With the festive season fast approaching, the likes of State Bank of India and HDFC Bank have rolled out their festive offers on home, vehicle and personal loans.

Even without such offers, public sector banks continue to offer cheapest home loan interest rates, compared to their private sector counterparts.

The reserve bank of India (RBI) had cut repo rates for much of 2019 and early 2020, before pausing in recent months. These cuts have meant that borrowing rates are at low and attractive levels.

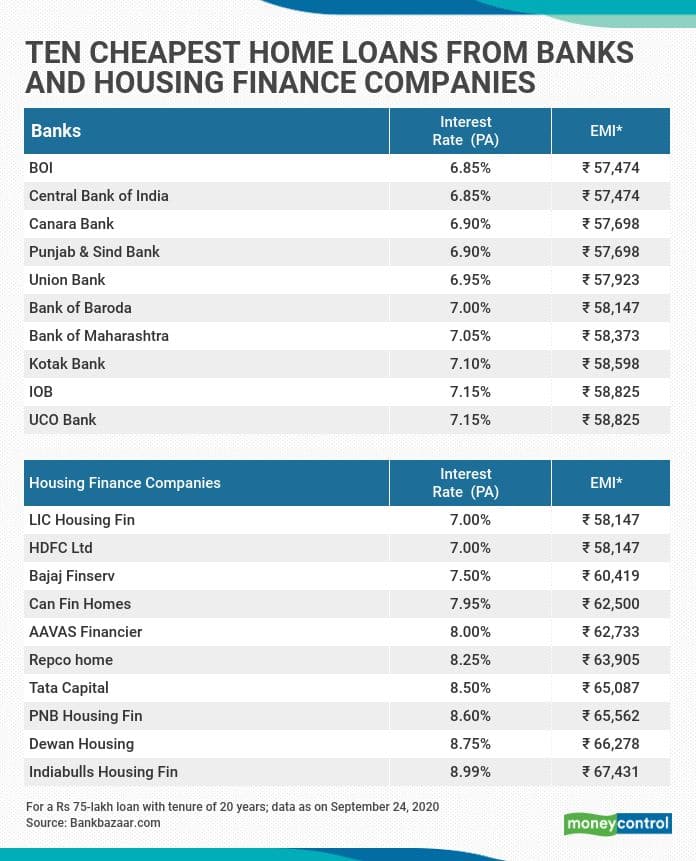

Interest rate and charges on home loan for all listed (BSE) public and private banks, and HFCs as listed in NHB's website which offers home loan up to Rs 75 lakh are considered for data compilation; Banks/HFCs for which data is not available on their website, are not considered. Data is collected from respective bank/HFCs website as on September 24, 2020. The lowest rate offered by the bank/HFC on a loan of Rs 75 lakh is considered in the table. Processing and other charges are assumed to be zero for EMI calculation.

PSBs lead the charge

Bank of India and Central Bank of India lead this pack with an interest rate of 6.85 per cent for a Rs 75-lakh home loan with a tenure of 20 years, as per Bankbazaar data. This would mean an equated monthly instalment (EMI) of Rs 57,474. Canara Bank and Punjab and Sind Bank are next on the list, with both charging an interest rate of 6.90 per cent. Barring Kotak Mahindra Bank (7.1 per cent), all others on the list of top ten banks offering cheapest home loan rates happen come from the public sector. While SBI does not figure amongst the top ten, it is close on the heels of its PSB peers with 7.20 per cent interest on its home loans.

Non-banking finance companies (NBFCs) generally charge rates far higher than what banks do, but two large HFCs offer competitive rates. Home loans of Rs 75-lakh from HDFC Ltd and LIC Housing Finance carry interest of 7 per cent each. The EMI amount in these cases will work out to Rs 58,147. The gap between other NBFCs and these two large lenders is quite wide. The third non-banking entity on the list – Bajaj Finserv – charges 7.5 per cent for home loans.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.