Recently, Paytm partnered with SBI Card to roll out two credit cards: Paytm SBI card Select and Paytm SBI card. The cards are focused on catering to digitally-savvy customers who shop online majorly, especially in tier-2 and tier-3 cities. You can apply for the card through the Paytm app. The annual fees is Rs 1499 for Paytm SBI card Select and Rs 499 for Paytm SBI card. Are these cards worthwhile and should you apply for them?

What’s the offer

Once you apply for these cards using the Paytm app, SBI will decide your credit limit, “based on the transaction history on Paytm,” says Ashwini Kumar Tewari, MD & CEO, SBI Card. Both are physical cards.

For Paytm SBI Card Select, annual fee is waived if you spend at least Rs 2 lakh a year. There is no fee waiver for Paytm SBI Card holders.

Both cards offer cashbacks if you book movie and travel tickets on the Paytm app or shop at Paytm Mall (the online store). A small cashback is also on offer if you shop from other websites or physical stores. “You can also block or unblock the card through a single click on both the Paytm app as well as the SBI Card app,” says a spokesperson from Paytm.

What works

If you use the Paytm app exclusively for booking travel or movie tickets, shopping on Paytm Mall and paying utility bills, then these credit cards are designed for you. It offers up to 5 percent cashback for transactions done on the Paytm app using the card.

The card offers safety features. You can switch off the contactless payments feature on your cards. And they also offer a cyber fraud insurance cover; Rs 2 lakh on Paytm SBI Card Select and Rs 1 lakh cover on Paytm SBI Card.

Also read: Overspent on your credit card this Diwali? Here’s how you can reduce your debt

What doesn’t work

There is no major benefit for transacting using these credit cards outside of the Paytm app or mall. “When you compare it with HDFC Bank’s Millennia credit card, you will know that 5 percent cashback is extended to shopping on popular e-commerce websites like Amazon and Flipkart,” says Tushar Jain, a personal finance blogger at www.jaintushar.com. The HDFC Bank’s Millennia card doesn’t bind customers to one platform for taking the maximum cashback benefit.

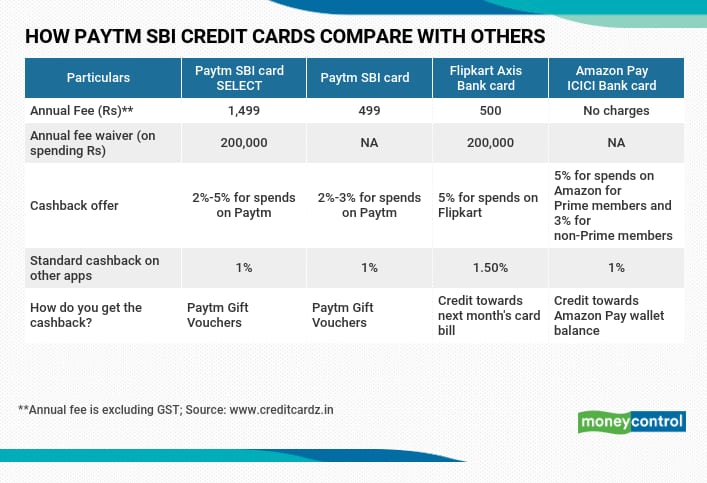

When we compare Paytm SBI Card Select and Paytm SBI Card with other co-branded cards such as Flipkart Axis Bank card and Amazon Pay ICICI Bank card the cashback offer seems to be of a similar range. You get a 5 percent and 3 percent cashback on Paytm SBI Card Select and Paytm SBI Card, respectively, upon booking movie and travel tickets on Paytm app as well as on shopping from Paytm Mall. For other spends on Paytm app using these cards, you will receive a 2 per cent cashback while 1 per cent cashback is offered on spends elsewhere.

“But, co-branded cards of Flipkart and Amazon will continue to see a better demand as people tend to spend more on these popular e-commerce websites for shopping instead of Paytm,” says a spokesperson from www.creditcardz.in.

“While people might be shopping more on these e-commerce platforms, there are users spending on the Paytm platform as well. Starting from paying education fees, monthly utility bills, booking travel tickets, paying rent, insurance premium, etc. as well as the card can be used offline in merchant stores and earn flat 2 per cent cashback. So, the avenues where our card can be used are vast,” says a spokesperson from Paytm. These cards will make sense for you only if you are using the Paytm app exclusively for regular transactions.

The annual fees charged on both variants of Paytm SBI Card are higher with fewer benefits <see table>. Also, if you wish to get the annual fees waived off, you’ve got to spend more using Paytm SBI Card. “The annual fee waiver after Rs two lakh spending is too bigger amount for a card in this segment,” says Jain. HDFC Bank Millennia Credit Card offers the annual fee waiver for spends of at least Rs 30,000 and above within the first 90 days of issuing the card, or after at least Rs 1 lakh is spent through the year.

How does a customer get cashback?

The way Paytm SBI Cards give cashbacks is similar to other co-branded card of Amazon Pay ICICI Bank. Here, both variants of Paytm SBI Card give cashback in the form of Paytm gift vouchers. These gift vouchers can be used to make any payment on the Paytm app. Similarly, for Amazon Pay ICICI Bank card, the Amazon Pay wallet of customers gets credited with a cashback amount. A customer can redeem the amount from Amazon Pay wallet on next purchase (she can buy anything with this money) or while paying utility bills via Amazon.

For customers of Flipkart Axis Bank card, the credit card bill gets reduced with a cashback amount in a statement.

Moneycontrol’s take

Paytm SBI cards binds you to the Paytm app. They limit your choices because these cards want you to not just spend more through the Paytm system but also consume the benefits from them. Paytm SBI Card or Paytm SBI Card Select makes sense for you only if you use the Paytm app exclusively for day-to-day shopping, or pay utility bills or make bookings for travel and so on. If you don’t, skip these cards. They pale in comparison with what competitors offer.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.