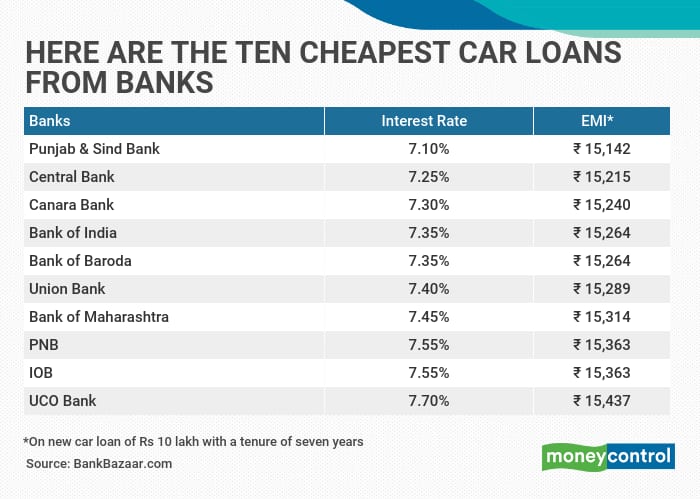

For a car loan of Rs 10 lakh with a tenure of seven years, the interest rates start from 7.1 percent. State-owned lender Punjab & Sind Bank offer this lowest rate and the equated monthly instalment (EMI) works out to Rs 15,142. It is followed by another public sector bank (PSB) – Central Bank of India – that is offering an interest rate of 7.25 percent, as per data from Bankbazaar. All top ten slots of lenders offering lowest interest rates are occupied by PSBs, with interest rates ranging from 7.1 per cent to 7.7 percent. Next on the list are Bank of India (7.35 percent) and Bank of Baroda (7.35 percent). UCO Bank is the tenth on the list with 7.7 percent. State Bank of India’s (SBI) interest rate of 7.85 percent per annum does not figure in the list of ten cheapest new car loan interest rate offers.

The loan aggregator portal has considered interest rates on car loan for all listed (BSE) public and private banks for the data compilation. Banks for which data is not available on their website, are not considered. Data collected from respective bank's website as on November 5, 2020. Banks are listed in ascending order on the basis of interest rate i.e. bank offering lowest interest rate on car loan is placed at top and highest at the bottom. Lowest interest rate offered by the banks on loan of Rs 10 lakh is shown in the table (see graphic). EMI is calculated on the basis of Interest rate mentioned in the table for Rs 10 lakh loan with tenure of 7 years (processing and other charges are assumed to be zero for EMI calculation); Interest mentioned in the table is indicative and it may vary depending on bank's terms and conditions (* minimum interest as per APR in quarter-ended in September 2020).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.